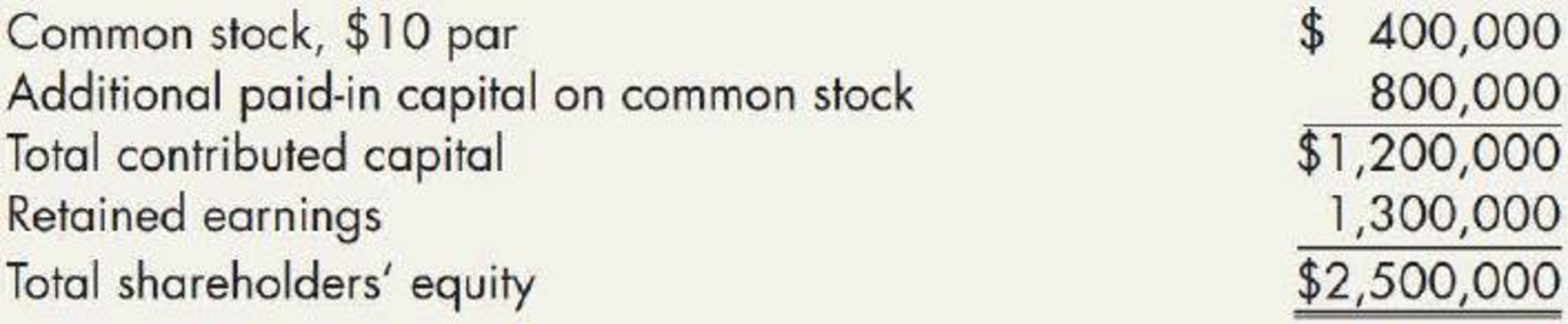

Stock Dividend Comparison Although Oriole Company has enough

Required:

- 1. Assuming a 15% stock dividend is declared and issued, prepare the shareholders’ equity section immediately after the date of issuance.

- 2. Assuming, instead, that a 30% stock dividend is declared and issued, prepare the shareholders’ equity section immediately after the date of issuance.

- 3. Next Level What unusual result do you notice when you compare your answers from Requirement 1 with Requirement 2? From a theoretical standpoint, how might this have been avoided?

Trending nowThis is a popular solution!

Chapter 16 Solutions

Intermediate Accounting: Reporting and Analysis

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Management (14th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Do fast answer of this accounting questionsarrow_forwardOn January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400arrow_forwardcan you please solve this questionsarrow_forward

- XUV Industries manufactures premium-quality glassware. The standard materials cost is 3 pounds of raw glass at $2.00 per pound. During October, 15,000 pounds of raw glass costing $2.10 per pound were used to produce 6,000 glassware items. Determine the materials price variance and materials quantity variance.helparrow_forwardOn January 1, 20X2, Mace, which uses the straight-line method, purchases a machine for $72,000 that it expects to last for 8 years; Mace expects the machine to have a residual value of $10,000. What is the machine's book value at the end of 20X4? i. $48,750 ii. $42,010 iii. $35,550 iv. $50,400 Answerarrow_forwardHow many units must be sold to break even?arrow_forward

- XUV Industries manufactures premium-quality glassware. The standard materials cost is 3 pounds of raw glass at $2.00 per pound. During October, 15,000 pounds of raw glass costing $2.10 per pound were used to produce 6,000 glassware items. Determine the materials price variance and materials quantity variance.arrow_forwardDon't use ai given answer accounting questionsarrow_forwardQUESTION 1 Repsola is a drilling company that operates an offshore Oilfield in Feeland. Five years ago, Feeland had a major oil discovery and granted licenses to drill oil to reputable, experienced drilling companies. The licensing agreement requires the company to remove the oil rig at the end of production and restore the seabed. Ninety percent of the eventual costs of undertaking the work relate to the removal of the oil rig and restoration of damage caused by building it and ten percent arise through the extraction of the oil. At the Statement of Financial Position (SOFP) date (December 31 2025), the rig has been constructed but no oil has been extracted On January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of $500 million. Two years later the oil rig was completed. The rig is expected to be removed in 20 years from the date of acquisition. The estimated eventual cost is 100 million. The company's cost of capital is 10% and its year end is December…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning