Concept explainers

Lease amortization schedule

• LO15–2

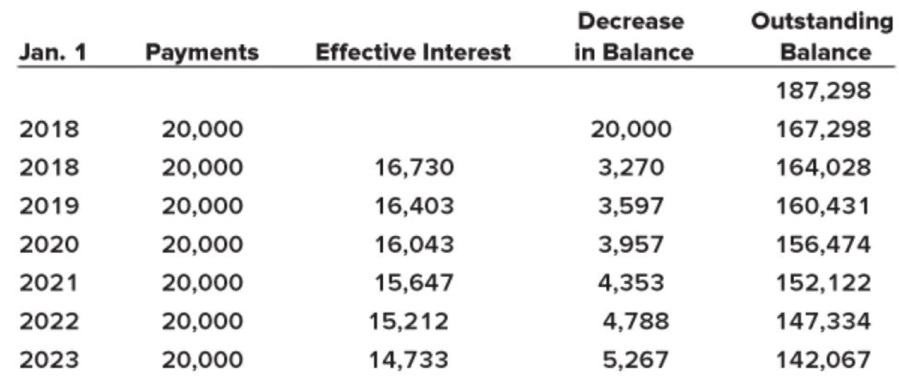

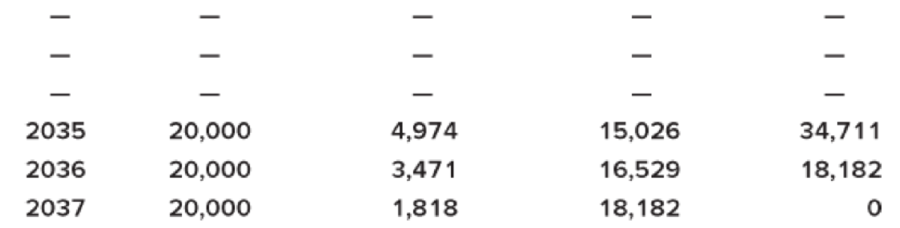

On January 1, 2018, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of the Equipment Leasing’s lease amortization schedule appear below:

Required:

1. What is Majestic’s lease liability at the beginning of the lease (after the first payment)?

2. What amount would Majestic record as a right-of-use asset?

3. What is the lease term in years?

4. What is the effective annual interest rate?

5. What is the total amount of lease payments?

6. What is the total effective interest expense recorded over the term of the lease?

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

INTERMEDIATE ACTG+CONNECT <LOOSE>

- D5arrow_forwardO On January 1, 2024, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of the Equipment Leasing’s lease amortization schedule appear below: January 1 Payments Effective Interest Decrease in Balance Outstanding Balance $ 314,048 2024 $ 24,000 $ 24,000 $ 290,048 2025 $ 24,000 $ 14,502 $ 9,498 $ 280,550 2026 $ 24,000 $ 14,028 $ 9,972 $ 270,578 2027 $ 24,000 $ 13,529 $ 10,471 $ 260,107 2028 $ 24,000 $ 13,005 $ 10,995 $ 249,112 2029 $ 24,000 $ 12,456 $ 11,544 $ 237,568 2030 $ 24,000 $ 11,878 $ 12,122 $ 225,446 — — — — — — — — — — — — — — — 2041 $ 24,000 $ 11,272 $ 12,728 $ 44,627 2042 $ 24,000 $ 2,231 $ 21,769 $ 22,858 2043 $ 24,000 $ 1,143 $ 22,857 $ 0 Required: What is Majestic’s lease liability at the beginning of the lease (after the first payment)? What…arrow_forwardEP#4 On January 1, 2021, Pharoah, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $6200000; however, the book value to Holt is $5150000.(c) The building has an estimated economic life of 10 years, with no residual value. Pharoah depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Pharoah’s incremental borrowing rate is 12% per year. Holt Warehouse Co. set the annual rental to insure a 6% rate of return. The implicit rate of the lessor is known by Pharoah, Inc.(f) The yearly rental…arrow_forward

- Please answerarrow_forwardEP#5 On January 1, 2021, Yancey, Inc. signs a 10-year noncancelable lease agreement to lease a storage building from Holt Warehouse Company. Collectibility of lease payments is reasonably predictable and no important uncertainties surround the amount of costs yet to be incurred by the lessor. The following information pertains to this lease agreement.(a) The agreement requires equal rental payments at the beginning each year.(b) The fair value of the building on January 1, 2021 is $6,000,000; however, the book value to Holt is $4,950,000.(c) The building has an estimated economic life of 10 years, with no residual value. Yancey depreciates similar buildings using the straight-line method.(d) At the termination of the lease, the title to the building will be transferred to the lessee.(e) Yancey’s incremental borrowing rate is 11% per year. Holt Warehouse Co. set the annual rental to insure a 10% rate of return. The implicit rate of the lessor is known by Yancey, Inc.(f) The yearly…arrow_forwardPROBLEM NO. 3 Assume that DBP Leasing Corp. and Minasugbo Inc. sign a lease contract effective on January 1, 2019 where DBP Leasing leases to Minasugbo a bulldozer. The terms and provisions of the lease contract and other pertinent date are as follows: • The term of the lease is five years. The lease agreement is non-cancelable, requiring equal rental payments of P20,711.11 at the beginning of each year (annuity-due basis). The bulldozer has a fair value at the commencement of the lease of P100,000, an estimated economic life of five years, and a guaranteed residual value of P5,000. (Minasugbo expects that it is probable that the expected value of the residual value at the end of the lease will be greater than the guaranteed amount of P5,000.) The lease contains no renewal options. The bulldozer reverts to DBP Leasing at the termination of the lease. Minasugbo's incremental borrowing rate is 5 percent per year. • Minasugbo depreciates its equipment on a straight-line basis. DBP Leasing…arrow_forward

- kk.3arrow_forwardOn January 1, 2024, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing’s lease amortization schedule appear below: January 1 Payments Effective Interest Decrease in Balance Outstanding Balance 2024 $ 244,813 2024 $ 27,000 $ 27,000 $ 217,813 2025 $ 27,000 $ 23,959 $ 3,041 $ 214,772 2026 $ 27,000 $ 23,625 $ 3,375 $ 211,397 2027 $ 27,000 $ 23,254 $ 3,746 $ 207,651 2028 $ 27,000 $ 22,842 $ 4,158 $ 203,493 2029 $ 27,000 $ 22,384 $ 4,616 $ 198,877 — — — — — — — — — — — — — — — 2041 $ 27,000 $ 10,852 $ 16,148 $ 82,505 2042 $ 27,000 $ 9,076 $ 17,924 $ 64,581 2043 $ 27,000 $ 7,104 $ 19,896 $ 44,685 2044 $ 49,600 $ 4,915 $ 44,685 $ 0 What is the lease term in years? 20 years What is the asset’s residual value expected at the end…arrow_forward(Leases) 6 Exercise 15-5 (Static) Sales-type lease; lessor; balance sheet and income statement effects [LO15-3] On June 30, 2021, Georgia-Atlantic, Inc. leased warehouse equipment from Bullders, Inc. The lease agreement calls for Georgia- Atlantic to make semiannual lease payments of $562,907 over a three-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's incremental borrowing rate is 10%, the same rate Builders used to calculate lease payment amounts. Builders manufactured the equipment at a cost of $2.5 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which Builders is "selling" the equipment (present value of the lease payments) at June 30, 2021. 2. What amount related to the lease would Builders report in its balance sheet at December 31, 2021 (ignore taxes)? 3. What…arrow_forward

- Sagararrow_forwardQuestion 1 (theory) What was the major change in accounting for leases introduced by new accounting standard AASB16/IFRS16? Why was such a change launched by the professional standard setting bodies to abandon AASB117/IAS17? Question 2 On 1 July 2020, Sherlock Ltd leased a processing plant to Holmes Ltd. The plant was purchased by Sherlock Ltd on 1 July 2020 for its fair value of $467 112. The lease agreement contained the following provisions: Lease term 3 years Economic terms of the plant 5 years Annual rental payments, in arrears (commencing 30?6/2021) $150,000 Residual value at the end of lease term $90,000 Residual guaranteed by lessee $60,000 Interest rate implicit in lease 7% The lease is cancellable only with the permission of the lessor Holmes Ltd intends to return the processing plant to Sherlock Ltd at the end of the lease term. The lease has been classified as a finance lease by Sherlock Ltd. Required: Prepare: (a) the…arrow_forwardHow do they find the irr?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning