Concept explainers

Comprehensive Problem 2:

Accounting Cycle with Subsidiary Ledgers, Part 1

During the second half of December 20-1, TJ’s Specialty Shop engaged in the following transactions:

CengageNowv2 provides “Show Me How” videos for selected exercises and problems. Additional resources, such as Excel templates for completing selected exercises and problems, are available for download from the companion website at Cengage.com.

Dec. 16 Received payment from Lucy Greene on account, $1,960.

16 Sold merchandise on account to Kim Fields, $160, plus sales tax of $8. Sale No. 640.

17 Returned merchandise to Evans Essentials for credit, $150.

18 Issued Check No. 813 to Evans Essentials in payment of December 1 balance of $1,250, less the credit received on December 17.

19 Sold merchandise on account to Lucy Greene, $620, plus tax of $31. Sale No. 641.

22 Received payment from John Dempsey on account, $1,560.

23 Issued Check No. 814 for the purchase of supplies, $120. (Debit Supplies)

24 Purchased merchandise on account from West Wholesalers, $1,200.

Invoice No. 465, dated December 24, terms n/30.

26 Purchased merchandise on account from Nathen Co., $800.

Invoice No. 817, dated December 26, terms 2/10, n/30.

27 Issued Check No. 815 to KC Power & Light (Utilities Expense) for the month of December, $630.

27 Sold merchandise on account to John Dempsey, $2,020, plus tax of $101. Sale No. 642.

29 Received payment from Martha Boyle on account, $2,473.

29 Issued Check No. 816 in payment of wages (Wages Expense) for the two-week period ending December 28, $1,100.

30 Issued Check No. 817 to Meyers Trophy Shop for a cash purchase of merchandise, $200.

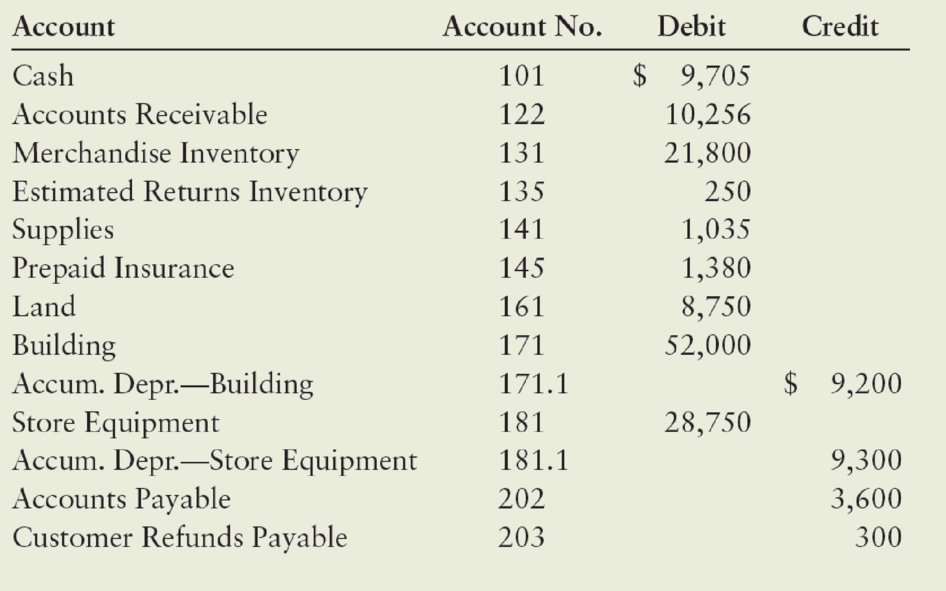

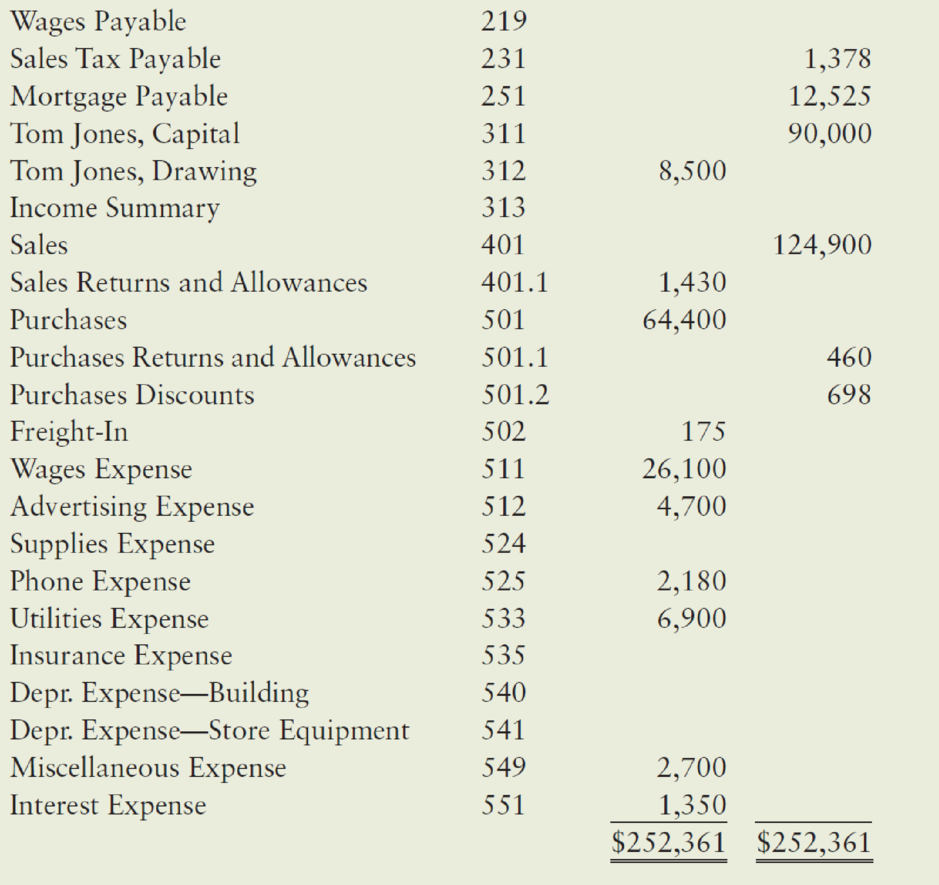

As of December 16, TJ’s account balances were as follows:

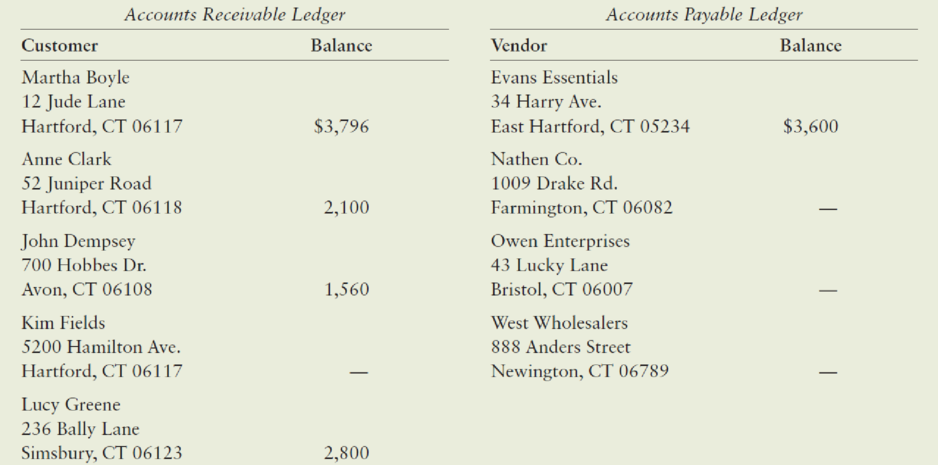

TJ’s also had the following subsidiary ledger balances as of December 16:

4. Prepare schedules of

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

College Accounting, Chapters 1-27

- ??arrow_forwardOn January 1, 2016, Microlevel, Inc., purchased $70,000 face value of the 2% bonds of Service Express, Inc., at 104. The bonds mature on January 1, 2021. For the year ended December 31, 2017, Microlevel received cash interest of $1,400. What was the interest revenue that Microlevel earned in this period? A. $1,960 B. $1,456 C. $840 D. $1,400arrow_forwardHow much is Tristab's amount realizedarrow_forward

- Get correct answer general accounting questionarrow_forwardCarol's Coats Company purchases a sewing machine, paying $3,000.00 plus GST. They paid shipping costs of $50.00 plus GST for delivery to their plant. An invoice from an electrician for installation at $200.00 plus GST still needs to be paid. What would this purchase entry be? a. Debit Equipment $3,000.00, Credit Cash $3,000.00 b. Debit Equipment $3,412.50, Credit Cash $3,412.50 c. Debit Equipment $3,000.00, Debit Freight $50.00, Debit Installation $200.00, Debit GST Paid $162.50, Credit Cash $3,412.50 d. Debit Equipment $3,250.00, Debit GST Paid $162.50, Credit Accounts Payable $210.00, Credit Cash $3,202.50arrow_forwardAssume Orlando Tech Inc. made sales of $1,120 million during 2022. The cost of goods sold (COGS) for the year totaled $745 million. At the end of 2021, Orlando Tech Inc.'s inventories stood at $260 million, and the company ended 2022 with an inventory of $310 million. Compute Orlando Tech Inc.'s gross profit percentage and rate of inventory turnover for 2022.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College