Concept explainers

Tax credit; uncertainty regarding sustainability

• LO16–9

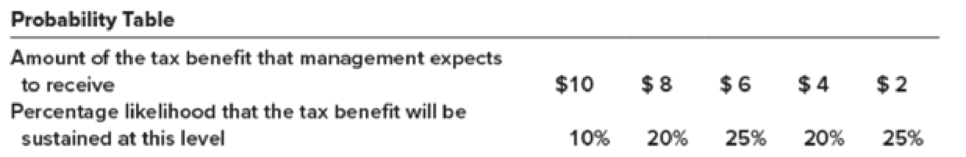

Delta Catfish Company has taken a position in its tax return to claim a tax credit of $10 million (direct reduction in taxes payable) and has determined that its sustainability is “more likely than not,” based on its technical merits. Delta has developed the probability table shown below of all possible material outcomes ($ in millions):

Delta’s taxable income is $85 million for the year. Its effective tax rate is 40%. The tax credit would be a direct reduction in current taxes payable.

Required:

1. At what amount would Delta measure the tax benefit in its income statement?

2. Prepare the appropriate

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

INTERMEDIATE ACCOUNTING

Additional Business Textbook Solutions

Macroeconomics

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Fundamentals of Management (10th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Financial Accounting, Student Value Edition (5th Edition)

- Boehms, Inc has cash of $36,000, supplies costing $1,500, and stockholder's equity of $28,000. Determine the liabilities of the business. Write the accounting equation for Boehms, Inc.arrow_forwardI want to correct answer general accounting questionarrow_forwardPlease solve this questionarrow_forward

- MCQarrow_forwardA business purchased equipment for $165,000 on January 1, 2021. The equipment will be depreciated over the five years of its estimated useful life using the straight-line depreciation method. The business records depreciation once a year on December 31. Which of the following is the adjusting entry required to record depreciation on the equipment for the year 2021? (Assume the residual value of the acquired equipment to be zero.) A) Debit $165,000 to Equipment, and credit $145,000 to Cash. B) Debit $33,000 to Depreciation Expense-Equipment, and credit $33,000 to Accumulated Depreciation-Equipment. C) Debit $165,000 to Depreciation Expense-Equipment, and credit $145,000 to Accumulated Depreciation-Equipment. D) Debit $33,000 to Depreciation Expense, and credit $33,000 to Equipment.arrow_forwardfinancial accountingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education