INTERMEDIATE ACTG+CONNECT <LOOSE>

9th Edition

ISBN: 9781260517125

Author: SPICELAND

Publisher: MCGRAW-HILL CUSTOM PUBLISHING

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 15.7P

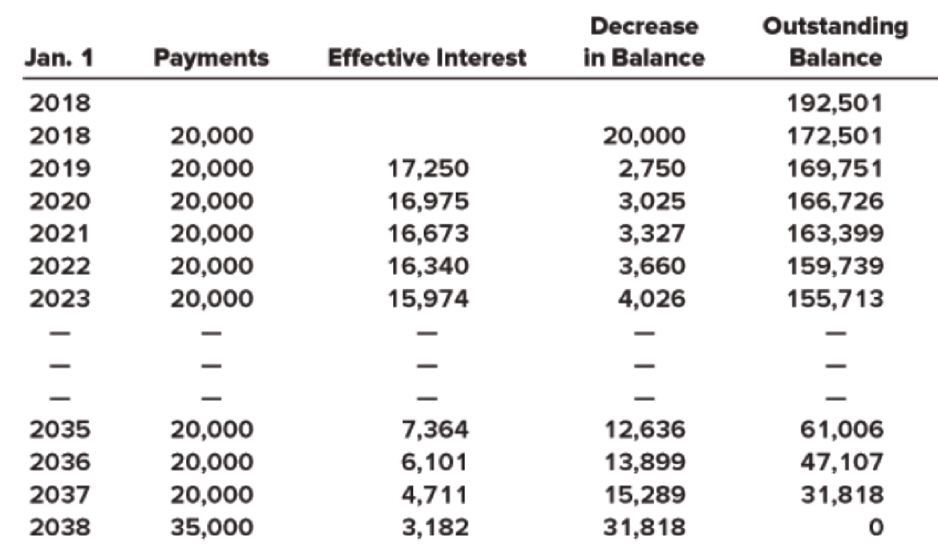

Lease amortization schedule

• LO15–2, LO15–6

On January 1, 2018, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing’s lease amortization schedule appear below:

Required:

- 1. What is the lease term in years?

- 2. What is the asset’s residual value expected at the end of the lease term?

- 3. What is the effective annual interest rate?

- 4. What is the total amount of lease payments for United?

- 5. What is the total amount of lease payments for NIC?

- 6. What is United’s net investment at the beginning of the lease (after the first payment)?

- 7. What is United’s total effective interest revenue recorded over the term of the lease?

- 8. What amount would NIC record as a right-of-use asset at the beginning of the lease?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting

Need help !

Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 credit

Financial Accounting 3.1

Chapter 15 Solutions

INTERMEDIATE ACTG+CONNECT <LOOSE>

Ch. 15 - Prob. 15.1QCh. 15 - Prob. 15.2QCh. 15 - Prob. 15.3QCh. 15 - A lessee should classify a lease transaction as a...Ch. 15 - Lukawitz Industries leased non-specialized...Ch. 15 - In accounting for a finance lease/sales-type...Ch. 15 - What is selling profit on a sales-type lease? How...Ch. 15 - At the beginning of an operating lease, the lessee...Ch. 15 - At the beginning of an operating lease, the lessor...Ch. 15 - In accounting for an operating lease, how are the...

Ch. 15 - Briefly describe the conceptual basis for asset...Ch. 15 - In a financing lease, front loading of lease...Ch. 15 - The discount rate influences virtually every...Ch. 15 - A lease that has a lease term (including any...Ch. 15 - A lease might specify that lease payments may be...Ch. 15 - What is a purchase option? How does it affect...Ch. 15 - A six-year lease can be renewed for two additional...Ch. 15 - Culinary Creations leased kitchen equipment under...Ch. 15 - What situations cause us to remeasure a lease...Ch. 15 - Prob. 15.20QCh. 15 - Compare the way a purchase option that is...Ch. 15 - What nonlease costs might be included as part of...Ch. 15 - The lessors initial direct costs often are...Ch. 15 - When are initial direct costs recognized in an...Ch. 15 - Prob. 15.25QCh. 15 - Prob. 15.26QCh. 15 - Prob. 15.27QCh. 15 - When a company sells an asset and simultaneously...Ch. 15 - Prob. 15.29QCh. 15 - Lease classification LO151 (Note: Brief Exercises...Ch. 15 - Lease classification LO151, LO152 Corinth Co....Ch. 15 - Lessee and lessor; calculate interest;...Ch. 15 - Finance lease; lessee; balance sheet effects ...Ch. 15 - Finance lease; lessee; income statement effects ...Ch. 15 - Sales-type lease; lessor; income statement effects...Ch. 15 - Prob. 15.7BECh. 15 - Operating lease LO154 (Note: Brief Exercises 8...Ch. 15 - Operating lease LO154 At the beginning of its...Ch. 15 - Short-term lease LO155 King Cones leased ice...Ch. 15 - Uncertain lease term LO156 Java Hut leased a...Ch. 15 - Uncertain lease payments LO156 On January 1,...Ch. 15 - Purchase option; lessor; sales-type lease LO152,...Ch. 15 - Residual value; sales-type lease LO152, LO153,...Ch. 15 - Guarantee d residual value LO156 On January 1,...Ch. 15 - Lessors initial direct costs; sales-type lease ...Ch. 15 - Nonlease payments LO152, LO157 On January 1,...Ch. 15 - Lease classification LO151 Each of the four...Ch. 15 - Finance lease; calculate lease payments LO152...Ch. 15 - Finance lease; lessee; balance sheet and income...Ch. 15 - Prob. 15.4ECh. 15 - Sales-type lease; lessor; balance sheet and income...Ch. 15 - Finance lease; lessee LO152 (Note: Exercises 6,...Ch. 15 - Sales-type lease with no selling profit; lessor ...Ch. 15 - Sales-type lease with selling profit; lessor;...Ch. 15 - Prob. 15.9ECh. 15 - Lessor calculation of annual lease payments;...Ch. 15 - Lessee and lessor; sales-type lease with selling...Ch. 15 - Lessee; finance lease; effect on financial...Ch. 15 - Lessee; operating lease; effect on financial...Ch. 15 - Lessor; operating lease; effect on financial...Ch. 15 - Sales-type lease; lessor; income statement effects...Ch. 15 - Lessee; operating lease LO154 Grichuk Power...Ch. 15 - Lessee a nd lessor; operating lease LO154 On...Ch. 15 - Short-term lease LO155 Chance Enterprises leased...Ch. 15 - Lessee; renewal option LO152, LO156 Natick...Ch. 15 - Variable lease payments LO152, LO156 On January...Ch. 15 - Lessee; variable lease payments LO152, LO156 On...Ch. 15 - Lessee; variable lease payments LO152, LO156 On...Ch. 15 - Lessee; renewal options LO152, LO156 On January...Ch. 15 - Calculation of annual lease payments; residual...Ch. 15 - Lessor; sales-type lease; residual value effect on...Ch. 15 - Lease concepts; finance/sales-type leases;...Ch. 15 - Lessee; lessee guaranteed residual value LO152,...Ch. 15 - Calculation of annual lease payments; purchase...Ch. 15 - Finance lease; purchase options; lessee LO152,...Ch. 15 - Purchase option; lessor; sales-type lease; no...Ch. 15 - Nonlease payments; lessor and lessee LO152, LO157...Ch. 15 - Lessors initial direct costs; sales-type lease ...Ch. 15 - Lessors initial direct costs; sales-type lease ...Ch. 15 - Lessors initial direct costs; operating lease ...Ch. 15 - Prob. 15.35ECh. 15 - Prob. 15.36ECh. 15 - Prob. 15.37ECh. 15 - Sale-leaseback Appendix 15 To raise operating...Ch. 15 - Sale-leaseback; operating lease Appendix 15 To...Ch. 15 - Prob. 15.1PCh. 15 - Finance lease LO152 At the beginning of 2018, VHF...Ch. 15 - Lease amortization schedule LO152 On January 1,...Ch. 15 - Finance /sales-type lease; lessee and lessor ...Ch. 15 - Lessee; operating lease; advance payment;...Ch. 15 - Operating lease; scheduled rent increases LO154...Ch. 15 - Lease amortization schedule LO152, LO156 On...Ch. 15 - Reassessment of lease term LO152, LO154, LO156 On...Ch. 15 - Lease concepts; sales-type leases; guaranteed and...Ch. 15 - Prob. 15.10PCh. 15 - Change in lease term; operating lease; lessor ...Ch. 15 - Lessee; renewal option LO152, LO156 High Time...Ch. 15 - Lessee and lessor; lessee guaranteed residual...Ch. 15 - Lessee and lessor; lessor; sales-type lease with...Ch. 15 - Nonlease payments; lessor and lessee LO152, LO157...Ch. 15 - Lessors initial direct costs; operating and...Ch. 15 - Nonlease costs; lessor and lessee LO152, LO157...Ch. 15 - Lessee-guaranteed residual value; unguaranteed...Ch. 15 - Initial direct costs; sales-type lease LO152,...Ch. 15 - Initial dire ct costs; sales-type lease with a...Ch. 15 - Guaranteed residual value; sales-type lease ...Ch. 15 - Unguaranteed residual value; nonlease payments;...Ch. 15 - Purchase option reasonably certain to be exercised...Ch. 15 - Lessee and lessor; lessee guaranteed residual...Ch. 15 - Prob. 15.25PCh. 15 - Prob. 15.26PCh. 15 - Modification of a lease LO152, LO153, LO156 On...Ch. 15 - Finance lease; lessee; financial statement effects...Ch. 15 - Prob. 15.29PCh. 15 - Sales-type lease; lessor; financial statement...Ch. 15 - Prob. 15.31PCh. 15 - Research Case 151 FASB codification; locate and...Ch. 15 - Ethics Case 153 Leasehold improvements LO153...Ch. 15 - Analysis Case 154 Lease concepts; Walmart LO151...Ch. 15 - Communication Case 155 Wheres the gain? Appendix...Ch. 15 - Prob. 15.7BYPCh. 15 - Prob. 1CCTCCh. 15 - Prob. 1CCIFRS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditneed helparrow_forwardGeneral Accounting Question 2.5arrow_forwardI will report your answer to Coursehero using chatgpt they block your account and will not give your payment!!! so don't answer with chatgpt. The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward

- Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardI need help The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardHi This Question is Simple I want Answer step by step of this Financial Accountingarrow_forward

- Need help The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardNo AI The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward4. The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License