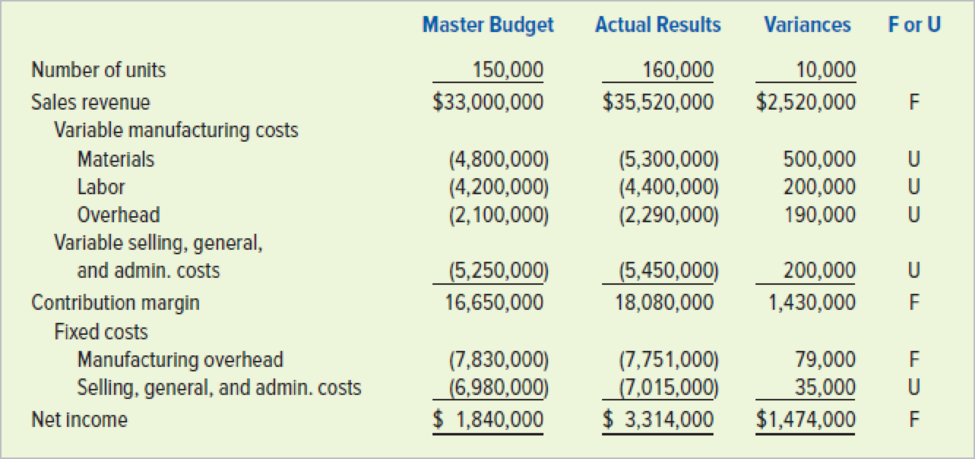

David Catrow is the manufacturing production supervisor for Faraday Motor Works (FMW), a company that manufactures electrical motors for industrial applications. Trying to explain why he did not get the year-end bonus that he had expected, he told his wife, “This is the dumbest place I’ve ever worked. Last year the company set up this budget assuming it would sell 150,000 units. Well, it sold only 140,000. The company lost money and gave me a bonus for not using as much materials and labor as was called for in the budget. This year, the company has the same 150,000 units goal and it sells 160,000. The company’s making all kinds of money. You’d think I’d get this big fat bonus. Instead, management tells me I used more materials and labor than was budgeted. They said the company would have made a lot more money if I’d stayed within my budget. I guess I gotta wait for another bad year before I get a bonus. Like I said, this is the dumbest place I’ve ever worked.”

FMW’s

Required

- a. Did FMW increase unit sales by cutting prices or by using some other strategy?

- b. Is Mr. Catrow correct in his conclusion that something is wrong with the company’s performance evaluation process? If so, what do you suggest be done to improve the system?

- c. Prepare a flexible budget and recompute the budget variances.

- d. Explain what might have caused the fixed costs to be different from the amount budgeted.

- e. Assume that the company’s materials price variance was favorable and its materials usage variance was unfavorable. Explain why Mr. Catrow may not be responsible for these variances. Now, explain why he may have been responsible for the materials usage variance.

- f. Assume the labor price variance is unfavorable. Was the labor usage variance favorable or unfavorable?

- g. Is the fixed cost volume variance favorable or unfavorable? Explain the effect of this variance on the cost of each unit produced.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- what are the Five List of Michael Porter's 5 Force Framework that describes the competitive dynamics of a firm and the industry they are in?arrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwarddefine each item below: A competitive advantage. 2) Data incorporation. 3) Financial Statement Analysis. 4) Product Differentiation. 5) Strategic positioning for a business firmarrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning