Joint costs and decision making. Jack Bibby is a prospector in the Texas Panhandle. He has also been running a side business for the past couple of years. Based on the popularity of shows such as “Rattlesnake Nation,” there has been a surge of interest from professionals and amateurs to visit the northern counties of Texas to capture snakes in the wild. Jack has set himself up as a purchaser of these captured snakes.

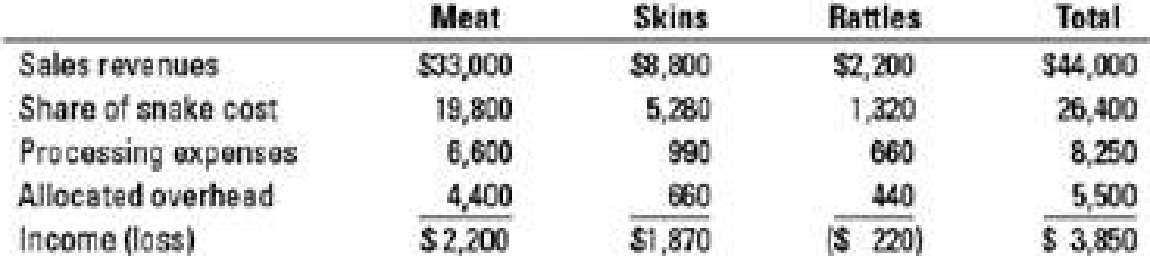

Jack purchases rattlesnakes in good condition from “snake hunters” for an average of $11 per snake. Jack produces canned snake meat, cured skins, and souvenir rattles, although he views snake meat as his primary product. At the end of the recent season, Jack Bibby evaluated his financial results:

The cost of snakes is assigned to each product line using the relative sales value of meat, skins, and rattles (i.e., the percentage of total sales generated by each product). Processing expenses are directly traced to each product line.

Jack has a philosophy of every product line paying for itself and is determined to cut his losses on rattles.

- 1. Should Jack Bibby drop rattles from his product offerings? Support your answer with computations.

Required

- 2. An old miner has offered to buy every rattle “as is” for $0.60 per rattle (note: “as is” refers to the situation where Jack only removes the rattle from the snake and no

processing costs are incurred). Assume that Jack expects to process the same number of snakes each season. Should he sell rattles to the miner? Support your answer with computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Cost Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText -- Access Card Package (15th Edition)

- You have been hired as a consultant for Pristine Urban - Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.4 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.6 million on an aftertax basis. In four years, the land could be sold for $2.8 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $275,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6, 100, 6, 800, 7, 400, and 5, 700 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forwardYou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forward

- You have been hired as a consultant for Pristine Urban-Tech Zither, Incorporated (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.55 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.75 million on an aftertax basis. In four years, the land could be sold for $2.95 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $305,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 6,400, 7,100, 7,700, and 6,000 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel…arrow_forwardou have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $2.1 million in anticipation of using it as a toxic waste dump site but has recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes it could sell the land for $2.3 million on an after-tax basis. In four years, the land could be sold for $2.4 million after taxes. The company also hired a marketing firm to analyze the zither market, at a cost of $125,000. An excerpt of the marketing report is as follows: The zither industry will have a rapid expansion in the next four years. With the brand name recognition that PUTZ brings to bear, we feel that the company will be able to sell 3,600, 4,300, 5,200, and 3,900 units each year for the next four years, respectively. Again, capitalizing on the name recognition of PUTZ, we feel that a…arrow_forwardRoald is the sales manager for a small regional manufacturing firm you own. You have asked him to put together a plan for expanding into nearby markets. You know that Roalds previous job had him working closely with many of your competitors in this new market, and you believe he will be able to facilitate the company expansion. He is to prepare a presentation to you and your partners outlining his strategy for taking the company into this expanded market. The day before the presentation, Roald comes to you and explains that he will not be making a presentation on market expansion but instead wants to discuss several ways he believes the company can reduce both fixed and variable costs. Why would Roald want to focus on reducing costs rather than on expanding into a new market?arrow_forward

- Smitty’s Home Repair Company, a regional hardware chain that specializes in do-it-yourself materials and equipment rentals, is cash rich because of several consecutive good years. One of the alternative uses for the excess funds is an acquisition. Linda Wade, Smitty’s treasurer and your boss, has been asked to place a value on a potential target, Hill’s Hardware, a small chain that operates in an adjacent state, and she has enlisted your help. Table below indicates Wade’s estimates of Hill’s earnings potential if it comes under Smitty’s management (in millions of dollars). The interest expense listed here includes the interest (1) on Hill’s existing debt, (2) on new debt that Smitty’s would issue to help finance the acquisition, and (3) on new debt expected to be issued over time to help finance expansion within the new “H division,” the code name given to the target firm. The retentions represent earnings that will be reinvested within the H division to help finance its growth.…arrow_forwardSmitty’s Home Repair Company, a regional hardware chain that specializes in do-it-yourself materials and equipment rentals, is cash rich because of several consecutive good years. One of the alternative uses for the excess funds is an acquisition. Linda Wade, Smitty’s treasurer and your boss, has been asked to place a value on a potential target, Hill’s Hardware, a small chain that operates in an adjacent state, and she has enlisted your help. Table 1 indicates Wade’s estimates of Hill’s earnings potential if it comes under Smitty’s management (in millions of dollars). The interest expense listed here includes the interest (1) on Hill’s existing debt,(2) on new debt that Smitty’s would issue to help finance the acquisition, and (3) on new debt expected to be issued over time to help finance expansion within the new “H division,” the code name given to the target firm. The retentions represent earnings that will be reinvested within the H division to help finance its growth. Hill’s…arrow_forwardHarold McWilliams owns and manages a general merchandise store in a rural area of Virginia. Harold sells appliances, clothing, auto parts, and farming equipment, among a wide variety of other types of merchandise. Because of normal seasonal and cyclical fluctuations in the local economy, he knows that his business will also have these fluctuations, and he is planning to use CVP analysis to help him understand how he can expect his profits to change with these fluctuations. Harold has the following information for his most recent year. Cost of goods sold represents the cost paid for the merchandise he sells, while operating costs represent rent, insurance, and salaries, which are entirely fixed. Sales $ 660,000 Cost of merchandise sold 462,000 Contribution margin 198,000 Operating costs 89,400 Operating profit $ 108,600 Required: 1-a. What is Harold’s margin of safety (MOS) in dollars? (Do not round intermediate calculations.) 1-b. What is the margin of safety (MOS)…arrow_forward

- Harold McWilliams owns and manages a general merchandise store in a rural area of Virginia. Harold sells appliances, clothing, auto parts, and farming equipment, among a wide variety of other types of merchandise. Because of normal seasonal and cyclical fluctuations in the local economy, he knows that his business will also have these fluctuations, and he is planning to use CVP analysis to help him understand how he can expect his profits to change with these fluctuations. Harold has the following information for his most recent year. Cost of goods sold represents the cost paid for the merchandise he sells, while operating costs represent rent, insurance, and salaries, which are entirely fixed. Sales Cost of merchandise sold Contribution margin Operating costs Operating profit. Required: 1-a. What is Harold's margin of safety (MOS) in dollars? (Do not round intermediate calculations.) 1-b. What is the margin of safety (MOS) ratio? (Input your answer as a percentage rounded to 2 decimal…arrow_forwardHello, can I get some help with this? Thank you so mucharrow_forwardHoosier Corporation is an entertainment company that produces and distributes digital content and operates its own amusement parks. The company is looking into expanding into a new market, Hoosiersville. There are several projects the CEO considers investing in to capture the values brought by the market. One project for consideration is an improvement to the existing amusement park in Hoosierville. If the project gets approved, the company expects an annual sale of $19.6 million from ticket sales, food, and concessions at the park, with an expected growth of 2.5% annually for a project life of 8 years. The annual operating expenses are expected to be 34% of sales, and the working capital (needed immediately) is expected to be 10% of the next year’s sales. The Tax Rate is 21% In addition, the CEO determines that the new park will need to buy a new rollercoaster which will have a $3 million upfront cost. The rollercoaster will be depreciated straight-line for eight years to an…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT  Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub