The controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the company’s income statement for the year ended September 30, 2020. As currently calculated, Red Lake’s net income is $540,000 for fiscal year 2019-2020.

Your working papers disclose the following opening balances and transactions in the company’s capital stock accounts during the year:

- 1. Common stock (at October 1, 2019, stated value $10, authorized 300,000 shares; effective December 1, 2019, stated value $5, authorized 600,000 shares):

Balance, October 1, 2019—issued and outstanding 60,000 shares

December 1, 2019—60,000 shares issued in a 2-for-l stock split

December 1, 2019—280,000 shares (stated value $5) issued at $39 per share

- 2. Treasury stock—common:

March 3, 2020—purchased 40,000 shares at $38 per share

April 1, 2020—sold 40,000 shares at $40 per share

- 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with $60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at $30 per share):

October 1, 2019—25,000 warrants issued at $6 each

- 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with $40 for 1 common share): April 1, 2020—20,000 warrants authorized and issued at $10 each

- 5. First mortgage bonds, 5½%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019—authorized, issued, and outstanding—the face value of $1,400,000

- 6. Convertible debentures, 7%, due 2036 (initially, each $1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019—authorized and issued at their face value (no premium or discount) of $2,400,000

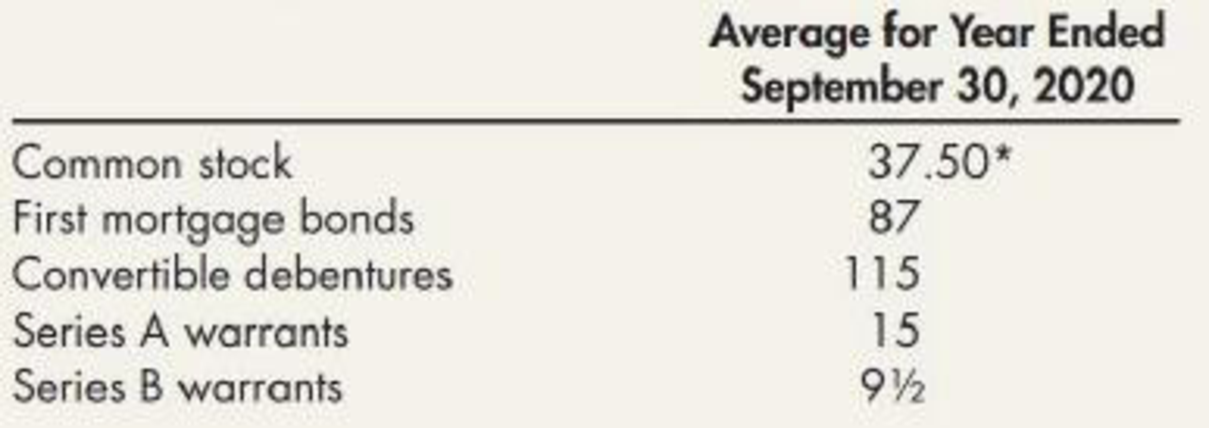

The following table shows the average market prices for the company’s securities during 2019-2020:

*$Adjusted for stock split

Required:

Prepare a schedule computing:

- 1. the basic earnings per share

- 2. the diluted earnings per share that should be presented on Red Lake’s income statement for the year ended September 30, 2020

A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Intermediate Accounting: Reporting and Analysis (Looseleaf)

- Marvin Company is a subsidiary of Hughes Corp. The controller believes that the yearly allowance for doubtful accounts for Marvin should be 8% of gross accounts receivable. Given the recession and the high interest rate environment, the president, nervous that the parent company might expect the subsidiary company to sustain its 10% growth rate, suggests that the controller increase the allowance for doubtful accounts to 9%. The president thinks that the lower net income, which reflects a 6% growth rate, will be a more sustainable rate for Marvin Company. On the basis of the case above: In a recessionary environment with tight credit and high interest rates, What steps Marvin Company might consider to improve the accounts receivable situation? Evaluate each step identified in terms of the risks and costs involved. Should the controller be concerned with Marvin Company's growth rate in estimating the allowance? Does the president's request pose an ethical dilemma for the controller?…arrow_forwardPlease provide answer this financial accounting questionarrow_forwardFinancial Accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning