Concept explainers

Omaha Synthetic Fibers Inc. specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. The company has been in business for 20 years and has been profitable each of the past 15 years. Omaha Synthetic Fibers uses a standard-costing system and applies

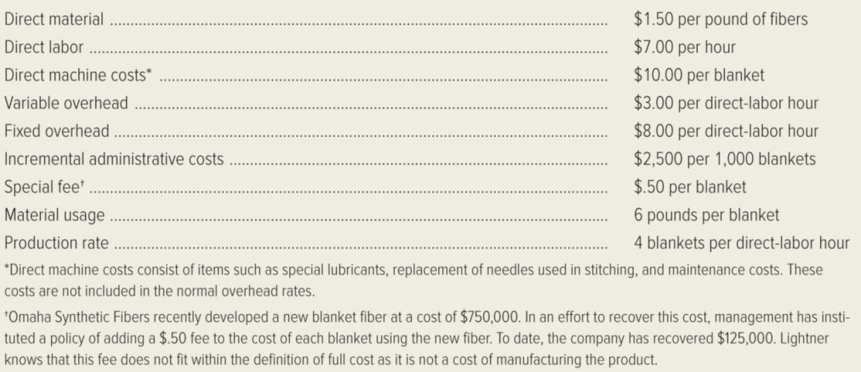

In order to prepare the bid for the 800,000 blankets, Andrea Lightner, director of cost management, has gathered the following information about the costs associated with the production of the blankets.

Required:

- 1. Calculate the minimum price per blanket that Omaha Synthetic Fibers Inc. could bid without reducing the company’s net income.

- 2. Using the full cost criteria and the maximum allowable return specified, calculate Omaha Synthetic Fibers Inc.’s bid price per blanket.

- 3. Independent of your answer to requirement (2), assume that the price per blanket that Omaha Synthetic Fibers Inc. calculated using the cost-plus criteria specified is greater than the maximum bid of $25 per blanket allowed. Discuss the factors that management should consider before deciding whether to submit a bid at the maximum acceptable price of $25 per blanket.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

MANAGERIAL ACCOUNTING-CUSTOM EBOOK>I<

- Find overhead at the end of the yeararrow_forwardAccountingarrow_forwardA manufacturing company uses the weighted-average method for inventory costing. At the end of the period, 20,500 units were in the ending Work-in-Process inventory and are 100% complete for materials and 68% complete for conversion. The equivalent costs per unit are materials $3.10 and conversion $2.45. Compute the cost that would be assigned to the ending Work-in-Process inventory for the period.arrow_forward

- Need help with this question solution general accountingarrow_forwardWhat is the profit marginarrow_forwardElon Industries uses direct labor hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor hours were 12,500 hours, and the total estimated manufacturing overhead was $300,000. At the end of the year, actual direct labor hours were 12,100 hours, and the actual manufacturing overhead was $294,500. Find overhead at the end of the year. Need answerarrow_forward

- A firm has net working capital of $640, net fixed assets of $2,780, and sales of $7,500. How many dollars worth of sales are generated from every $1 in total assets? Answerarrow_forwardCalculate the ending retained earnings??? Give me solutionarrow_forwardElon Industries uses direct labor hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor hours were 12,500 hours, and the total estimated manufacturing overhead was $300,000. At the end of the year, actual direct labor hours were 12,100 hours, and the actual manufacturing overhead was $294,500. Find overhead at the end of the year.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning