Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 1PA

The following is a list of costs that were incurred in the production and sale of large commercial airplanes:

- a. Annual bonus paid to the chief operating officer of the company

- b. Annual fee to a celebrity to promote the aircraft

- c. Cost of electronic guidance system installed in the airplane cockpit

- d. Cost of electrical wiring throughout the airplane

- e. Cost of miniature replicas of the airplane used to promote and market the airplane

- f. Cost of normal scrap from production of airplane body

- g. Cost of paving the headquarters employee parking lot

- h. Decals for cockpit door, the cost of which is immaterial to the cost of the final product

- i. Depreciation on factory equipment

- j. Hourly wages of employees that assemble the airplane

- k. Hydraulic pumps used in the airplane’s flight

control system - l. Instrument panel installed in the airplane cockpit

- m. Interior trim material used throughout the airplane cabin

- n. Masks for use by painters in painting the airplane body

- o. Metal used for producing the airplane body

- p. Oil to lubricate factory equipment

- q. Power used by painting equipment

- r. Prebuilt leather seats installed in the first-class cabin

- s. Production Quality Control Department costs for the year

- t. Salaries of Marketing Department personnel

- u. Salaries of test pilots

- v. Salary of chief financial officer

- w. Salary of plant manager

- x. Special advertising campaign in Aviation World magazine

- y. Turbo-charged airplane engine

- z. Yearly cost of the maintenance contract for robotic equipment

Instructions

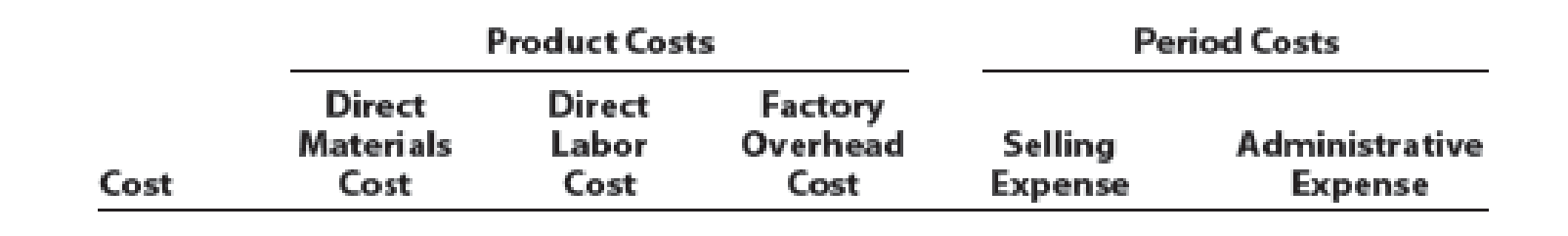

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the equity at the end of the year?

General Accounting

hi expert please help me

Chapter 15 Solutions

Financial And Managerial Accounting

Ch. 15 - What are the major differences between managerial...Ch. 15 - Prob. 2DQCh. 15 - Prob. 3DQCh. 15 - Distinguish between prime costs and conversion...Ch. 15 - What is the difference between a product cost and...Ch. 15 - Name the three inventory accounts for a...Ch. 15 - In what order should the three inventories of a...Ch. 15 - What are the three categories of manufacturing...Ch. 15 - How do the manufacturing costs incurred during a...Ch. 15 - How does the Cost of goods sold section of the...

Ch. 15 - Management process Three phases of the management...Ch. 15 - Direct materials, direct labor, and factory...Ch. 15 - Prob. 3BECh. 15 - Product and period costs Identify the following...Ch. 15 - Cost of goods sold, cost of goods manufactured...Ch. 15 - Prob. 6BECh. 15 - Prob. 1ECh. 15 - Indicate whether the following costs of Procter ...Ch. 15 - Prob. 3ECh. 15 - For apparel manufacturer Abercrombie Fitch, Inc....Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - From the choices presented in parentheses, choose...Ch. 15 - Classifying costs In a service company A partial...Ch. 15 - Classifying costs The following is a manufacturing...Ch. 15 - Financial statements of a manufacturing firm The...Ch. 15 - Manufacturing company balance sheet Partial...Ch. 15 - Cost of direct materials used in production for a...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Cost of goods manufactured for a manufacturing...Ch. 15 - Income statement for a manufacturing company Two...Ch. 15 - Statement of cost of goods manufactured for a...Ch. 15 - Cost of goods sold, profit margin, and net income...Ch. 15 - Cost flow relationships The following information...Ch. 15 - The following is a list of costs that were...Ch. 15 - The following is a list of costs incurred by...Ch. 15 - A partial list of Foothills Medical Centers costs...Ch. 15 - Manufacturing income statement, statement of cost...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - The following is a list of costs that were...Ch. 15 - Prob. 2PBCh. 15 - A partial list of The Grand Hotels costs follows:...Ch. 15 - Several items are omitted from the income...Ch. 15 - Statement of cost of goods manufactured and income...Ch. 15 - Comfort Plus, Inc., has a hotel with 300 rooms in...Ch. 15 - Hilton Hotels and Marriott International:...Ch. 15 - Comparing occupancy for two hotels Sunrise Suites...Ch. 15 - Prob. 4MADCh. 15 - Prob. 5MADCh. 15 - Prob. 1TIFCh. 15 - Communication Todd Johnson is the Vice President...Ch. 15 - For each of the following managers, describe how...Ch. 15 - The following situations describe scenarios that...Ch. 15 - Geek Chic Company provides computer repair...Ch. 15 - Which of the following items would not be...Ch. 15 - Prob. 2CMACh. 15 - A firm has 100,000 in direct materials costs,...Ch. 15 - In practice, items such as wood screws and glue...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chapter 15 Homework 13 Saved Help Save & Exit Submit Part 1 of 2 0.83 points eBook Ask Required information Use the following information to answer questions. (Algo) [The following information applies to the questions displayed below.] Information on Kwon Manufacturing's activities for its first month of operations follows: a. Purchased $100,800 of raw materials on credit. b. Materials requisitions show the following materials used for the month. Job 201 Job 202 Total direct materials Indirect materials Total materials used $ 49,000 24,400 73,400 9,420 $ 82,820 c. Time tickets show the following labor used for the month. Print References Job 201 $ 40,000 Job 202 13,400 Total direct labor 53,400 25,000 $ 78,400 Indirect labor Total labor used d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. Sold Job 201 for $166,160 on credit. g. Incurred the following actual other…arrow_forwardquesrion 2arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2, 173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes $76,000; Dividends $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capital (325 marks)arrow_forward

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License