College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4SEA

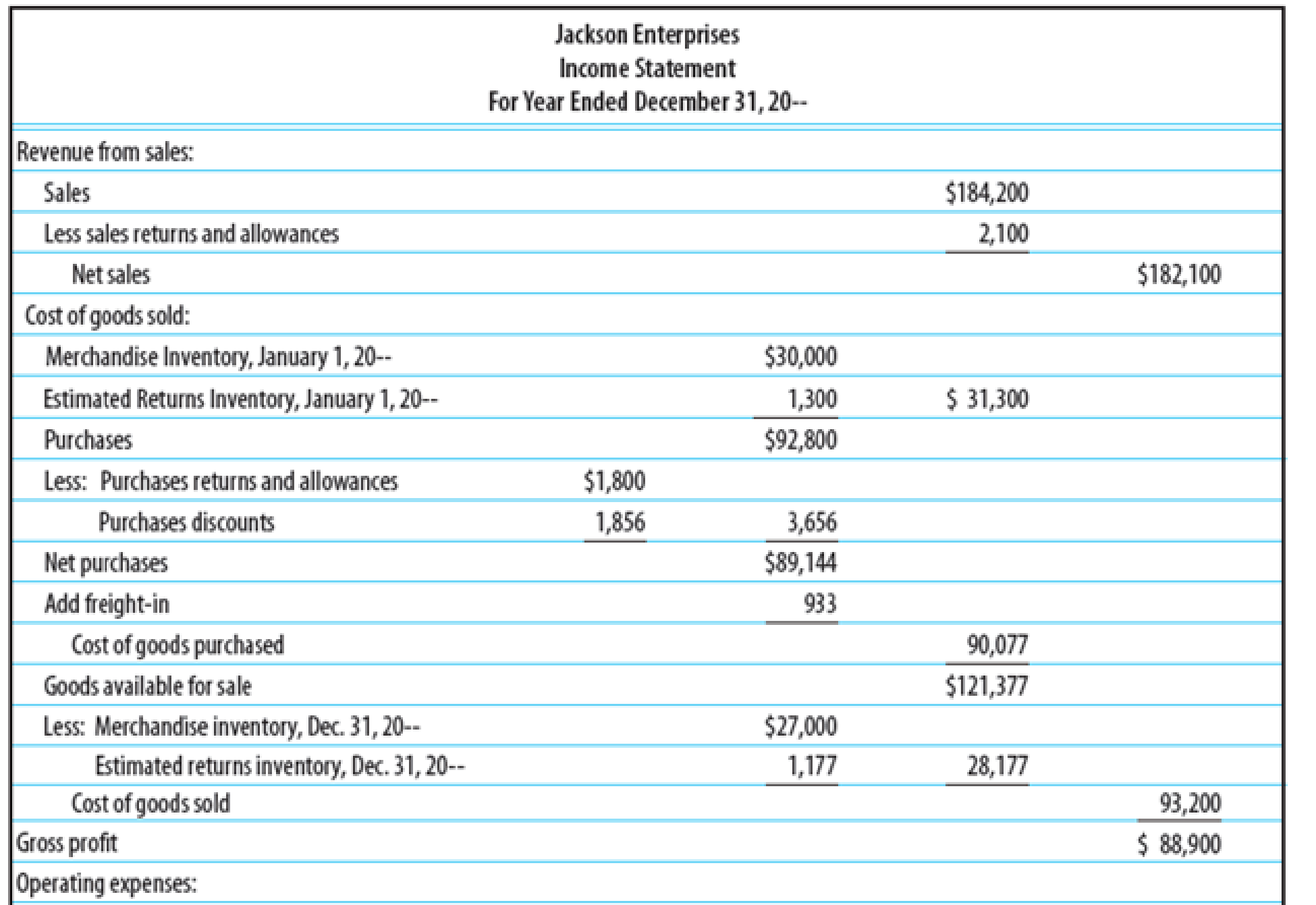

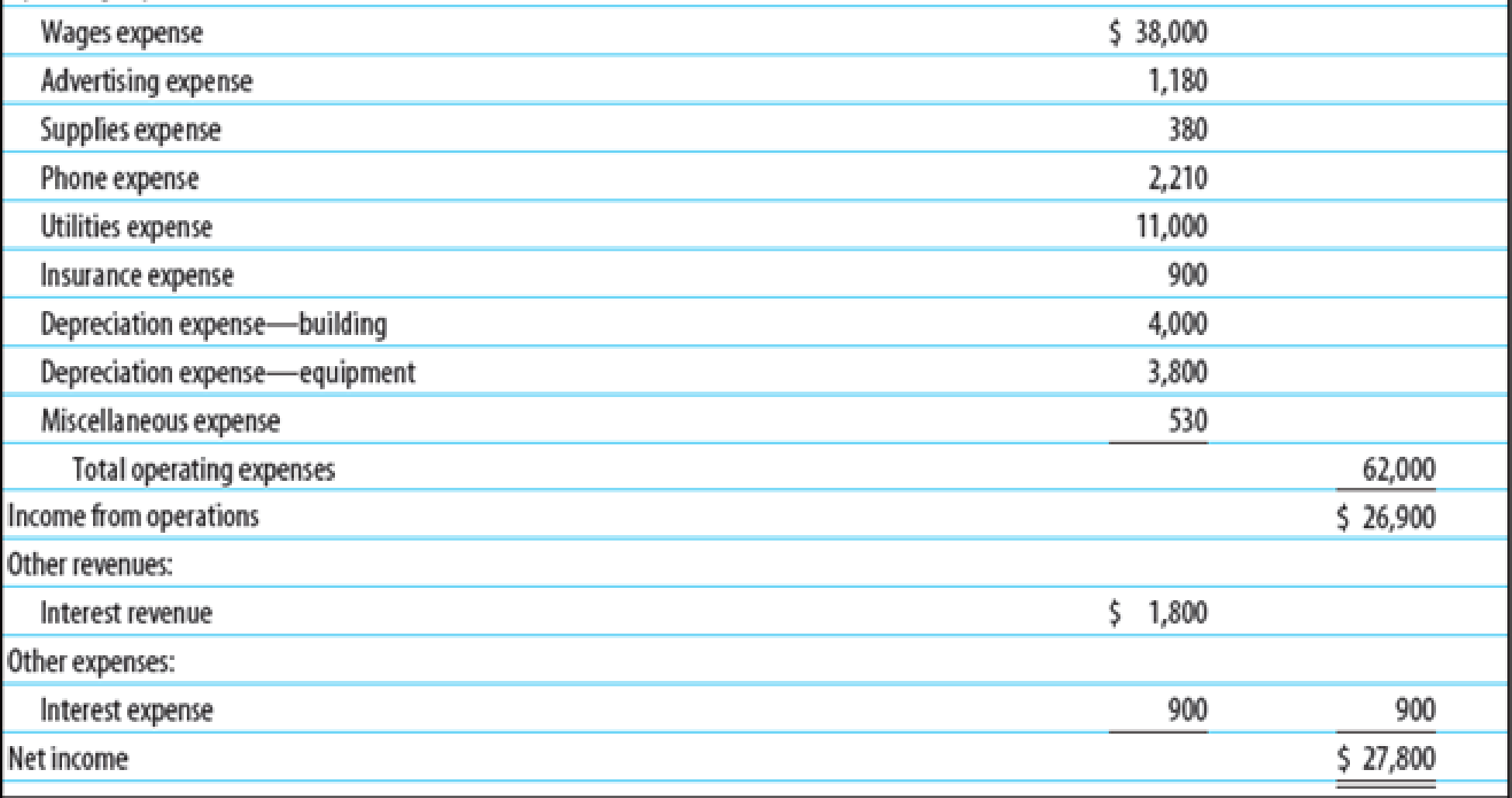

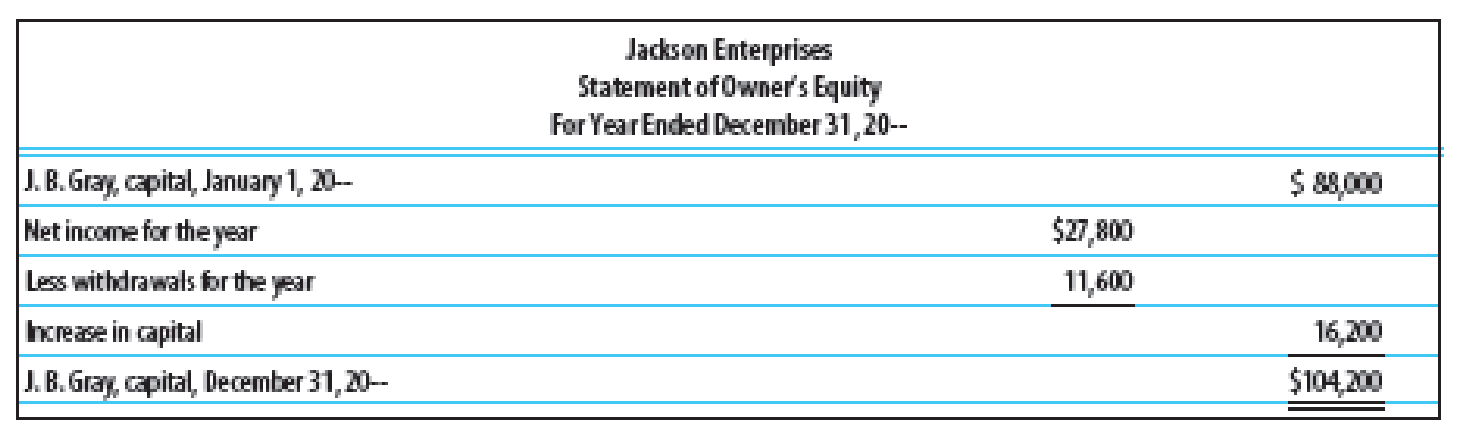

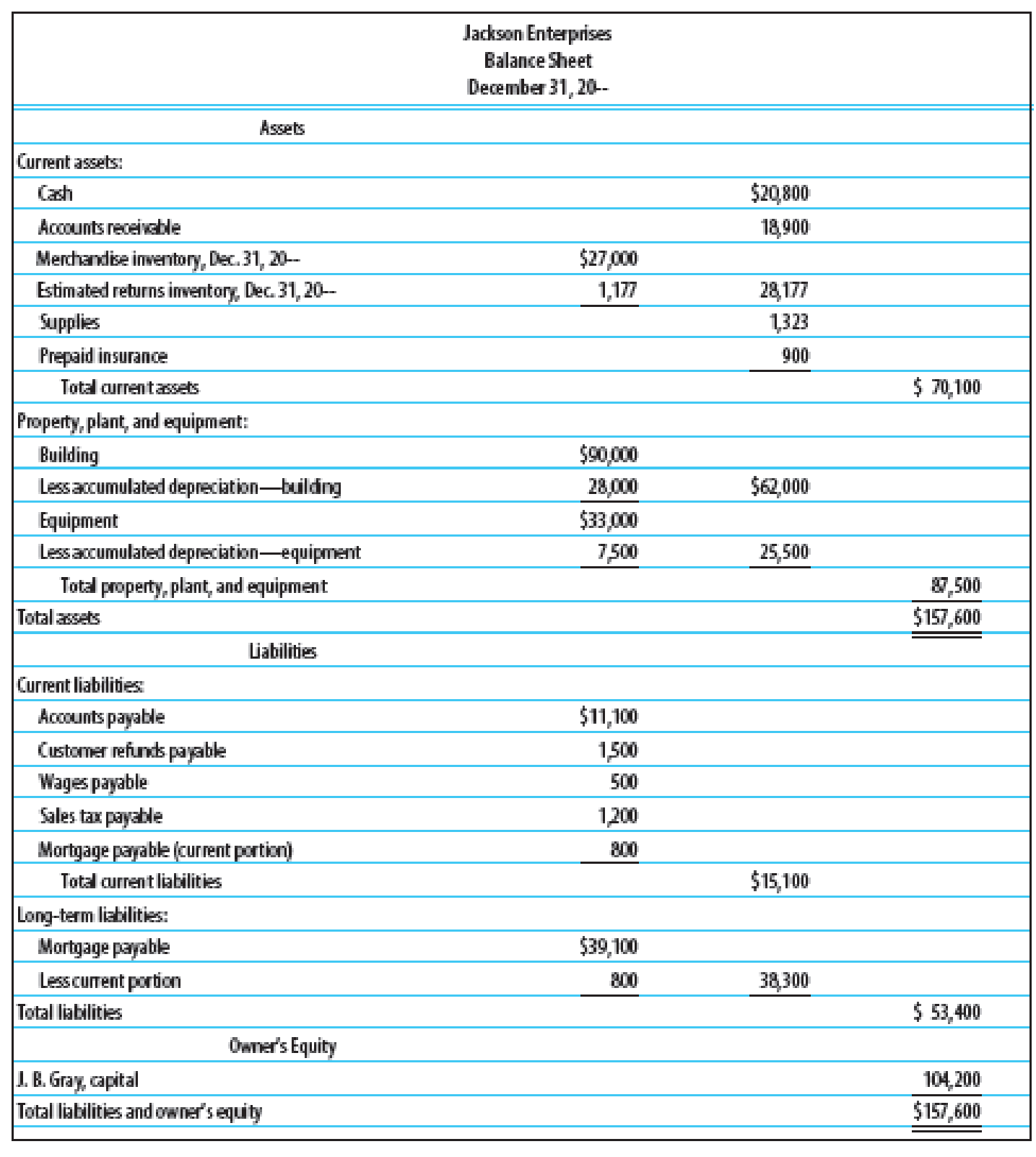

FINANCIAL RATIOS Based on the financial statements for Jackson Enterprises (income statement, statement of owner’s equity, and

- 1.

Working capital - 2.

Current ratio - 3. Quick ratio

- 4. Return on owner’s equity

- 5. Accounts receivable turnover and average number of days required to collect receivables

- 6. Inventory turnover and average number of days required to sell inventory

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

How does the matching principle impact the recording of expenses? Need help

Please provide the accurate answer to this general accounting problem using valid techniques.

How does the matching principle impact the recording of expenses?

Chapter 15 Solutions

College Accounting, Chapters 1-27

Ch. 15 - LO1 A multiple-step form of income statement...Ch. 15 - Prob. 2TFCh. 15 - Prob. 3TFCh. 15 - Prob. 4TFCh. 15 - LO4 Accounts receivable turnover is the number of...Ch. 15 - Prob. 1MCCh. 15 - Prob. 2MCCh. 15 - Prob. 3MCCh. 15 - Prob. 4MCCh. 15 - Prob. 5MC

Ch. 15 - Prob. 1CECh. 15 - Prob. 2CECh. 15 - Prob. 3CECh. 15 - Prob. 4CECh. 15 - Prob. 5CECh. 15 - Prob. 6CECh. 15 - Prob. 1RQCh. 15 - Prob. 2RQCh. 15 - Describe how to calculate the following ratios (a)...Ch. 15 - Where is the information obtained that is needed...Ch. 15 - Explain the function of each of the four closing...Ch. 15 - What is the purpose of a post-closing trial...Ch. 15 - What is the primary purpose of reversing entries?Ch. 15 - What is the customary date for reversing entries?Ch. 15 - What adjusting entries should be reversed?Ch. 15 - REVENUE SECTION. MULTIPLE-STEP INCOME STATEMENT...Ch. 15 - COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME...Ch. 15 - MULTIPLE-STEP INCOME STATEMENT Use the following...Ch. 15 - FINANCIAL RATIOS Based on the financial statements...Ch. 15 - CLOSING ENTRIES Using the spreadsheet and...Ch. 15 - REVERSING ENTRIES From the spreadsheet used in...Ch. 15 - ADJUSTING, CLOSING, AND REVERSING ENTRIES Prepare...Ch. 15 - INCOME STATEMENT, STATEMENT OF OWNERS EQUITY, AND...Ch. 15 - FINANCIAL RATIOS Use the spreadsheet and financial...Ch. 15 - END-OF-PERIOD SPREADSHEET, ADJUSTING, CLOSING, AND...Ch. 15 - REVENUE SECTION, MULTIPLE-STEP INCOME STATEMENT...Ch. 15 - COST OF GOODS SOLD SECTION, MULTIPLE-STEP INCOME...Ch. 15 - MULTIPLE-STEP INCOME STATEMENT Use the following...Ch. 15 - FINANCIAL RATIOS Based on the financial...Ch. 15 - CLOSING ENTRIES Using the spreadsheet and...Ch. 15 - Prob. 6SEBCh. 15 - Prob. 7SEBCh. 15 - INCOME STATEMENT, STATEMENT OF OWNERS EQUITY, AND...Ch. 15 - FINANCIAL RATIOS Use the work sheet and financial...Ch. 15 - END-OF-PERIOD SPREADSHEET, ADJUSTING, CLOSING, AND...Ch. 15 - Prob. 1MYWCh. 15 - Dominique Fouque owns and operates Dominiques Doll...Ch. 15 - Prob. 1CPCh. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Prob. 2.1COPCh. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Prob. 2.4COPCh. 15 - Prob. 2.5COPCh. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Comprehensive Problem 2: Accounting Cycle with...Ch. 15 - Prob. 2.8COP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License