Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 3BE

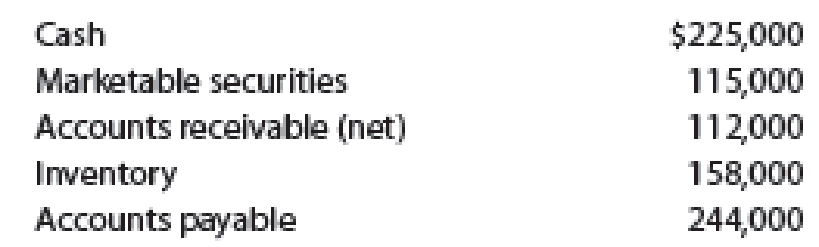

The following items are reported on a company’s

Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Titan Manufacturing applies overhead cost to jobs on the basis of 85% of direct labor cost. If Job 427 shows $93,500 of manufacturing overhead applied, the direct labor cost on the job was: a. $79,475 b. $110,000 c. $120,000

I need help with this general accounting question using the proper accounting approach.

Could you help me solve this financial accounting question using appropriate calculation techniques?

Chapter 16 Solutions

Managerial Accounting

Ch. 16 - Prob. 1DQCh. 16 - What is the advantage of using comparative...Ch. 16 - Prob. 3DQCh. 16 - Prob. 4DQCh. 16 - Prob. 5DQCh. 16 - What do the following data, taken from a...Ch. 16 - Prob. 7DQCh. 16 - Prob. 8DQCh. 16 - The dividend yield of Suburban Propane Partners,...Ch. 16 - Prob. 10DQ

Ch. 16 - Prob. 1BECh. 16 - Prob. 2BECh. 16 - The following items are reported on a companys...Ch. 16 - Prob. 4BECh. 16 - Prob. 5BECh. 16 - Prob. 6BECh. 16 - Prob. 7BECh. 16 - Prob. 8BECh. 16 - Prob. 9BECh. 16 - Prob. 10BECh. 16 - Prob. 11BECh. 16 - Prob. 1ECh. 16 - The following comparative income statement (in...Ch. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Prob. 5ECh. 16 - The following data were taken from the balance...Ch. 16 - PepsiCo, Inc. (PEP), the parent company of...Ch. 16 - Current position analysis The bond indenture for...Ch. 16 - Prob. 9ECh. 16 - Accounts receivable analysis Xavier Stores Company...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Ratio of liabilities to stockholders equity and...Ch. 16 - Hasbro, Inc. (HAS), and Mattel, Inc. (MAT), are...Ch. 16 - Recent balance sheet information for two companies...Ch. 16 - Prob. 16ECh. 16 - Prob. 17ECh. 16 - Prob. 18ECh. 16 - Prob. 19ECh. 16 - Prob. 20ECh. 16 - Prob. 21ECh. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Prob. 24ECh. 16 - Prob. 25ECh. 16 - Comprehensive income Anson Industries, Inc.,...Ch. 16 - Prob. 1PACh. 16 - Prob. 2PACh. 16 - Prob. 3PACh. 16 - Measures of liquidity, solvency, and profitability...Ch. 16 - Prob. 5PACh. 16 - Prob. 1PBCh. 16 - Prob. 2PBCh. 16 - Prob. 3PBCh. 16 - Prob. 4PBCh. 16 - Prob. 5PBCh. 16 - Prob. 1MADCh. 16 - Prob. 2MADCh. 16 - Deere Company (DE) manufactures and distributes...Ch. 16 - Marriott International, Inc. (MAR), and Hyatt...Ch. 16 - Prob. 1TIFCh. 16 - Real-world annual report The financial statements...Ch. 16 - Prob. 3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardHalle Manufacturing has an overhead application rate of 125% and allocates overhead based on direct materials. During the current period, direct labor is $78,000, and direct materials used are $112,000. Determine the amount of overhead Halle Manufacturing should record in the current period. a. $78,000 b. $97,500 c. $112,000 d. $140,000 e. $190,000arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- Bentley industries applied manufacturing overhead on the basis of direct labor hours.arrow_forwardSolve this question and accountingarrow_forwardDaley Industries wishes to develop a single predetermined overhead rate. The company's expected annual fixed overhead is $420,000, and its variable overhead cost per machine hour is $3.25. The company's relevant range is from 200,000 to 650,000 machine hours. Daley expects to operate at 520,000 machine hours for the coming year. The plant's theoretical capacity is 850,000 machine hours. The predetermined overhead rate per machine hour should be: a. $3.85 b. $4.06 c. $3.75 d. $4.25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License