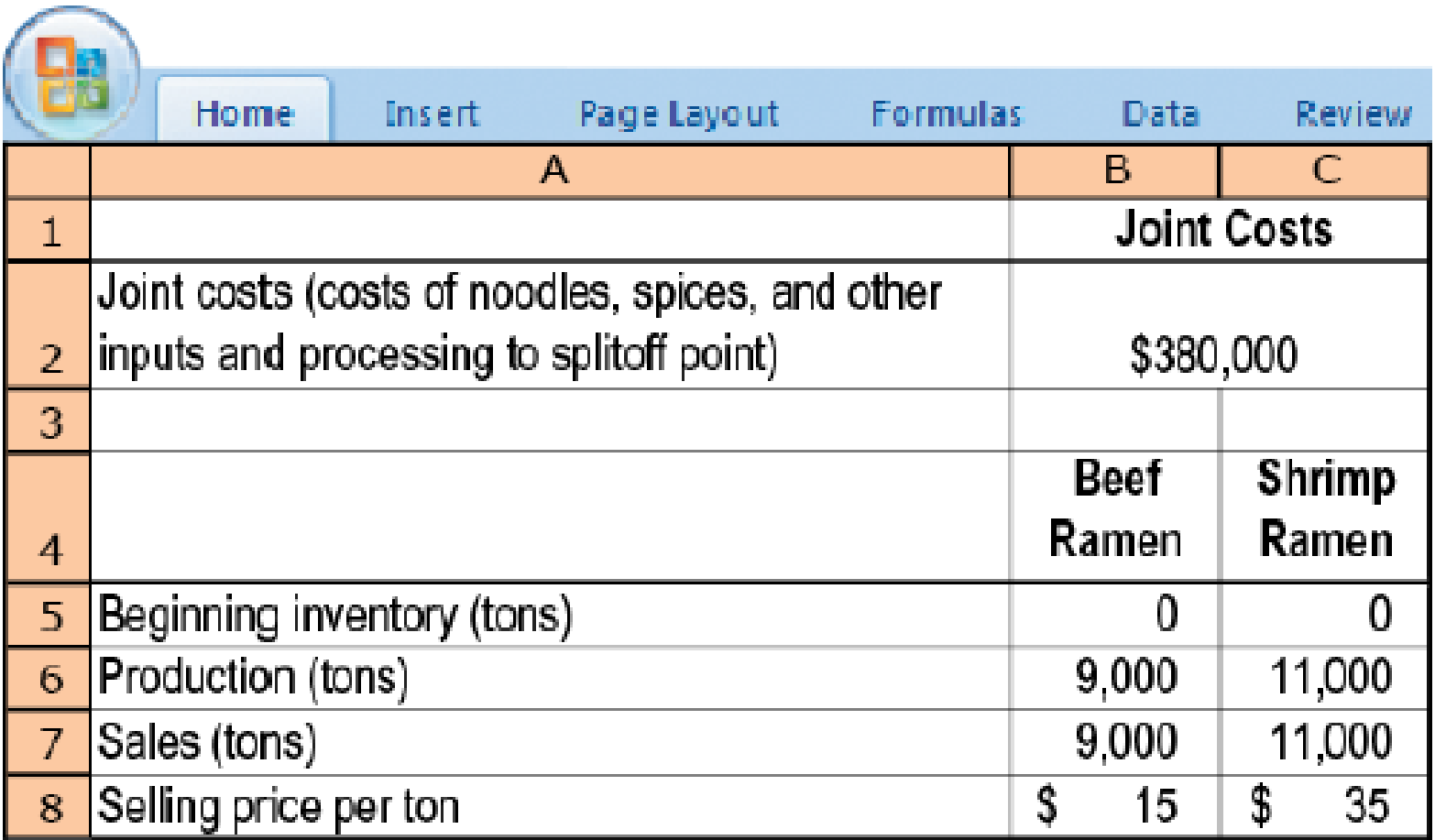

Joint-cost allocation, sales value, physical measure, NRV methods. Tasty Foods produces two types of microwavable products: beef-flavored ramen and shrimp-flavored ramen. The two products share common inputs such as noodle and spices. The production of ramen results in a waste product referred to as stock, which Tasty dumps at negligible costs in a local drainage area. In June 2017, the following data were reported for the production and sales of beef-flavored and shrimp-flavored ramen:

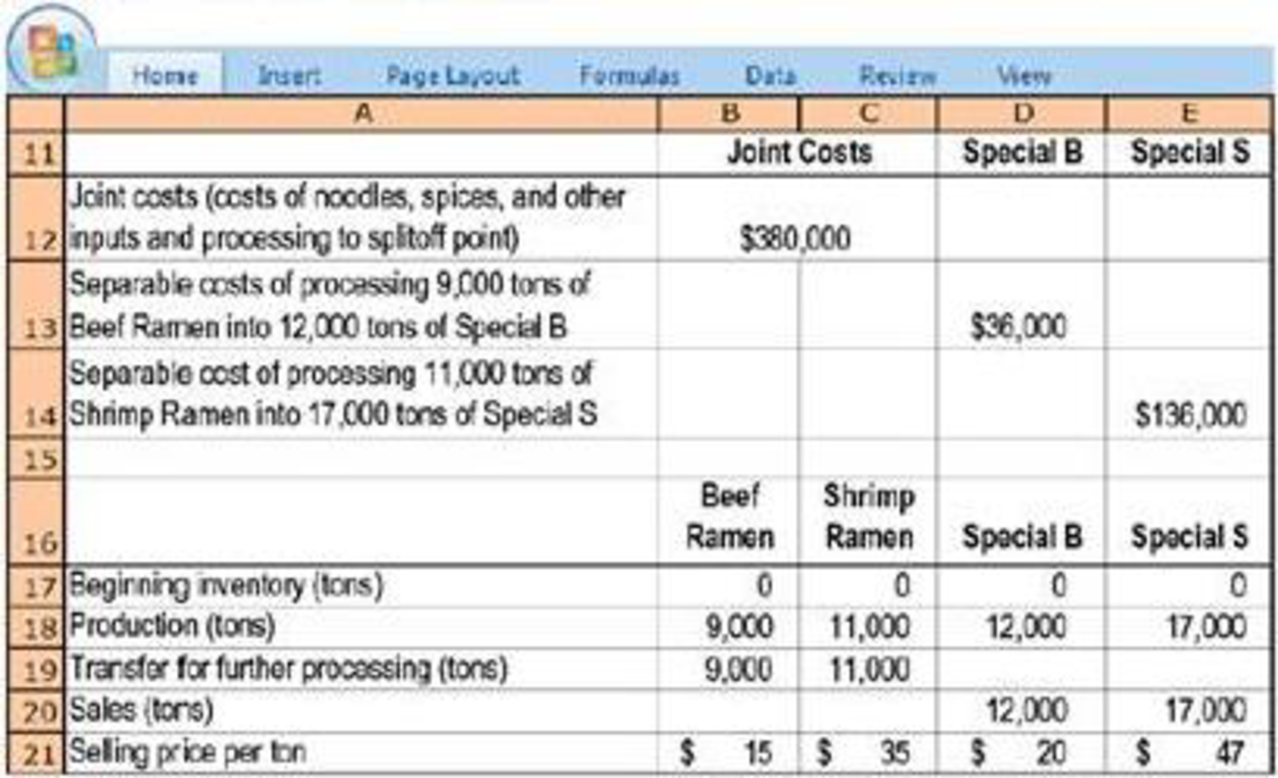

Due to the popularity of its microwavable products, Tasty decides to add a new line of products that targets dieters. These new products are produced by adding a special ingredient to dilute the original ramen and are to be sold under the names Special B and Special S, respectively. Following are the monthly data for all the products:

- 1. Calculate Tasty’s gross-margin percentage for Special B and Special S when joint costs are allocated using the following:

Required

- a. Sales value at splitoff method

- b. Physical-measure method

- c. Net realizable value method

Trending nowThis is a popular solution!

Chapter 16 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Uma Company uses the allowance method of accounting for uncollectable accounts. On May 3, the Uma Company wrote off the $3,500 uncollectable account of its customer, J. Rowlence. On July 10, Uma received a check for the full amount of $3,500 from J. Rowlence. On July 10, what are the entry or entries Uma makes to record the recovery of the bad debt? Entries in table formatarrow_forwardFinancial accounting questionarrow_forwardMID Company had originally expected to earn operating income of $130,000 in the coming year. MID's degree of operating leverage is 3.5. Recently, MID revised its plans and now expects to increase sales by 23% next year. What is the percent change in operating income expected by MID in the coming year?arrow_forward

- Que. - On March 1, 201, Dorchester Company's beginning work-in- process inventory had 10,000 units. This is its only production department. Beginning WIP units were 50% completed as to conversion costs. Dorchester introduces direct materials at the beginning of the production process. During March, all beginning WIP was completed and an additional 21,500 units were started and completed. Dorchester also started but did not complete 8,500 units. These units remained in the ending WIP inventory and were 70% completed as to conversion costs. Dorchester uses the weighted average method. Use this information to determine for March 2019 the equivalent units of production for conversion costs.arrow_forwardMID Company had originally expected to earn operating income of $130,000 in the coming year. MID's degree of operating leverage is 3.5. Recently, MID revised its plans and now expects to increase sales by 23% next year. What is the percent change in operating income expected by MID in the coming year? Accountingarrow_forwardTable formatarrow_forward

- The owners' equity of Pure Air, Inc. is dollar 600,000 on December 31, 2020, and is equal to two-fifth of total liabilities. What is the amount of total assets?arrow_forwardA company reported the following information for its most recent year of operation: purchases, $100,000; beginning inventory, $20,000; and cost of goods sold, $110,000. How much was the company's ending inventory? A) $10,000. B) $20,000. C) $15,000. D) $30,000.arrow_forwardAfter the accounts are adjusted and closed at the end of the year, accounts receivable have a final balance of $750,000 and an estimate of $93,000 is estimated for doubtful accounts. What is the net realizable value of accounts receivable? Please helparrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,