North American Pharmaceuticals, Inc. specializes in packaging bulk drugs in standard dosages for local hospitals. The company has been in business for seven years and has been profitable since its second year of operation. Don Greenway, Assistant Controller, installed a

Wyant Memorial Hospital has asked North American Pharmaceuticals to bid on the packaging of one million doses of medication at total cost plus a return on total cost of no more than 15 percent. Wyant defines total cost as including all variable costs of performing the service, a reasonable amount of fixed

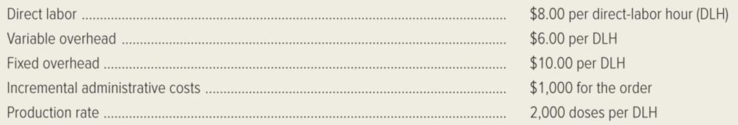

Greenway has accumulated the following information prior to the preparation of the bid.

Required:

- 1. Calculate the minimum price per dose that North American Pharmaceuticals could bid for the Wyant Memorial Hospital job that would not reduce the pharmaceutical company’s income.

- 2. Calculate the bid price per dose using total cost and the maximum allowable return specified by Wyant Memorial Hospital.

- 3. Independent of your answer to requirement (2), suppose that the price per dose that North American Pharmaceuticals, Inc. calculated using the cost-plus criterion specified by Wyant Memorial Hospital is greater than the maximum bid of $.015 per dose allowed by Wyant. Discuss the factors that the pharmaceutical company’s management should consider before deciding whether or not to submit a bid at the maximum price of $.015 per dose that Wyant allows.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- On December 31, 2018, Blackpink Company, a financing institution lent ₱15,000,000 to YG Corp. due 3 years after. The loan is supported by an 12% note receivable. Based on the company’s initial estimates the present value of the 12 months expected credit loss (ECL) discounted at 10% is at 2,000,000. The probability of default (PD) is at 7%. Blackpink Company was able to collect interest as it became due at the end of 2019. There was no evidence of significant increase in credit risk by the end 2019 and that the receivable is determined to have “low credit risk”. There were no changes in its initial estimate of the 12 months expected credit loss either. By the end of 2020, Blackpink Company was able to collect interest as it became due. Based on available forward-looking information (determinable without undue cost or effort), however, there is evidence that there was a significant increase in credit risk by the end of 2020. Blackpink Company therefore had to change its basis…arrow_forwardNeed correct answer general accounting questionarrow_forwardCalculate Federal Income Tax Withholding Using the Percentage Method (Pre-2020 Form W-4) Publication 15-T. round to two decimal places at each calculationarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College