Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

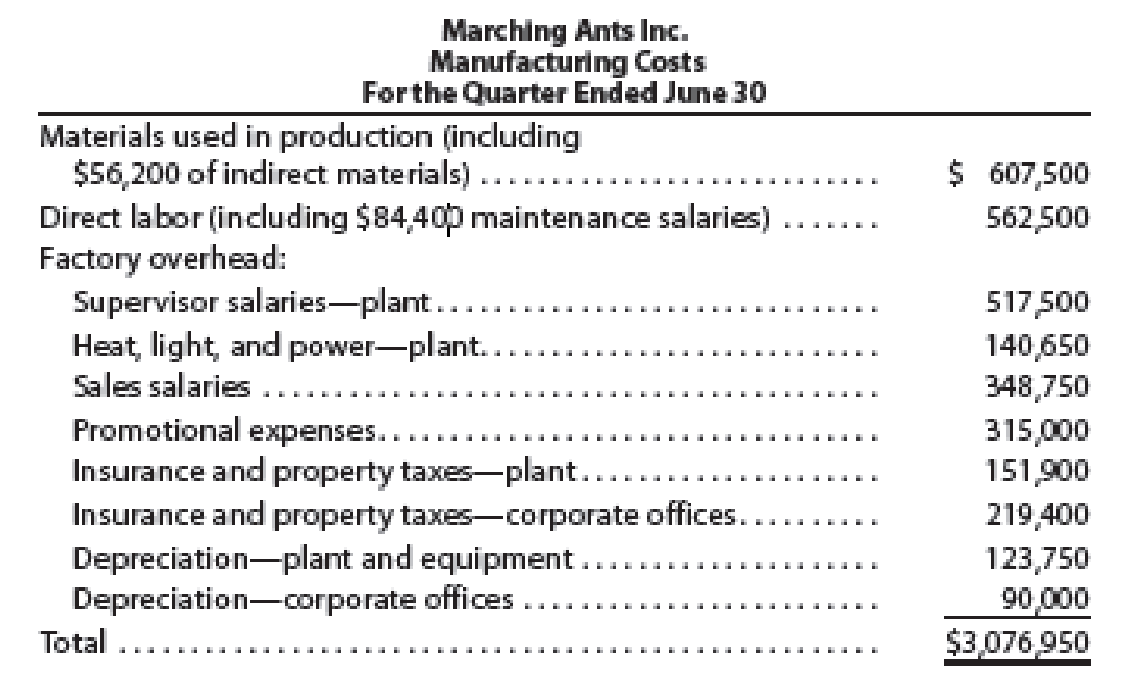

Chapter 15, Problem 8E

Classifying costs

The following is a

a. List the errors in the preceding report.

b. Prepare a corrected report.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the revised depreciation expense for 2019?

help me to solve this questions

What percent are variable costs of sales?

Chapter 15 Solutions

Financial And Managerial Accounting

Ch. 15 - What are the major differences between managerial...Ch. 15 - Prob. 2DQCh. 15 - Prob. 3DQCh. 15 - Distinguish between prime costs and conversion...Ch. 15 - What is the difference between a product cost and...Ch. 15 - Name the three inventory accounts for a...Ch. 15 - In what order should the three inventories of a...Ch. 15 - What are the three categories of manufacturing...Ch. 15 - How do the manufacturing costs incurred during a...Ch. 15 - How does the Cost of goods sold section of the...

Ch. 15 - Management process Three phases of the management...Ch. 15 - Direct materials, direct labor, and factory...Ch. 15 - Prob. 3BECh. 15 - Product and period costs Identify the following...Ch. 15 - Cost of goods sold, cost of goods manufactured...Ch. 15 - Prob. 6BECh. 15 - Prob. 1ECh. 15 - Indicate whether the following costs of Procter ...Ch. 15 - Prob. 3ECh. 15 - For apparel manufacturer Abercrombie Fitch, Inc....Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - Classifying costs In a service company A partial...Ch. 15 - Classifying costs The following is a manufacturing...Ch. 15 - Financial statements of a manufacturing firm The...Ch. 15 - Manufacturing company balance sheet Partial...Ch. 15 - Cost of direct materials used in production for a...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Income statement for a manufacturing company Two...Ch. 15 - Statement of cost of goods manufactured for a...Ch. 15 - Cost of goods sold, profit margin, and net income...Ch. 15 - Cost flow relationships The following information...Ch. 15 - The following is a list of costs that were...Ch. 15 - The following is a list of costs incurred by...Ch. 15 - A partial list of Foothills Medical Centers costs...Ch. 15 - Manufacturing income statement, statement of cost...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - The following is a list of costs that were...Ch. 15 - Prob. 2PBCh. 15 - A partial list of The Grand Hotels costs follows:...Ch. 15 - Several items are omitted from the income...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - Comfort Plus, Inc., has a hotel with 300 rooms in...Ch. 15 - Hilton Hotels and Marriott International:...Ch. 15 - Comparing occupancy for two hotels Sunrise Suites...Ch. 15 - Prob. 4MADCh. 15 - Prob. 5MADCh. 15 - Prob. 1TIFCh. 15 - Communication Todd Johnson is the Vice President...Ch. 15 - For each of the following managers, describe how...Ch. 15 - The following situations describe scenarios that...Ch. 15 - Geek Chic Company provides computer repair...Ch. 15 - Which of the following items would not be...Ch. 15 - Prob. 2CMACh. 15 - A firm has 100,000 in direct materials costs,...Ch. 15 - In practice, items such as wood screws and glue...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the recent period there were 1,080 units of product in a department, one-third completed. These units were finished and an additional 5,620 units were started and completed during the period. 960 units were still in process at the end of the period. One-fourth completed. Using the weighted-average valuation method the equivalent units produced by the department were____Units. Right Answerarrow_forwardWhat is total gross income for the year?arrow_forwardexpert of general accounting answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License