College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4SEB

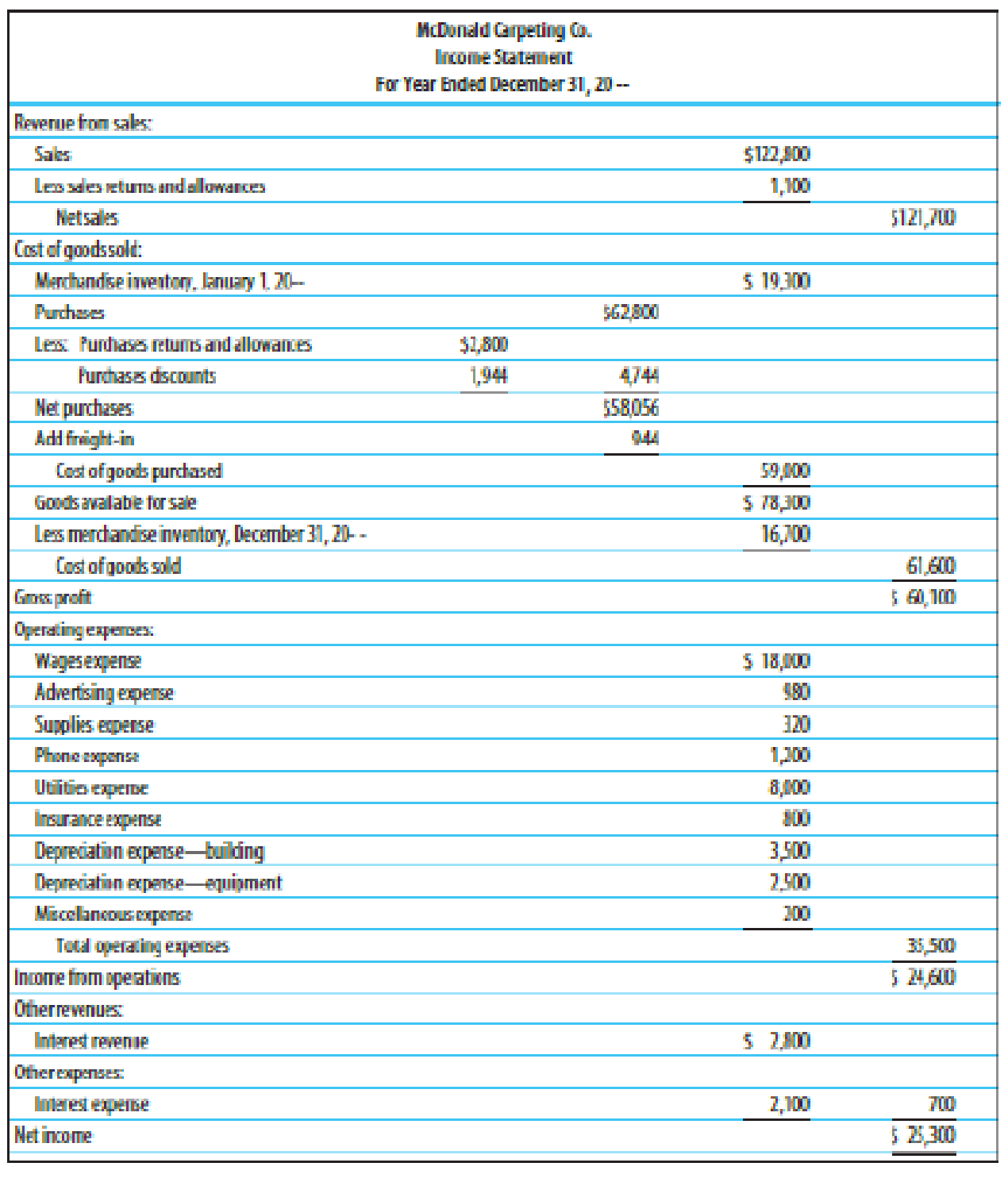

FINANCIAL RATIOS Based on the financial statements, shown on pages 605–606, for McDonald Carpeting Co. (income statement, statement of owner’s equity, and

- 1.

Working capital - 2.

Current ratio - 3. Quick ratio

- 4. Return on owner’s equity

- 5. Accounts receivable turnover and the average number of days required to collect receivables

- 6. Inventory turnover and the average number of days required to sell inventory

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Need correct answer general Accounting

Year

0123

Cash Flow

-$ 19,000

11,300

10,200

6,700

a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent?

Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.

b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent?

Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.

c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent?

Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.

a. Profitability index

b. Profitability index

c. Profitability index

Sol This question answer

Chapter 15 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 15 - LO1 A multiple-step form of income statement...Ch. 15 - Prob. 2TFCh. 15 - Prob. 3TFCh. 15 - Prob. 4TFCh. 15 - LO4 Accounts receivable turnover is the number of...Ch. 15 - Prob. 1MCCh. 15 - Prob. 2MCCh. 15 - Prob. 3MCCh. 15 - Prob. 4MCCh. 15 - Prob. 5MC

Ch. 15 - Prob. 1CECh. 15 - Prob. 2CECh. 15 - 1. L01 Prepare a multiple-step income statement...Ch. 15 - Prob. 4CECh. 15 - Prob. 5CECh. 15 - Prob. 6CECh. 15 - Prob. 1RQCh. 15 - Prob. 2RQCh. 15 - Describe how to calculate the following ratios (a)...Ch. 15 - Where is the information obtained that is needed...Ch. 15 - Explain the function of each of the four closing...Ch. 15 - What is the purpose of a post-closing trial...Ch. 15 - What is the primary purpose of reversing entries?Ch. 15 - What is the customary date for reversing entries?Ch. 15 - What adjusting entries should be reversed?Ch. 15 - REVENUE SECTION. MULTIPLE-STEP INCOME STATEMENT...Ch. 15 - COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME...Ch. 15 - MULTIPLE-STEP INCOME STATEMENT Use the following...Ch. 15 - FINANCIAL RATIOS Based on the financial statements...Ch. 15 - CLOSING ENTRIES From the work sheet on page 600,...Ch. 15 - REVERSING ENTRIES From the work sheet used in...Ch. 15 - Prob. 7SEACh. 15 - INCOME STATEMENT. STATEMENT OF OWNER S EQUITY, AND...Ch. 15 - FINANCIAL RATIOS Use the work sheet and financial...Ch. 15 - WORK SHEET, ADJUSTING, CLOSING, AND REVERSING...Ch. 15 - REVENUE SECTION, MULTIPLE-STEP INCOME STATEMENT...Ch. 15 - COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME...Ch. 15 - MULTIPLE-STEP INCOME STATEMENT Use the following...Ch. 15 - FINANCIAL RATIOS Based on the financial...Ch. 15 - CLOSING ENTRIES From the work sheet on page 607...Ch. 15 - Prob. 6SEBCh. 15 - ADJUSTING, CLOSING, AND REVERSING ENTRIES Prepare...Ch. 15 - INCOME STATEMENT, STATEMENT OF OWNERS EQUITY, AND...Ch. 15 - FINANCIAL RATIOS Use the work sheet and financial...Ch. 15 - Prob. 10SPBCh. 15 - Prob. 1MYWCh. 15 - Dominique Fouque owns and operates Dominiques Doll...Ch. 15 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What is the impact on Abercrombie & Fitch's financial statements from the write-down of its logo-adorned merchandise…arrow_forwardTherefore the final answerarrow_forwardAns ? General Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License