Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 6DQ

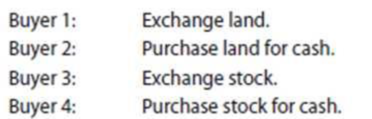

LO.2 Ross would like to dispose of some land he acquired five years ago because he believes it will not continue to appreciate. Its value has increased by $50,000 over the five-year period. He also intends to sell stock that has declined in value by $50,000 during the eight-month period he has owned it.

Ross has four offers to acquire the stock and land. Identify the tax issues relevant to Ross in disposing of this land and stock.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Nicole is a calendar-year taxpayer who accounts for her business using the cash method. On average, Nicole sends out bills for about $12,000 of her services on the first of each month. The bills are due by the end of the month, and typically 70 percent of the bills are paid on time and 98 percent are paid within 60 days.

a. Suppose that Nicole is expecting a 2 percent reduction in her marginal tax rate next year. Ignoring the time value of money, estimate the tax savings for Nicole if she postpones mailing the December bills until January 1 of next year.

General accounting

Can you solve this general accounting question with accurate accounting calculations?

Chapter 15 Solutions

Individual Income Taxes

Ch. 15 - Prob. 1DQCh. 15 - Prob. 2DQCh. 15 - Prob. 3DQCh. 15 - Prob. 4DQCh. 15 - LO.2 Melissa owns a residential lot in Spring...Ch. 15 - LO.2 Ross would like to dispose of some land he...Ch. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQ

Ch. 15 - Prob. 11DQCh. 15 - LO.3 Reba, a calendar year taxpayer, owns an...Ch. 15 - Prob. 13DQCh. 15 - Prob. 14DQCh. 15 - Prob. 15DQCh. 15 - Prob. 16CECh. 15 - Prob. 17CECh. 15 - Prob. 18CECh. 15 - Prob. 19CECh. 15 - LO.3 On June 5, 2019, Brown, Inc., a calendar year...Ch. 15 - LO.3 Camilos property, with an adjusted basis of...Ch. 15 - Prob. 22CECh. 15 - Prob. 23CECh. 15 - Prob. 24CECh. 15 - Prob. 25CECh. 15 - Prob. 26CECh. 15 - Prob. 27PCh. 15 - Prob. 28PCh. 15 - Prob. 29PCh. 15 - Prob. 30PCh. 15 - Prob. 31PCh. 15 - Prob. 32PCh. 15 - Prob. 33PCh. 15 - Ed owns investment land with an adjusted basis of...Ch. 15 - Prob. 35PCh. 15 - Prob. 36PCh. 15 - Prob. 37PCh. 15 - Prob. 38PCh. 15 - Prob. 39PCh. 15 - Prob. 40PCh. 15 - LO.3 Howards roadside vegetable stand (adjusted...Ch. 15 - Prob. 42PCh. 15 - Prob. 43PCh. 15 - Prob. 44PCh. 15 - Prob. 45PCh. 15 - Prob. 46PCh. 15 - What are the maximum postponed gain or loss and...Ch. 15 - Prob. 48PCh. 15 - Prob. 49PCh. 15 - Prob. 50PCh. 15 - Prob. 51PCh. 15 - Prob. 52PCh. 15 - Prob. 53PCh. 15 - Prob. 54PCh. 15 - Prob. 55PCh. 15 - Prob. 56PCh. 15 - Devon Bishop, age 45, is single. He lives at 1507...Ch. 15 - Prob. 1RPCh. 15 - Prob. 2RPCh. 15 - Taylor owns a 150-unit motel that was constructed...Ch. 15 - Prob. 6RPCh. 15 - Prob. 1CPACh. 15 - Susie purchased her primary residence on March 15,...Ch. 15 - Chad owned an office building that was destroyed...Ch. 15 - Prob. 4CPACh. 15 - Marsha exchanged land used in her business in...Ch. 15 - Prob. 6CPACh. 15 - Prob. 7CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to (Legally) Never Pay Taxes Again; Author: Next Level Life;https://www.youtube.com/watch?v=q63F1pBrUHA;License: Standard Youtube License