COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 73P

Comprehensive Variance Problem

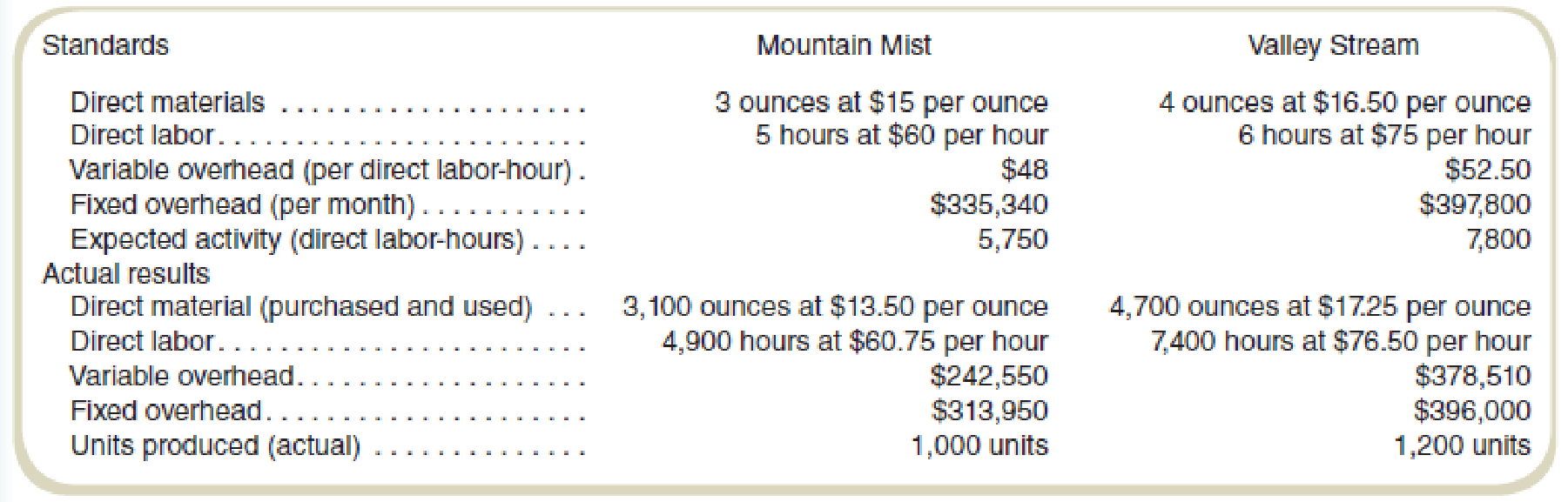

Sweetwater Company manufactures two products, Mountain Mist and Valley Stream. The company prepares its

Required

- a. Prepare a

variance analysis for each variable cost for each product. - b. Prepare a fixed

overhead variance analysis for each product like the one in Exhibit 16.13.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

FIND @ General Account Solution

The Gasson Company uses the weighted-average method in its process

costing system. The company's ending work-in-process inventory

consists of 15,000 units, The ending work-in-process inventory is 100%

complete with respect to materials and 80% complete with respect to

labor and overhead. If the costs per equivalent unit for the period are

$4.40 for the materials and $1.60 for labor and overhead, what is the

balance of the ending work-in-process inventory account would be:

a. $85,200

b. $90,000

c. $76,700

d. $65,500

EnField Corp. has 7 employees and each employee is paid on average

$173 per day and works 7 days a week. The company's year-end is

December 31. The employees were last paid on December 23 for the

two weeks that ended on December 16. What is the wages and salary

payable to record for December 31?

a. $2,595

b. $1,384

c. $9,688

d. $18,165

Chapter 16 Solutions

COST ACCOUNTING W/CONNECT

Ch. 16 - What are the advantages of the contribution margin...Ch. 16 - How can a budget be used for performance...Ch. 16 - The flexible budget for coats it computed by...Ch. 16 - A flexible budget is: a. Appropriate for control...Ch. 16 - What is the standard cost sheet?Ch. 16 - What is the basic difference between a mailer...Ch. 16 - Standards and budgets are the same thing. True or...Ch. 16 - Actual direct materials costs differ from the...Ch. 16 - Fixed cost variances are computed differently from...Ch. 16 - What is the advantage of preparing the flexible...

Ch. 16 - What is the link between flexible budgeting and...Ch. 16 - Actual revenues are greater than budgeted for...Ch. 16 - Pick an organization you know, such as a school,...Ch. 16 - Give two reasons why dividing production cost...Ch. 16 - Prob. 15CADQCh. 16 - My firm has a wage contract with the union....Ch. 16 - Prob. 17CADQCh. 16 - The production volume variance should be charged...Ch. 16 - Prob. 19CADQCh. 16 - Prob. 20CADQCh. 16 - Flexible Budgeting The master budget at Western...Ch. 16 - Sales Activity Variance Refer to the data in...Ch. 16 - Profit Variance Analysis Refer to the data in...Ch. 16 - Flexible Budget Given the data shown in the...Ch. 16 - Fill in Amounts on Flexible Budget Graph Fill in...Ch. 16 - Flexible Budget Label (a) and (b) in the graph and...Ch. 16 - Prepare Flexible Budget Osage, Inc., manufactures...Ch. 16 - Sales Activity Variance Refer to the data in...Ch. 16 - Profit Variance Analysis Use the information from...Ch. 16 - Sales Activity Variance The following data are...Ch. 16 - Sales Activity Variance Selected data for October...Ch. 16 - Prob. 32ECh. 16 - Prob. 33ECh. 16 - Prob. 34ECh. 16 - Prob. 35ECh. 16 - Prob. 36ECh. 16 - Prob. 37ECh. 16 - Variable Cost Variances The following data reflect...Ch. 16 - Variable Cost Variances The records of Norton,...Ch. 16 - (Appendix used in requirement [b]) Variable Cost...Ch. 16 - (Appendix used in requirement [b]) Variable Cost...Ch. 16 - Fixed Cost Variances Information on Carney...Ch. 16 - Prob. 43ECh. 16 - Prob. 44ECh. 16 - Fixed Cost Variances Mint Company applies fixed...Ch. 16 - Prob. 46ECh. 16 - Prob. 47ECh. 16 - (Appendix used in requirement [c]) Comprehensive...Ch. 16 - Comprehensive Cost Variance Analysis NSF Lube is a...Ch. 16 - Overhead Variances Brice Corporation shows the...Ch. 16 - Solve for Master Budget Given Actual Results A new...Ch. 16 - Find Missing Data for Profit Variance Analysis...Ch. 16 - Find Data for Profit Variance Analysis Required...Ch. 16 - Prob. 54PCh. 16 - Prepare Flexible Budget Odessa, Inc., reports the...Ch. 16 - Prob. 56PCh. 16 - Prob. 57PCh. 16 - Prob. 58PCh. 16 - Prob. 59PCh. 16 - Prob. 60PCh. 16 - Direct Materials Information about direct...Ch. 16 - Prob. 62PCh. 16 - Prob. 63PCh. 16 - Prob. 64PCh. 16 - Overhead Cost and Variance Relationships...Ch. 16 - Prob. 66PCh. 16 - Prob. 67PCh. 16 - Ethics and Standard Costs Farmer Franks produces...Ch. 16 - Comprehensive Variance Problem The standard cost...Ch. 16 - Prob. 70PCh. 16 - Find Actual and Budget Amounts from Variances JW...Ch. 16 - Variance Computations with Missing Data The...Ch. 16 - Comprehensive Variance Problem Sweetwater Company...Ch. 16 - Prob. 74PCh. 16 - Prob. 75PCh. 16 - Keewee Company manufactures a single product for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ?? Financial accounting questionarrow_forwardABC Company sold a machine for $8,500 that originally cost $16,000. The balance of the Accumulated Depreciation account related to this equipment was $10,300. The entry to record the gain or loss on the disposal of this machine would include: a. A debit to loss in the amount of $3,500. b. A debit to loss in the amount of $6,500. c. A credit to gain in the amount of $2,800. d. A credit to gain in the amount of $2,500.arrow_forwardWhat is wages?arrow_forward

- ABC Company's accounting records for 2019 indicated the following costs had been incurred: Direct materials purchased $1,24,000 Depreciation, factory equipment 30,000 Direct labor 97,000 Utilities 18,000 Sales commissions 65,000 Indirect materials 25,000 Depreciation, office equipment 17,000 Production supervisor's salary 76,000 Advertising 61,000 60% of the utilities relate to the factory while 40% of the utilities relate to the general office building. Calculate the total period costs incurred during 2019.arrow_forwardNeed all answer step by step to below financial accounting problemarrow_forwardWhat is the profit margin?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY