Concept explainers

1.

Compute the basic earnings per share for Company M.

1.

Explanation of Solution

Earnings per share (EPS):

The amount of net income available to each shareholder per common share outstanding is referred to as earnings per share (EPS).

Compute the basic earnings per share for Company M.

Working notes:

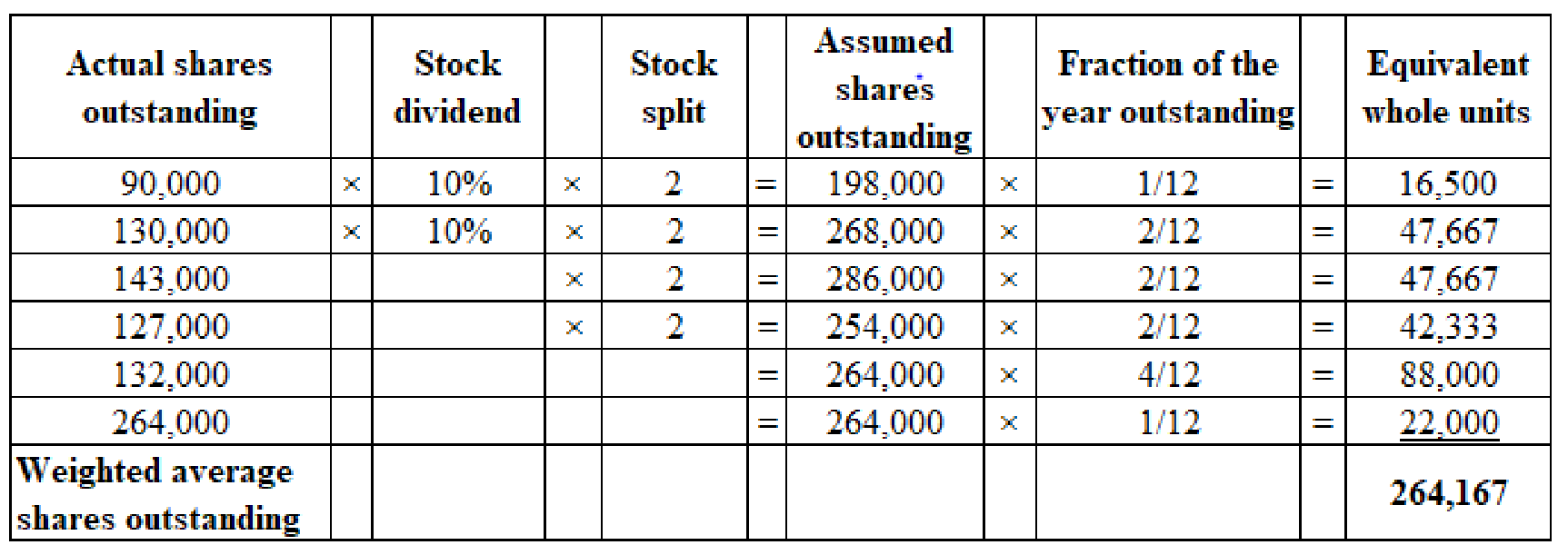

(1) Calculation of weighted average shares outstanding:

(Figure 1)

2.

Compute the tentative and incremental dilutive earnings per share for each dilutive security.

2.

Explanation of Solution

Compute tentative diluted EPS for stock options.

Compute the incremental diluted EPS for stock options.

Compute the incremental diluted EPS for convertible bonds.

Compute the incremental diluted EPS of convertible preferred stock.

Compute tentative diluted EPS assuming for 12% convertible preferred stock.

Compute tentative diluted EPS assuming, exercisable options, 9% convertible bonds, and 12% convertible preferred stock.

Working notes:

(1) Calculate the value of exercisable options:

(2) Compute the number of shares required:

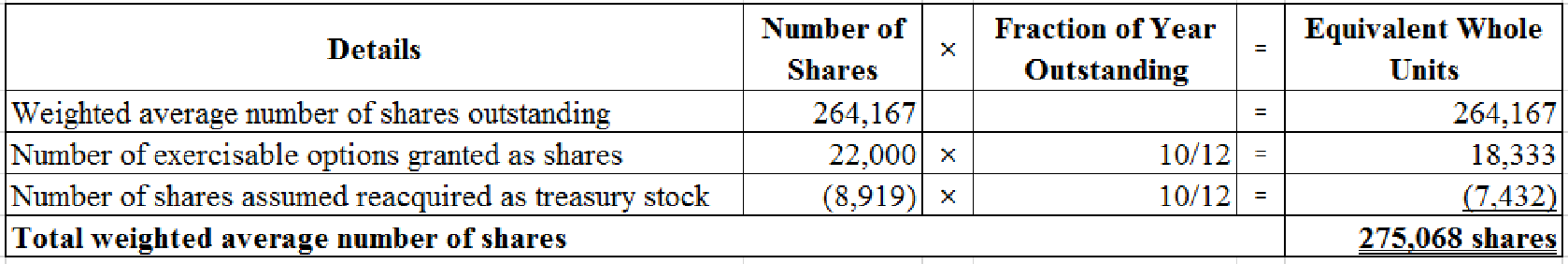

(3) Compute the total weighted average number of common shares.

(Figure 2)

(4) Compute the amount of interest expense, net of income tax on 9% bonds.

(5) Compute the number of common shares due to conversion of 9% bonds.

(6) Compute the number of common shares due to conversion of preferred shares.

3.

Identify the amount that will be reported as basic and diluted earnings per share for the year 2019.

3.

Explanation of Solution

The Company M must report an amount of $1.95 as basic earnings per share and $1.64 as diluted earnings per share in its 2019 income statement.

Want to see more full solutions like this?

Chapter 16 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- Please provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardCan you explain the correct methodology to solve this financial accounting problem?arrow_forward

- Can you explain this financial accounting question using accurate calculation methods?arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning