Comparison of alternative joint-cost-allocation methods, further-processing decision, chocolate products. The Rich and Creamy Edibles Factory manufactures and distributes chocolate products. It purchases cocoa beans and processes them into two intermediate products: chocolate-powder liquor base and milk-chocolate liquor base. These two intermediate products become separately identifiable at a single splitoff point. Every 600 pounds of cocoa beans yields 20 gallons of chocolate-powder liquor base and 60 gallons of milk-chocolate liquor base.

The chocolate-powder liquor base is further processed into chocolate powder. Every 20 gallons of chocolate-powder liquor base yield 680 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 60 gallons of milk-chocolate liquor base yield 1,100 pounds of milk chocolate.

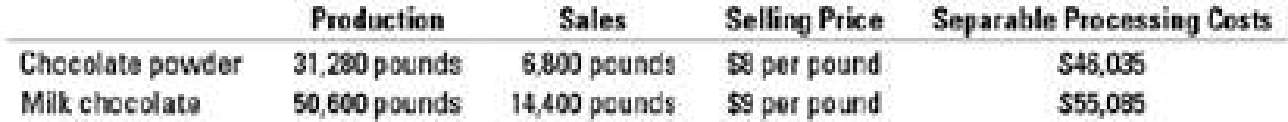

Production and sales data for August 2017 are as follows (assume no beginning inventory):

- Cocoa beans processed, 27,600 pounds

- Costs of processing cocoa beans to splitoff point (including purchase of beans), $70,000

Rich and Creamy Edibles Factory fully processes both of its intermediate products into chocolate powder or milk chocolate. There is an active market for these intermediate products. In August 2017, Rich and Creamy Edibles Factory could have sold the chocolate-powder liquor base for $21 a gallon and the milk-chocolate liquor base for $28 a gallon.

- 1. Calculate how the joint costs of $70,000 would be allocated between chocolate powder and milk chocolate under the following methods:

Required

- a. Sales value at splitoff

- b. Physical measure (gallons)

- c. NRV

- d. Constant gross-margin percentage NRV

- 2. What are the gross-margin percentages of chocolate powder and milk chocolate under each of the methods in requirement 1?

- 3. Could Rich and Creamy Edibles Factory have increased its operating income by a change in its decision to fully process both of its intermediate products? Show your computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

EBK HORNGREN'S COST ACCOUNTING

- Bonita Family Instruments makes cellos. During the past year, the company made 6,700 cellos even though the budget was planned for only 5,720. The company paid its workers an average of $15 per hour, which was $1 higher than the standard labor rate. The production manager budgets four direct labor hours per cello. During the year, a total of 24,850 direct labor hours were worked. Calculate the direct labor rate and efficiency variances.arrow_forwardProblem related to Accountingarrow_forwardIts. General Account problem.arrow_forward

- MCQ. GENERAL. ACCOUNT.arrow_forwardAccounting 55arrow_forwardEnd of the year physical inventory determined that $760,000 of goods were on hand. The following items were not in physical count: $96,000 of the goods were in transit shipped FOB destination (received 3 days after inventory count). The company then sold $40,000 worth of inventory FOB destination. What is the inventory at the end of the year?arrow_forward

- Answer? ? Financial accountingarrow_forwardA company has received a loan from a bank with certain debt covenants that require the company to maintain specific financial ratios. Discuss the potential impact of these covenants on the company's financial statements and the steps the company can take to ensure compliance. What are the consequences of violating debt covenants? How can the company negotiate with the bank to modify the covenants if necessary? 5 MARKSarrow_forwardGet correct answer accounting questionsarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning