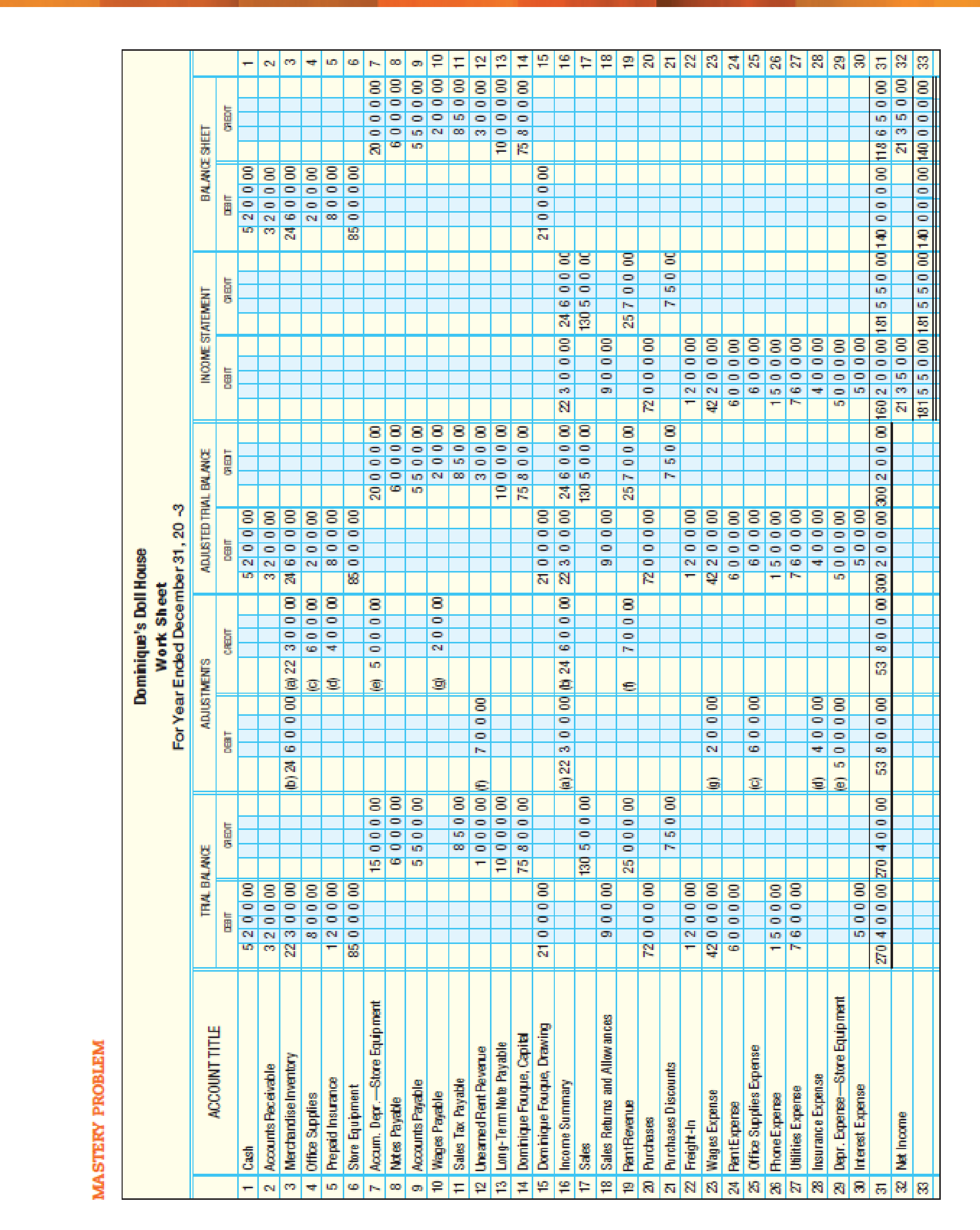

Dominique Fouque owns and operates Dominique’s Doll House. She has a small shop in which she sells new and antique dolls. She is particularly well known for her collection of antique Ken and Barbie dolls. A completed work sheet for 20-3 is shown on page 612. Fouque made no additional investments during the year and the long-term note payable is due in 20-9. No portion of the long-term note is due within the next year. Net credit sales for 20-3 were $35,300, and receivables on January 1 were $2,500.

REQUIRED

- 1. Prepare a multiple-step income statement.

- 2. Prepare a statement of owner’s equity.

- 3. Prepare a

balance sheet . - 4. Compute the following measures of performance and financial condition for 20-3:

- (a)

Current ratio - (b) Quick ratio

- (c)

Working capital - (d) Return on owner’s equity

- (e)

Accounts receivable turnover and average number of days required to collect receivables

- (e)

- (f) Inventory turnover and the average number of days required to sell inventory

- (a)

- 5. Prepare

adjusting entries and indicate which should be reversed and why. - 6. Prepare closing entries.

- 7. Prepare reversing entries for the adjustments where appropriate.

1.

Prepare a multi-step income statement of DD House.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a statement of multi-step income statement.

| DD | |||

| Income Statement | |||

| For Year Ended December 31, 20-3 | |||

| Particulars | Amount | Amount | Amount |

| Revenue from sales: | |||

| Sales | $130,500 | ||

| Less: sales returns and allowances | $900 | ||

| Net sales | $129,600 | ||

| Cost of goods sold: | |||

| Merchandise inventory, Jan. 1, 20-3 | $22,300 | ||

| Purchases | $72,000 | ||

| Less: Purchases discounts | $750 | ||

| Net purchases | $71,250 | ||

| Add freight-in | 1,200 | ||

| Cost of goods purchased | 72,450 | ||

| Goods available for sale | $94,750 | ||

| Less: march. inventory, Dec. 31, 20-3 | 24,600 | ||

| Cost of goods sold | $70,150 | ||

| Gross profit | $59,450 | ||

| Operating expenses: | |||

| Wages expense | $42,200 | ||

| Rent expense | $6,000 | ||

| Office supplies expense | $600 | ||

| Phone expense | $1,500 | ||

| Utilities expense | $7,600 | ||

| Insurance expense | $400 | ||

| Depreciation expense—store equipment | $5,000 | ||

| Total operating expenses | $63,300 | ||

| Income (loss) from operations | ($3,850) | ||

| Other revenues: | |||

| Rent revenue | $25,700 | ||

| Other expenses: | |||

| Interest expense | ($500) | $25,200 | |

| Net income | $21,350 | ||

Table (1)

2.

Prepare a statement of owners’ equity of DD house.

Explanation of Solution

Statement of Owners’ equity: This statement reports the beginning stockholder's equity and all the changes which led to ending stockholder's equity. Additional capital, net income from income statement is added to and drawings or dividends are deducted from beginning stockholder's equity to arrive at the end result, closing balance of stockholder's equity.

Prepare an owners’ equity statement.

| DD | ||

| Statement of Owner’s Equity | ||

| For Year Ended December 31, 20-3 | ||

| Particulars | Amount | Amount |

| DF's, capital, January 1, 20-3 | $75,800 | |

| Net income for the year | $21,350 | |

| Less: withdrawals for the year | $21,000 | |

| Add: Increase in capital | $350 | |

| DF's, capital, December 31, 20-3 | $76,150 | |

Table (2)

3.

Prepare a balance sheet of DD House.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare a balance sheet.

| DD | ||

| Balance Sheet | ||

| For Year Ended December 31, 20-3 | ||

| Amount | Amount | |

| Assets | ||

| Current assets: | ||

| Cash | $5,200 | |

| Accounts receivable | $3,200 | |

| Merchandise inventory | $24,600 | |

| Office supplies | $200 | |

| Prepaid insurance | $800 | |

| Total current assets | $34,000 | |

| Property, plant, and equipment: | ||

| Store equipment | $85,000 | |

| Less accumulated depreciation | $20,000 | $65,000 |

| Total assets | $99,000 | |

| Liabilities | ||

| Current liabilities: | ||

| Notes payable | $6,000 | |

| Accounts payable | $5,500 | |

| Wages payable | $200 | |

| Sales tax payable | $850 | |

| Unearned rent revenue | $300 | |

| Total current liabilities | $12,850 | |

| Long-term liabilities: | ||

| Long-term note payable | $10,000 | |

| Total liabilities | $22,850 | |

| Owner’s Equity | ||

| DF's, capital | $76,150 | |

| Total liabilities and owner’s equity | $99,000 | |

Table (3)

4.

Compute the following measures of performance and financial condition for 20-3.

- (a) Current ratio

- (b) Quick ratio

- (c) Working capital

- (d) Return on owners’ equity

- (e) Accounts receivable turnover and average number of days required to collect receivables.

- (f) Inventory turnover and the average number of days required to sell inventory.

Explanation of Solution

(a)

Current ratio: The financial ratio which evaluates the ability of a company to pay off the debt obligations which mature within one year or within completion of operating cycle is referred to as current ratio. This ratio assesses the liquidity of a company.

Calculate current ratio.

(b)

Quick ratio: The financial ratio which evaluates the ability of a company to pay off the instant debt obligations is referred to as quick ratio. Quick assets are cash, marketable securities, and accounts receivables. This ratio assesses the short-term liquidity of a company.

Calculate quick ratio.

(c)

Working capital: Working capital refers to the excess amount of current assets over its current liabilities of a business. It measures the excess funds that are required for the companies to carry out their day to day operations, excluding any new funds that have been invested during the year.

Calculate working capital.

(d)

Calculate return on owners’ equity.

(e)

Calculate accounts receivable turnover and average collection period.

(f)

Calculate inventory turnover and average days to sell inventory.

5.

Prepare adjusting entries and indicate which should be reversed and why.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries.

| Date | Account titles and Explanation | Debit | Credit | |

| December 31 | a. | Income summary | $22,300 | |

| Merchandise inventory | $22,300 | |||

| December 31 | b. | Merchandise inventory | $24,600 | |

| Income summary | $24,600 | |||

| December 31 | c. | Office supplies expense | $600 | |

| Office supplies | $600 | |||

| December 31 | d. | Insurance expense | $400 | |

| Prepaid insurance | $400 | |||

| December 31 | e. | Depreciation expense - Store equipment | $5,000 | |

| Accumulated depreciation - Store equipment | $5,000 | |||

| December 31 | f. | Unearned rent revenue | $700 | |

| Rent revenue | $700 | |||

| December 31 | g. | Wages expense | $200 | |

| Wages payable | $200 |

Table (4)

Indicate the adjusting entry that should be reversed.

- a. Never reverse adjustments for merchandise inventory.

- b. Never reverse adjustments for merchandise inventory.

- c. No. No asset or liability with a zero balance has been increased.

- d. No. No asset or liability with a zero balance has been increased.

- e. Never reverse adjustments for depreciation.

- f. No. No asset or liability with a zero balance has been increased.

- g. Yes. A liability with a zero balance has been increased.

6.

Prepare closing entries.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Sales | $130,500 | |

| Rent revenue | $25,700 | ||

| Purchase discounts | $750 | ||

| Income summary | $156,950 | ||

| Income summary | $137,900 | ||

| Sales returns and allowances | $900 | ||

| Purchases | $72,000 | ||

| Freight in | $1,200 | ||

| Wages expense | $42,200 | ||

| Rent expense | $6,000 | ||

| Office supplies expense | $600 | ||

| Phone expense | $1,500 | ||

| Utilities expense | $7,600 | ||

| Insurance expense | $400 | ||

| Depreciation expense - store equipment | $5,000 | ||

| Interest expense | $500 | ||

| Income summary | $21,350 | ||

| DF's Capital | $21,350 | ||

| DF's Capital | $21,000 | ||

| DF's Drawings | $21,000 |

Table (5)

7.

Prepare reversing entry.

Explanation of Solution

Reversing entry: Entries made on the first day of the next accounting cycle, and it abridges the recording transactions in the different period. It is an opposite of adjusting entry.

Prepare reversing entry

| Date | Account titles and Explanation | Debit | Credit |

| January 1 - 20-4 | Wages payable | $200 | |

| Wages expense | $200 |

Table (6)

Want to see more full solutions like this?

Chapter 15 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- incoporate the accounting conceptual frameworksarrow_forwarda) Define research methodology in the context of accounting theory and discuss the importance of selecting appropriate research methodology. Evaluate the strengths and limitations of quantitative and qualitative approaches in accounting research. b) Assess the role of modern accounting theories in guiding research in accounting. Discuss how contemporary theories, such as stakeholder theory, legitimacy theory, and behavioral accounting theory, shape research questions, hypotheses formulation, and empirical analysis. Question 4 Critically analyse the role of financial reporting in investment decision-making, emphasizing the qualitative characteristics that enhance the usefulness of financial statements. Discuss how financial reporting influences both investor confidence and regulatory decisions, using relevant examples.arrow_forwardFastarrow_forward

- CODE 14 On August 1, 2010, Cheryl Newsome established Titus Realty, which completed the following transactions during the month: a. Cheryl Newsome transferred cash from a personal bank account to an account to be used for the business in exchange for capital stock, $25,000. b. Paid rent on office and equipment for the month, $2,750. c. Purchased supplies on account, $950. d. Paid creditor on account, $400. c. Earned sales commissions, receiving cash, $18,100. f. Paid automobile expenses (including rental charge) for month, $1,000, and miscel- laneous expenses, $600. g. Paid office salaries, $2,150. h. Determined that the cost of supplies used was $575. i. Paid dividends, $2,000. REQUIREMENTS: 1. Determine increase - decrease of each account and new balance 2. Prepare 3 F.S: Income statement; Retained Earnings Statement; Balance Sheet Scanned with CamScannerarrow_forwardAssume that TDW Corporation (calendar-year-end) has 2024 taxable income of $952,000 for purposes of computing the §179 expense. The company acquired the following assets during 2024: (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Asset Machinery Computer equipment Furniture Total Placed in Service September 12 February 10 April 2 Basis $ 2,270,250 263,325 880,425 $ 3,414,000 b. What is the maximum total depreciation, including §179 expense, that TDW may deduct in 2024 on the assets it placed in service in 2024, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation deduction (including §179 expense)arrow_forwardEvergreen Corporation (calendar-year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Date Placed in Asset Machinery Service October 25 Original Basis $ 120,000 Computer equipment February 3 47,500 Used delivery truck* August 17 Furniture April 22 60,500 212,500 The delivery truck is not a luxury automobile. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation and elects out of §179 expense?arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT