Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 10P

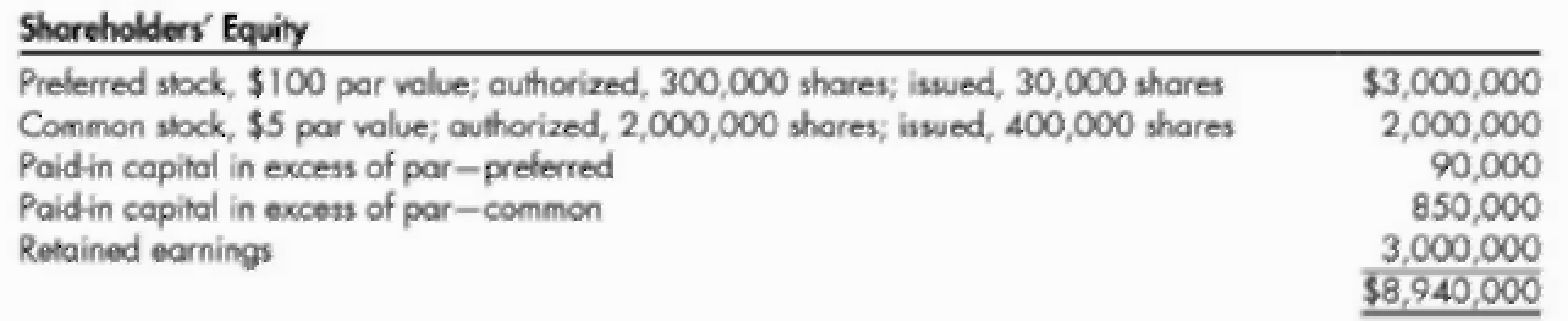

Comprehensive The shareholders’ equity section of Superior Corporation’s

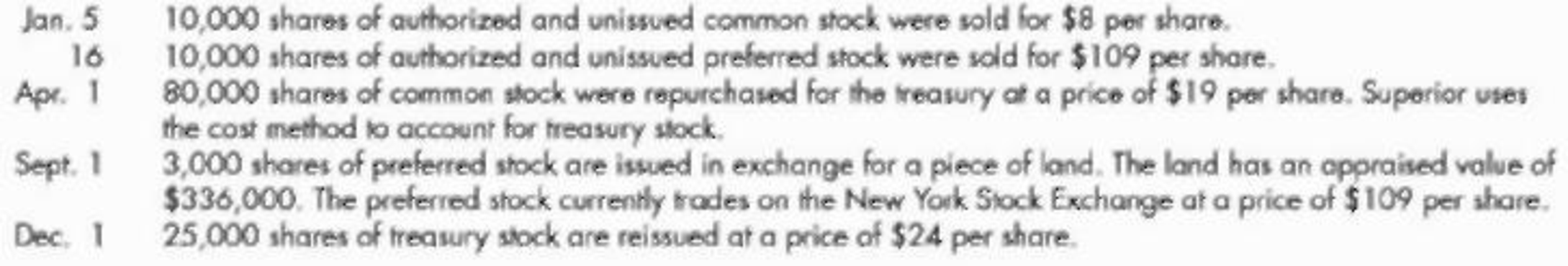

The following events occurred during 2019:

Required:

- 1. Prepare

journal entries for each of the above transactions. - 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019.

- 3. Calculate Superior's legal capital at December 31, 2019.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

KIARA LIMITED

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER:

ASSETS

Property, plant and equipment (cost)

Accumulated depreciation

Long-term investments

Inventory

Accounts receivable

Company tax paid in advance

Bank

EQUITY AND LIABILITIES

2024

2023

R

R

2 490 000

1 620 000

(630 000)

660 000

1 050 000

1 230 000

30 000

(480 000)

450 000

1 290 000

900 000

0

750 000

660 000

5 580 000

4 440 000

Ordinary share capital

2 700 000

2 000 000

Retained income

1 500 000

1 158 000

Long-term loan from Kip Bank (15%)

900 000

1 000 000

Accounts payable

480 000

228 000

Company tax payable

0

54 000

5 580 000

4 440 000

ADDITIONAL INFORMATION

All purchases and sales are on credit.

Interim dividends paid during the year amounted to R150 750.

Credit terms of 3/10 net 60 days are granted by creditors.

Accounting Question

REQUIRED

Study the information given below and answer the following questions. Where discount factors are required

use only the four decimals present value tables that appear after the formula sheet or in the module guide.

Ignore taxes.

5.1 Calculate the Accounting Rate of Return on average investment of the second alternative

(expressed to two decimal places).

5.2 Determine which of the two investment opportunities the company should choose by

calculating the Net Present Value of each alternative. Your answer must include the

calculation of the present values and NPV.

5.3 Calculate the Internal Rate of Return of the first alterative (expressed to two decimal

places). Your answer must include two net present value calculations (using consecutive

rates/percentages) and interpolation.

INFORMATION

The management of Bentall Incorporated is considering two investment opportunities:

(5 marks)

(9 marks)

(6 marks)

The first alternative involves the purchase of a new machine for R900 000 which…

Chapter 15 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 15 - Prob. 1GICh. 15 - Prob. 2GICh. 15 - What are the three components and the basic...Ch. 15 - List the various rights of a shareholder. Which do...Ch. 15 - What is the meaning of the following terms: (a)...Ch. 15 - Prob. 6GICh. 15 - Prob. 7GICh. 15 - How does preferred stock differ from common stock?Ch. 15 - What amount of the proceeds from the issuance of...Ch. 15 - Prob. 10GI

Ch. 15 - Prob. 11GICh. 15 - Prob. 12GICh. 15 - Prob. 13GICh. 15 - Prob. 14GICh. 15 - Prob. 15GICh. 15 - Prob. 16GICh. 15 - Prob. 17GICh. 15 - Prob. 18GICh. 15 - Prob. 19GICh. 15 - How is a preferred stock similar to a long-term...Ch. 15 - Prob. 21GICh. 15 - Prob. 22GICh. 15 - Prob. 23GICh. 15 - Prob. 24GICh. 15 - Prob. 25GICh. 15 - What additional disclosures about preferred and...Ch. 15 - Prob. 1MCCh. 15 - Cary Corporation has 50,000 shares of 10 par...Ch. 15 - What is the most likely effect of a stock split on...Ch. 15 - Prob. 4MCCh. 15 - Prob. 5MCCh. 15 - Prob. 6MCCh. 15 - Prob. 7MCCh. 15 - When treasury stock is purchased for cash at more...Ch. 15 - Preferred stock that may be retired by the...Ch. 15 - When treasury stock accounted for by the cost...Ch. 15 - Brown Corporation issues 800 shares of its 5 par...Ch. 15 - Heart Corporation entered into a subscription...Ch. 15 - Blue Corporation issues 200 packages of securities...Ch. 15 - Sun Corporation issues 500 shares of 8 par common...Ch. 15 - Next Level Morgan Corporation issues 500 packages...Ch. 15 - Prob. 6RECh. 15 - On January 1, 2019, Phoenix Corporation adopts a...Ch. 15 - On January 2, 2019, Brust Corporation grants its...Ch. 15 - Prob. 9RECh. 15 - Assume Cole Corporation originally issued 300...Ch. 15 - Violet Corporation issues 1,200 shares of 150 par...Ch. 15 - Assume that Lily Corporation has outstanding 1,500...Ch. 15 - Tulip Corporation uses the cost method to account...Ch. 15 - Par Value and No-Par Stock Issuance Caswell...Ch. 15 - Combined Sale of Stock Maxville Company issues 300...Ch. 15 - Sale of Stock with Bonds Pilsen Company issues 12%...Ch. 15 - Issuance of Stock for Land Putt Company issues 500...Ch. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Restricted Share Units On January 2, 2019, Dekker...Ch. 15 - Prob. 10ECh. 15 - Convertible Preferred Stock On January 2, 2019,...Ch. 15 - Prob. 12ECh. 15 - Stock Rights with Preferred Stock Nelson...Ch. 15 - Various Journal Entries Lodi Company is authorized...Ch. 15 - Treasury Stock, Cost Method On January 1, Lorain...Ch. 15 - Contributed Capital Adams Companys records provide...Ch. 15 - Prob. 17ECh. 15 - Treasury Stock, Cost and Par Value Methods On...Ch. 15 - Treasury Stock, No Par Propst-Steele Production...Ch. 15 - Subscriptions On August 3, 2019, the date of...Ch. 15 - Prob. 2PCh. 15 - Prob. 3PCh. 15 - Prob. 4PCh. 15 - Prob. 5PCh. 15 - Prob. 6PCh. 15 - Issuances of Stock Cada Corporation is authorized...Ch. 15 - Issuances of Stock Epple Corporation is authorized...Ch. 15 - Comprehensive Young Corporation has been operating...Ch. 15 - Comprehensive The shareholders equity section of...Ch. 15 - Treasury Stock Analysis Ray Holt Corporation has...Ch. 15 - Comprehensive Byrd Companys Contributed Capital...Ch. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Reconstruct Journal Entries At the end of its...Ch. 15 - Treasury Stock, Cost Method Bush-Caine Company...Ch. 15 - Prob. 17PCh. 15 - Prob. 1CCh. 15 - Prob. 2CCh. 15 - Prob. 3CCh. 15 - Capital Stock Capital stock is an important area...Ch. 15 - Treasury Stock A corporation sometimes engages in...Ch. 15 - Prob. 6CCh. 15 - Prob. 7CCh. 15 - Compensatory Share Option Plan Tom Twitlet,...Ch. 15 - Prob. 9CCh. 15 - Treasury Stock For numerous reasons, a corporation...Ch. 15 - Prob. 11CCh. 15 - Prob. 12CCh. 15 - Prob. 13CCh. 15 - Prob. 14C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- REQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forwardWhat is the expected return on a portfolio with a beta of 0.8 on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License