PRINCIPLES OF TAXATION F/BUS...(LL)

23rd Edition

ISBN: 9781260433197

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 2TPC

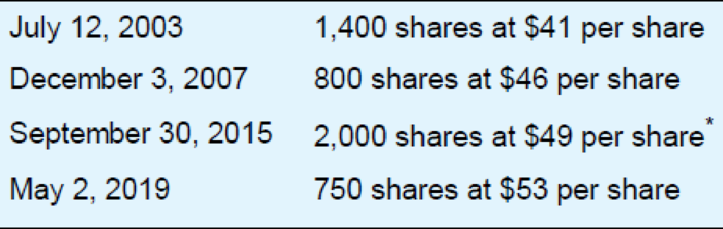

Ms. Kaspari, who has a 24 percent marginal rate on ordinary income and a 15 percent marginal rate on adjusted net

* Qualified small business stock.

In November 2019, Ms. Kaspari agreed to sell 1,000 KDS shares to Mr. Nolan for $60 per share. Which shares should she sell to maximize her after-tax cash from the sale?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Degregorio Corporation makes a product that uses a material with the

following direct material standards:

Standard quantity 4 kilos per unit

Standard price

$9 per kilo

The company produced 7,200 units in November using 29,290 kilos of

the material. During the month. the company purchased 31,480 kilos of

the direct material at a total cost of $277,024. The direct materials

purchases variance is computed when the materials are purchased.

The materials price variance for November is:

a. $5,592 F

b. $5,592 U

c. $6,296 F

d. $6,296 U

None

Select the correct equation format for the purchases budget.

a. Beginning inventory + expected sales = required purchases

b. Expected sales + Desired ending inventory = required purchases

c. Beginning inventory + expected sales - desired ending inventory =

required purchases

d. Expected sales + desired ending inventory - beginning inventory =

required purchases

Chapter 16 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

Ch. 16 - Contrast the income tax consequences of the yields...Ch. 16 - Prob. 2QPDCh. 16 - Mrs. Buckley, age 74, has 100,000 in a certificate...Ch. 16 - Ms. Quint sadly concluded that a 7,500 debt owed...Ch. 16 - Prob. 5QPDCh. 16 - Prob. 6QPDCh. 16 - Discuss the potential effect of the passive...Ch. 16 - Prob. 8QPDCh. 16 - Prob. 9QPDCh. 16 - Prob. 10QPD

Ch. 16 - Prob. 11QPDCh. 16 - Prob. 1APCh. 16 - Mr. and Mrs. Lays taxable income is 679,000, which...Ch. 16 - Dianne Stacy, a single taxpayer, has 272,000...Ch. 16 - Prob. 4APCh. 16 - Mrs. Nunn, who has a 24 percent marginal tax rate...Ch. 16 - Refer to the preceding problem and assume that...Ch. 16 - Mrs. Yue, a resident of Virginia, paid 50,000 for...Ch. 16 - Ms. Pay, who has a 40.8 percent marginal tax rate...Ch. 16 - Mr. Jolly received the 100,000 face amount on the...Ch. 16 - Prob. 10APCh. 16 - Prob. 11APCh. 16 - Prob. 12APCh. 16 - Prob. 13APCh. 16 - Fifteen years ago, Mr. Fairhold paid 50,000 for a...Ch. 16 - Refer to the facts in the preceding problem....Ch. 16 - Prob. 16APCh. 16 - Prob. 17APCh. 16 - Three years ago, Mrs. Gattis loaned 10,000 to Mr....Ch. 16 - Prob. 19APCh. 16 - Prob. 20APCh. 16 - Mrs. Beard recognized a 12,290 capital loss on the...Ch. 16 - Prob. 22APCh. 16 - Prob. 23APCh. 16 - Mr. and Mrs. Revel had 206,200 AGI before...Ch. 16 - Prob. 25APCh. 16 - Mr. Fox, a single taxpayer, recognized a 64,000...Ch. 16 - Mrs. Cox, a head of household, earned a 313,000...Ch. 16 - Prob. 28APCh. 16 - Prob. 29APCh. 16 - Mr. Dunn, who has a 32 percent marginal rate on...Ch. 16 - Prob. 31APCh. 16 - Prob. 32APCh. 16 - Prob. 33APCh. 16 - Prob. 34APCh. 16 - Prob. 35APCh. 16 - Prob. 36APCh. 16 - Ms. Turney owns a one-half interest in an...Ch. 16 - Prob. 38APCh. 16 - Prob. 39APCh. 16 - Prob. 40APCh. 16 - Mr. Erwins marginal tax rate on ordinary income is...Ch. 16 - Prob. 42APCh. 16 - Prob. 43APCh. 16 - Prob. 44APCh. 16 - Prob. 45APCh. 16 - Mrs. Wolter, an unmarried individual, owns...Ch. 16 - Prob. 1IRPCh. 16 - Prob. 2IRPCh. 16 - Prob. 3IRPCh. 16 - Prob. 4IRPCh. 16 - Prob. 5IRPCh. 16 - Two years ago, Ms. Eager loaned 3,500 to her...Ch. 16 - Prob. 7IRPCh. 16 - This year, Ms. Tan had a 29,000 capital loss...Ch. 16 - Prob. 9IRPCh. 16 - Mr. Pugh has a 7,900 adjusted basis in his limited...Ch. 16 - Prob. 11IRPCh. 16 - Mr. Durst died on March 8. His taxable estate...Ch. 16 - Prob. 13IRPCh. 16 - Prob. 1RPCh. 16 - Prob. 2RPCh. 16 - Prob. 1TPCCh. 16 - Ms. Kaspari, who has a 24 percent marginal rate on...Ch. 16 - Prob. 3TPCCh. 16 - Prob. 4TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please give me correct answer general accountingarrow_forwardA hardware store has budgeted sales of $46,000 for its power tools in August. Management wants to have $8,000 in power tool inventory at the end of August. Its beginning inventory is expected to be $5,000. What is the budgeted amount of merchandise purchases?arrow_forwardA company is considering whether to classify certain expenses as operating expenses or non-operating expenses. Discuss the potential impact of this classification on the company's financial statements and key ratios. What factors should the company consider when making this decision? How can the company ensure consistency in its expense classification? NO WRONG ANSWERarrow_forward

- provide correct answer general accounting questionarrow_forwardDo fast answer of this accounting questionsarrow_forwardWhich of the following formulas best describes the merchandise purchases budgets? a. Inventory to purchase = Budgeted ending inventory plus the budgeted cost of sales plus budgeted beginning inventory. b. Inventory to purchase = Budgeted beginning inventory plus the budgeted cost of sales less budgeted ending inventory. c. Inventory to purchase = Budgeted beginning inventory plus the budgeted cost of sales plus budgeted ending inventory. d. Inventory to purchase = Budgeted ending inventory plus the budgeted cost of sales less budgeted beginning inventory.arrow_forward

- Provide correct answer general accountingarrow_forwardI want answerarrow_forwardTatum Company has four products in its inventory. Information about ending inventory is as follows: Product Total Cost Total Net Realizable Value 101 $ 146,000 $ 113,000 102 108,000 123,000 103 73,000 63,000 104 43,000 63,000 Required: Determine the carrying value of ending inventory assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License