Concept explainers

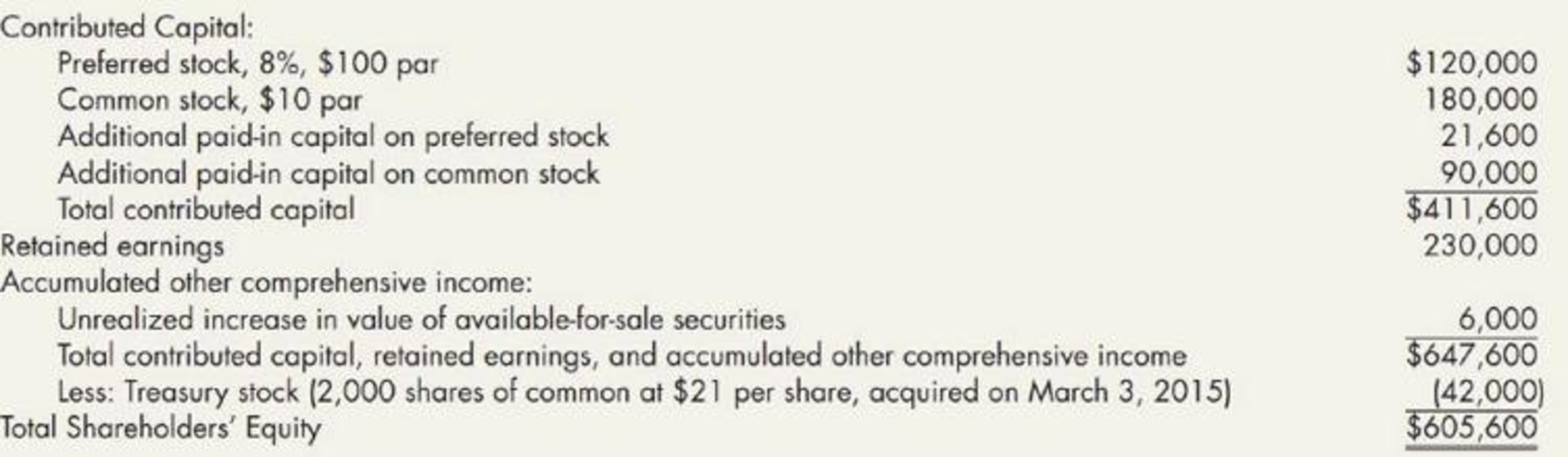

Gray Company lists the following shareholders’ equity items on its December 31, 2018,

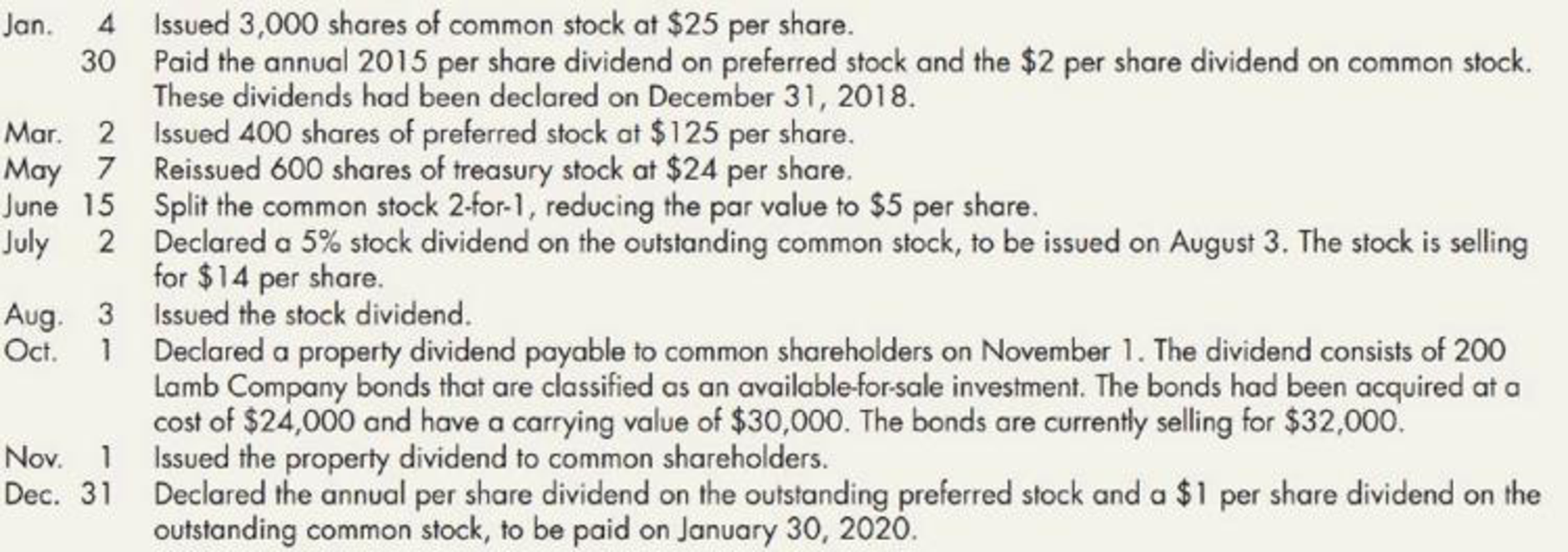

The following stock transactions occurred during 2019:

Required:

- 1. Prepare

journal entries to record the preceding transactions. - 2. Prepare the December 31, 2019, shareholders’ equity section (assume that 2019 net income was $225,000).

1.

Prepare necessary journal entry to record the given transactions.

Explanation of Solution

Stockholders’ Equity Section:

It is refers to the section of the balance sheet that shows the available balance stockholders’ equity as on reported date at the end of the financial year.

| Date | Account Titles and explanation | Debit ($) | Credit ($) |

| January 4, 2019 | Cash | 75,000 | |

| Common stock , at $10par | 10,000 | ||

|

Additional paid-in capital from stock dividend | 45,000 | ||

| ( To record the issuance of 1000 share of common stock at $40 per share) | |||

| January 30, 2019 | Dividend payable: Preferred | 9,600 | |

| Dividend payable: Common (1) | 32,000 | ||

| Cash | 41,600 | ||

| (To record declaration of preferred and common stock) | |||

| March 2, 2019 | Cash | 15,000 | |

| Preferred stock, $100 par | 1,500 | ||

|

Additional paid-in capital on preferred stock | 5,000 | ||

| ( To record issuance of preferred stock) | 11,500 | ||

| March 7, 2019 | Cash | 8,200 | |

| Treasury stock | 6,200 | ||

|

Additional paid-in capital on common stock | 2,000 | ||

| (To record the reissuance of treasury stock) | |||

| June 15, 2019 | No entry is required | ||

| June 15, 2019 | No entry is required | ||

|

July 2, 2019 | Retained earnings (2) | 27,440 | |

|

Common stock to be distributed | 9,800 | ||

|

Additional paid-in capital from stock dividend | 17,640 | ||

| (To record declaration of stock dividend) | |||

| August 3,2019 | Common stock to be distributed | 9,800 | |

| Common stock, $5 par | 9,800 | ||

| (To record the issuance of stock dividend) | |||

| October 1,2019 | Allowance for change in value of investment | 2,000 | |

| Unrealized increase in the value of available-for-sale of securities | 6,000 | ||

|

Gain on disposal of investment | 8,000 | ||

| (To record the declaration of property dividend) | |||

| Retained earnings | 32,000 | ||

| Property dividend payable | 32,000 | ||

| (To record the current value of the bond) | |||

| November 1,2019 | Property dividend payable | 32,000 | |

| Investment in Company L stock | 24,000 | ||

|

Allowance for change in value of investment | 8,000 | ||

| (To record the issuance of property dividend) | |||

| December 31, 2019 | Retained earnings | 53,960 | |

| Dividends payable: Preferred (3) | 12,800 | ||

| Dividends payable: Common (4) | 41,160 | ||

| (To record the declaration of annual per share dividend to the preferred and common stock) |

Table (1)

Note:

Note 1: On July 15 memorandum entry is made as the common stock split two for one and the par value is reduced from $10 to $5.

Note 2: On July 15 memorandum entry is made when treasury stock participates in the stock split. The treasury stock has 2,800 shares at a $6 par value per share costing $10.50 per share.

Working notes:

(1) Calculate the amount of dividend payable to the common stock:

(2) Calculate the amount of retained earnings:

| Particulars | Amount in $ |

| Shares issued | 42,000 |

| Less: Treasury shares (1,400 stock split for two for one) | 2,800 |

| Shares outstanding | 39,200 |

| Multiply: Stock dividend | 5% |

| Shares in stock dividend | 1,960 |

| Multiply: Current market price | $14 |

| Reduction in retained earnings | 27,440 |

Table (2)

(3) Calculate the amount of dividend payable to the preferred stock:

(4) Calculate the amount of dividend payable to the preferred stock:

2.

Prepare Company G’s statement of stockholder’s equity section for 2016.

Explanation of Solution

| Company G | |

| Shareholder's equity | |

| For the year ended December 31,2019 | |

| Particulars | Amount in $ |

| Contributed Capital: | |

| Preferred stock (8%, $100 par, 1,600 shares issued and outstanding) | 160,000 |

|

Common stock ($5 par, 43,960 shares issued of which 41,160 are outstanding and 2,800 shares are being held as treasury stock) | 219,800 |

| Additional paid-in capital on preferred stock | 31,600 |

| Additional paid-in capital on common stock | 93,000 |

| Additional paid-in capital from treasury stock | 1,800 |

| Additional paid-in capital from stock dividend | 17,640 |

| Total contributed capital | 523,840 |

|

Retained earnings (restricted in the amount of $29,400, the cost of the treasury shares) (5) | 341,600 |

| Total contributed capital, retained earnings, and donated capital | 865,440 |

| Less: Treasury stock (2,800 shares of common at $10.50 per share) | (29,400) |

| Total Shareholders’ Equity | 836,040 |

(Table 3)

(5) Calculate the amount of retained earnings:

Want to see more full solutions like this?

Chapter 16 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- This is an individual assignment. You are required to create a formal topic-to-sentence outline and a full five-paragraph essay [containing an introductory paragraph, 3 body paragraphs and a concluding paragraph], followed by an appropriate Works Cited list, and an annotated bibliography of one source used in the essay. Your essay must be based on ONE of the following prompts. EITHER A. What are the qualities of a socially responsible individual? OR B. Discuss three main groupings of life skills required by Twenty-first Century employers. Additionally, you will state which one of the expository methods [Analysis by Division OR Classification] you chose to guide development of your response to the question selected, and then provide a two or three sentence justification of that chosen method. Your essay SHOULD NOT BE LESS THAN 500 words and SHOULD NOT EXCEED 700 words. You are required to use three or four scholarly / reliable sources of evidence to support the claims made in your…arrow_forwardWhat is the gross profit rate on these general accounting question?arrow_forwardProvide answer this following requirements on these financial accounting questionarrow_forward

- PLEASE DO THE LAST ROW!!arrow_forwardFILL ALL CELLS PLEASE HELParrow_forwardLuctor Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Activity Allocation Base Supplies Number of square feet Travel Number of customer sites Allocation Rate $0.07 per square foot $23.00 per site Print Done Clear all Check answer 12:58 PMarrow_forward

- Were the overheads over applied or under applied and by how much for this general accounting question?arrow_forwardThe Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 45% income tax rate.arrow_forwardProvide correct answer this general accounting questionarrow_forward

- Needam Company has analyzed its production process and identified two primary activities. These activities, their allocation bases, and their estimated costs are listed below. BEE (Click on the icon to view the estimated costs data.) The company manufactures two products: Regular and Super. The products use the following resources in March: BEE (Click on the icon to view the actual data for March.) Read the requirements. Requirement 5. Compute the predetermined overhead allocation rates using activity-based costing. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the all Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Data table Regular Super Number of purchase orders 10 purchase orders Number of parts 600 parts 13 purchase orders 800 parts Activity Purchasing Materials handling - X…arrow_forwardMakenna is a waiter at Albicious Foods in South Carolina. Makenna is single with one other dependent and receives the standard tipped hourly wage. During the week ending October 25, 2024, Makenna worked 44 hours and received $210 in tips. Calculate Makenna's gross pay, assuming tips are included in the overtime rate determination. Use Table 3-2. Required: 1. Complete the payroll register for Makenna. 2a. Does Albicious Foods need to contribute to Makenna’s wages to meet FLSA requirements? 2b. If so, how much should be contributed?arrow_forward10. Record the journal entries for Holley Company for August. 11. Post appropriate entries to the Conversion Costs T-account to determine the amount of underallocated or overallocated overhead. Record the adjusting entry. 10. Record the journal entries for Holley Company for August. (Record debits first, then credits. Exclude explanations from journal entries) Journalize the purchase of raw materials. Date 5 a. Accounts Debit Credit Accounts Payable Accounts Receivable Conversion Costs Cost of Goods Sold Finished Goods Inventory Raw and In-Process Inventory Sales Revenue Wages Payable, Accumulated Depreciation, etc. More info a. Purchased raw materials on account, $30,000. b Incurred labor and overhead costs, $65,000. C d. Completed 900 units with standard costs of $75 for direct materials and $180 for conversion costs. Sold on account 600 units for $400 each. Print Done - Xarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning