Concept explainers

Solve for

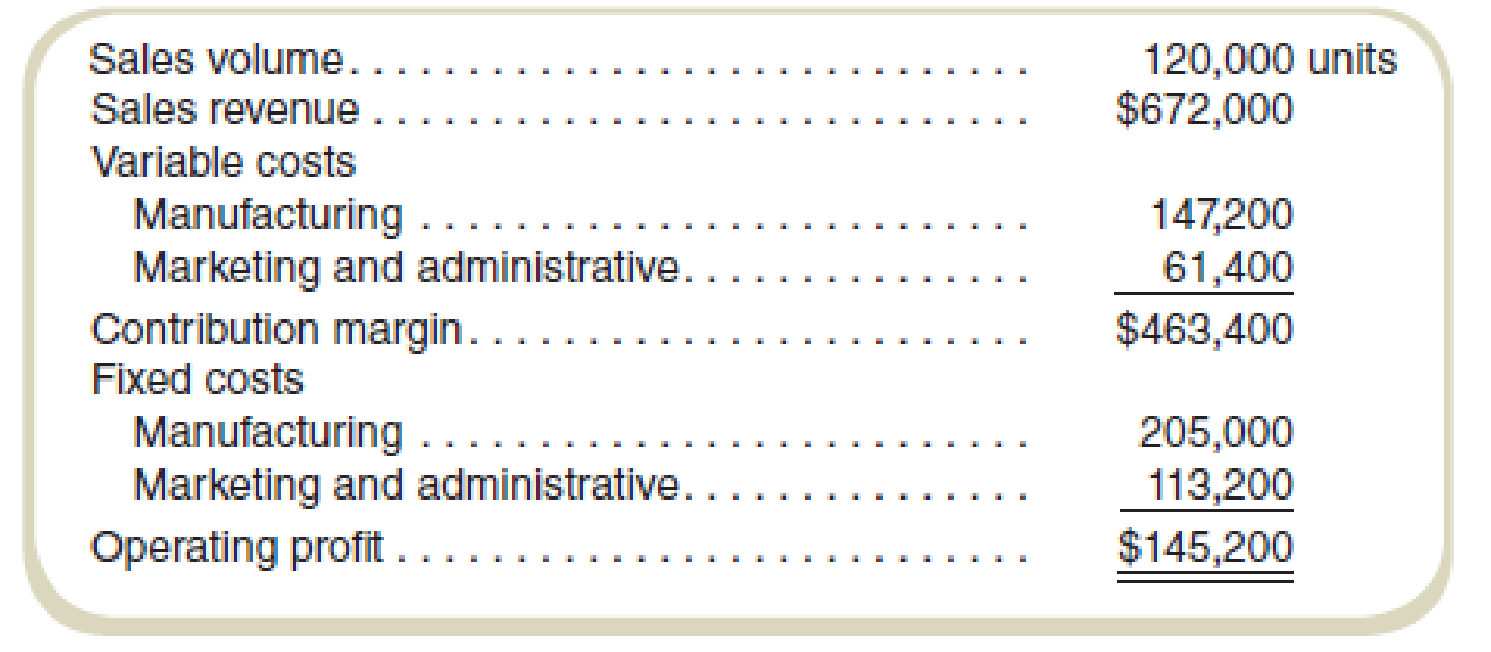

A new accounting intern at Gibson Corporation lost the only copy of this period’s master budget. The CFO wants to evaluate performance for this period but needs the master budget to do so. Actual results for the period follow:

The company planned to produce and sell 108,000 units for $5 each. At that volume, the contribution margin would have been $380,000. Variable marketing and administrative costs are budgeted at 10 percent of sales revenue.

Required

- a. Construct the master budget for the period.

- b. Prepare a profit

variance analysis like the one in Exhibit 16.5.

a.

Prepare the master budget for the period based on given information.

Explanation of Solution

Master Budget:

The master budget is prepared for synchronizing the organization goals with that of the individual units. Such a budget is particularly used to assess the actual performance. Operating and financial budgets are included in the master budgets.

Prepare the master budget for the period:

| Master budget | |

| Units Produced | 108,000 |

| Sales revenue | $540,000 |

| Less: Variable costs | |

| Manufacturing | $106,000 |

| Marketing &administrative costs | $54,000 |

| Contribution margin | $380,000 |

| Less: Fixed Costs | |

| Manufacturing | $216,000 |

| Less: Marketing &administrative costs | $56,000 |

| Operating Profits | $108,000 |

Table: (1)

b.

Prepare a profit variance analysis.

Explanation of Solution

Profit variance analysis:

The analysis that studies the difference between the actual operating profit and the standard operating profit is called the profit variance analysis.

Prepare a profit variance analysis:

|

Actual Revenue & Costs (a) |

Manufacturing variance |

Marketing and administrative variance |

Sales price variance |

Flexible budget (d) |

Sales Activity Variance |

Master budget (f) | |

| Units Produced | 120,000 | 120,000 | 12,000 | 108,000 | |||

| Sales revenue | $672,000 | $72,000F | $600,000(1) | $60,000F | $540,000 | ||

| Less: Variable costs | |||||||

| Manufacturing | $147,200 | $29,422U | $117,778(4) | $11,778U | $106,000 | ||

| Marketing &administrative costs | $61,400 | $1,400U | $60,000(3) | $6,000U | $54,000 | ||

| Contribution margin | $463,400 | $29,422U | $1,400U | $72,000F | $422,222(2) | $42,222 | $380,000 |

| Less: Fixed Costs | |||||||

| Manufacturing | $205,000 | $11,000F | $216,000 | $216,000(5) | |||

| Marketing &administrative costs | $113,200 | $57,200U | $56,000 | $56,000(7) | |||

| Operating Profits | $145,200 | $18,422U | $58,600U | $72,000F | $150,222 | $42,222F | $108,000(6) |

Table: (2)

Working Note 1:

Working Note 2:

Working Note 3:

Working Note 4:

Working Note 5:

Working Note 6:

Working Note 7:

Want to see more full solutions like this?

Chapter 16 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- Laws can be classified into several categories: criminal law versus civil law, substantive law versus procedural law, public versus private law, and law versus equity. Discuss one of these categories and the distinctions between the two types of laws.arrow_forwardDo fast answer of this accounting questionsarrow_forwardFinancial Accounting Question please answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning