Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4R

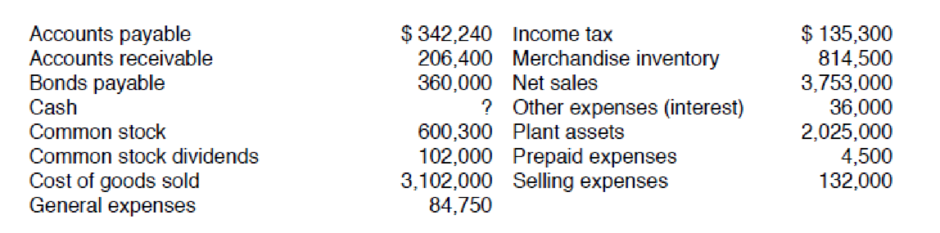

Prepare a ratio analysis for Global Technology for 2013. The following information is available for 2013:

The 2013 information should be entered in column B of the RATIOA2 worksheet. The 2012 information should be entered in column C. Save the revised file as RATIOA4. Print the worksheet when done.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The amount and nature of the gain/loss from the sale

Need help with this question solution general accounting

Can you please solve this

Chapter 15 Solutions

Excel Applications for Accounting Principles

Ch. 15 - The comparative financial statements of Global...Ch. 15 - The comparative financial statements of Global...Ch. 15 - a. What information does a comparison of the...Ch. 15 - Prepare a ratio analysis for Global Technology for...Ch. 15 - Compare your printout from requirement 2 with your...Ch. 15 - With the 2013 data still on the screen, click the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:CENGAGE L

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License