Comparison of alternative joint-cost-allocation methods, further-processing decision, chocolate products. The Rich and Creamy Edibles Factory manufactures and distributes chocolate products. It purchases cocoa beans and processes them into two intermediate products: chocolate-powder liquor base and milk-chocolate liquor base. These two intermediate products become separately identifiable at a single splitoff point. Every 600 pounds of cocoa beans yields 20 gallons of chocolate-powder liquor base and 60 gallons of milk-chocolate liquor base.

The chocolate-powder liquor base is further processed into chocolate powder. Every 20 gallons of chocolate-powder liquor base yield 680 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 60 gallons of milk-chocolate liquor base yield 1,100 pounds of milk chocolate.

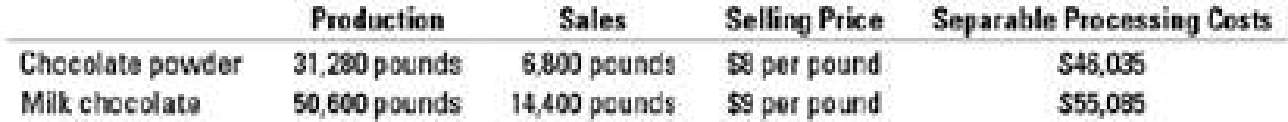

Production and sales data for August 2017 are as follows (assume no beginning inventory):

- Cocoa beans processed, 27,600 pounds

- Costs of processing cocoa beans to splitoff point (including purchase of beans), $70,000

Rich and Creamy Edibles Factory fully processes both of its intermediate products into chocolate powder or milk chocolate. There is an active market for these intermediate products. In August 2017, Rich and Creamy Edibles Factory could have sold the chocolate-powder liquor base for $21 a gallon and the milk-chocolate liquor base for $28 a gallon.

- 1. Calculate how the joint costs of $70,000 would be allocated between chocolate powder and milk chocolate under the following methods:

Required

- a. Sales value at splitoff

- b. Physical measure (gallons)

- c. NRV

- d. Constant gross-margin percentage NRV

- 2. What are the gross-margin percentages of chocolate powder and milk chocolate under each of the methods in requirement 1?

- 3. Could Rich and Creamy Edibles Factory have increased its operating income by a change in its decision to fully process both of its intermediate products? Show your computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Silver Star Manufacturing has $20 million in sales, an ROE of 15%, and a total assets turnover of 5 times. Common equity on the firm's balance sheet is 30% of its total assets. What is its net income? Round the answer to the nearest cent.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardprovide (P/E ratio)?arrow_forward

- What was xyz corporation's stockholders' equity at the of marcharrow_forward???arrow_forwardHorizon Consulting started the year with total assets of $80,000 and total liabilities of $30,000. During the year, the business recorded $65,000 in service revenues and $40,000 in expenses. Additionally, Horizon issued $12,000 in stock and paid $18,000 in dividends. By how much did stockholders' equity change from the beginning of the year to the end of the year?arrow_forward

- х chat gpt - Sea Content Content × CengageNOW × Wallet X takesssignment/takeAssignmentMax.co?muckers&takeAssignment Session Loca agenow.com Instructions Labels and Amount Descriptions Income Statement Instructions A-One Travel Service is owned and operated by Kate Duffner. The revenues and expenses of A-One Travel Service Accounts (revenue and expense items) < Fees earned Office expense Miscellaneous expense Wages expense Required! $1,480,000 350,000 36,000 875,000 Prepare an income statement for the year ended August 31, 2016 Labels and Amount Descriptions Labels Expenses For the Year Ended August 31, 20Y6 Check My Work All work saved.arrow_forwardEvergreen Corp. began the year with stockholders' equity of $350,000. During the year, the company recorded revenues of $500,000 and expenses of $320,000. The company also paid dividends of $30,000. What was Evergreen Corp.'s stockholders' equity at the end of the year?arrow_forwardEvergreen corp.'s stockholders' equity at the end of the yeararrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College