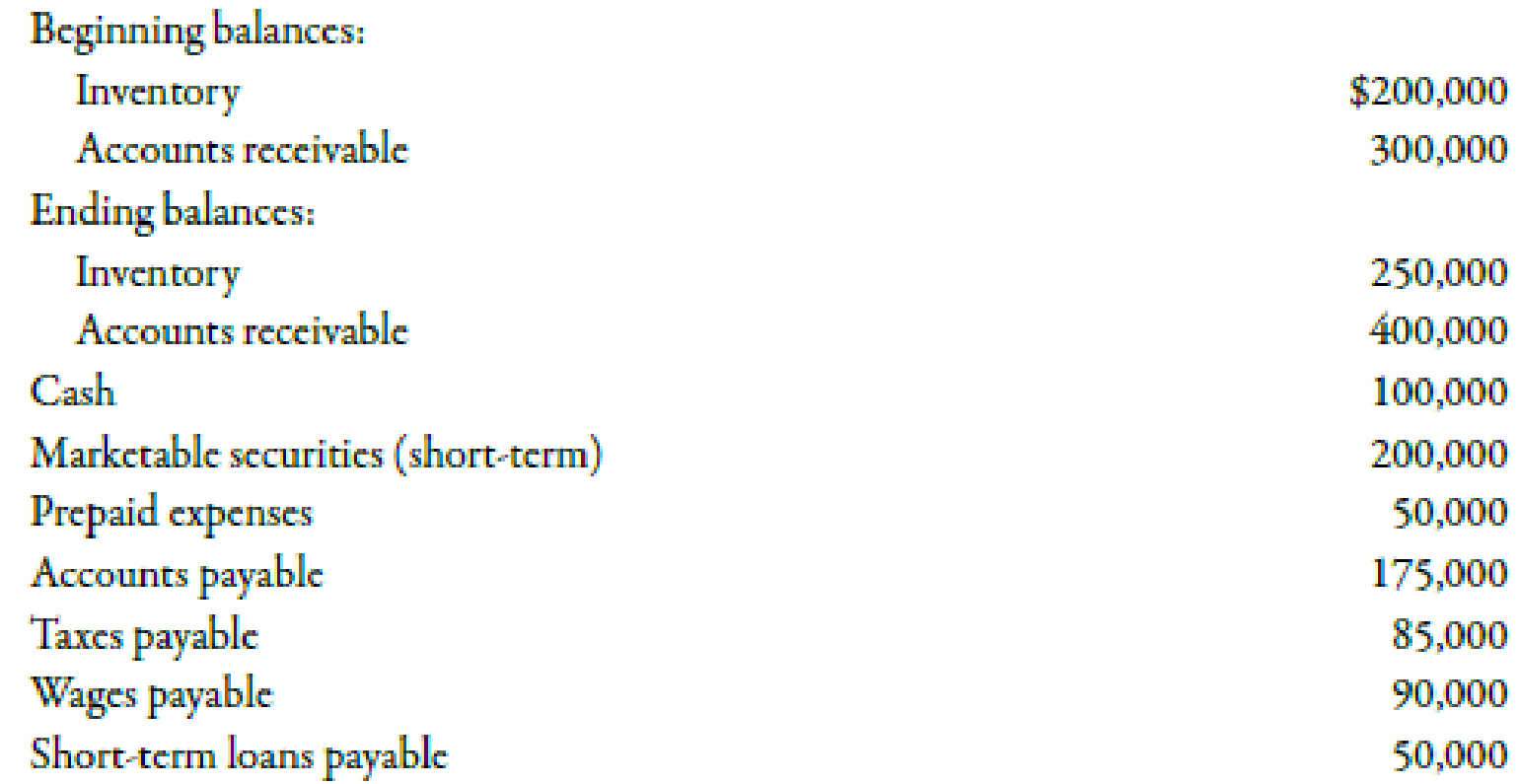

The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations:

During the year, Arnn had net sales of $2.45 million. The cost of goods sold was $1.3 million.

Required:

Note: Round all answers to two decimal places.

- 1. Compute the

current ratio . - 2. Compute the quick or acid-test ratio.

- 3. Compute the

accounts receivable turnover ratio. - 4. Compute the accounts receivable turnover in days.

- 5. Compute the inventory turnover ratio.

- 6. Compute the inventory turnover in days.

1.

Calculate current ratio

Answer to Problem 56P

Current ratio is 2.5.

Explanation of Solution

Liquidity ratio

Liquidity ratios evaluate a firm’s ability to fulfil its present obligations. Some of the ratios calculated are current ratio, acid-test ratio and inventory turnover ratio.

Use the following formula to compute current ratio:

Substitute the values in the above formula:

Therefore, current ratiois 2.5.

Working notes

1. Calculation of current assets:

2. Calculation of current liabilities:

2.

Calculate quick ratio.

Answer to Problem 56P

Quick ratio is 1.75

Explanation of Solution

Use the following formula to compute quick ratio:

Substitute the values in the above formula:

Therefore, quick ratio is 1.75

Working notes

1. Calculation of quick assets:

3.

Calculate accounts receivable turnover ratio.

Answer to Problem 56P

Accounts receivable turnover ratio is 7 times.

Explanation of Solution

Use the following formula to compute accounts receivable turnover ratio:

Substitute the values in the above formula:

Therefore, accounts receivable turnover ratio is 7 times.

Working notes

1. Calculation of average accounts receivables:

4.

Calculate accounts receivable turnover in days.

Answer to Problem 56P

Accounts receivable turnover in days is 52.14 days.

Explanation of Solution

Use the following formula to compute accounts receivable turnover in days:

Substitute the values in the above formula:

Therefore, accounts receivable turnover in days is 52.14 days.

5.

Calculate inventory turnover ratio.

Answer to Problem 56P

Inventory turnover ratio is 5.78 times.

Explanation of Solution

Use the following formula to compute inventory turnover ratio:

Substitute the values in the above formula:

Therefore,

Working notes

1. Calculation of average inventory:

6.

Calculate inventory turnover in days.

Answer to Problem 56P

Inventory turnover in days is 63.15 days.

Explanation of Solution

Use the following formula to compute inventory turnover in days:

Substitute the values in the above formula:

Therefore, inventory turnover in days is 63.15 days.

Want to see more full solutions like this?

Chapter 15 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

- On December 31, 2018, Blackpink Company, a financing institution lent ₱15,000,000 to YG Corp. due 3 years after. The loan is supported by an 12% note receivable. Based on the company’s initial estimates the present value of the 12 months expected credit loss (ECL) discounted at 10% is at 2,000,000. The probability of default (PD) is at 7%. Blackpink Company was able to collect interest as it became due at the end of 2019. There was no evidence of significant increase in credit risk by the end 2019 and that the receivable is determined to have “low credit risk”. There were no changes in its initial estimate of the 12 months expected credit loss either. By the end of 2020, Blackpink Company was able to collect interest as it became due. Based on available forward-looking information (determinable without undue cost or effort), however, there is evidence that there was a significant increase in credit risk by the end of 2020. Blackpink Company therefore had to change its basis…arrow_forwardNeed correct answer general accounting questionarrow_forwardCalculate Federal Income Tax Withholding Using the Percentage Method (Pre-2020 Form W-4) Publication 15-T. round to two decimal places at each calculationarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub