Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 16E

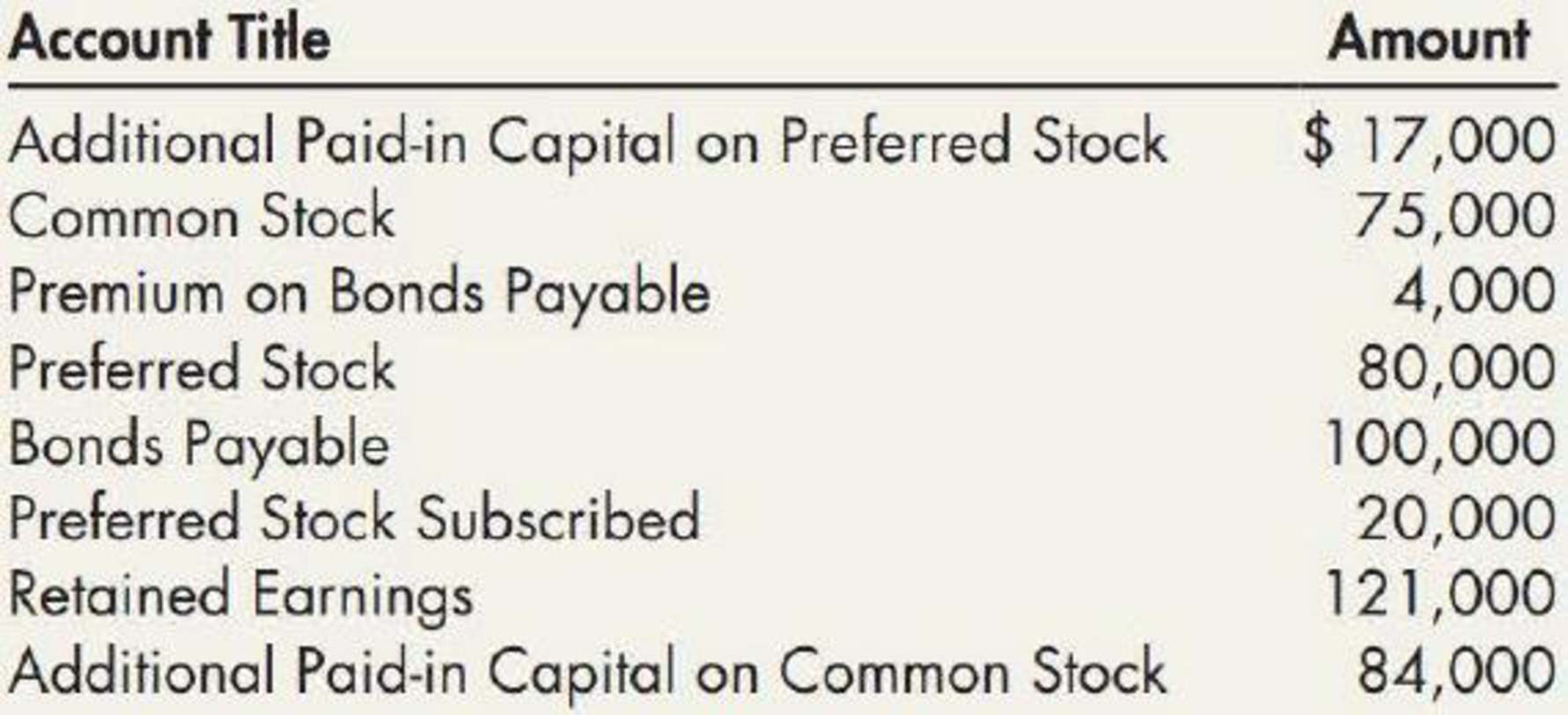

Contributed Capital Adams Company’s records provide the following information on December 31, 2019:

Additional information:

- 1. Common stock has a $5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding.

- 2.

Preferred stock has a $100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at $120 per share. The stock pays an 8% dividend, is cumulative, and is callable at $130 per share. - 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually.

Required:

Prepare the Contributed Capital section of the December 31, 2019,

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Statement of Financial position as at September 30 for 2023 and 2024

Assets 2023 2024

Cash and equivalents………………………………………. $56,100 $37,694

Receivables, Trade, less allowances of $1,104 and $991 respectively 47,753 37,645

Other Receivables…………………………………………………… 233 516

Inventories…………………………………………………………… 29,587 23,202

Prepaid expenses and other………………………………………….. 4,739 4,143

Total current assets…………………………………………………... 138,412 103,200

Property, plant and equipment, at cost………………………………. 314,880 298,609

Less accumulated depreciation………………………………………. (225,406) (211,494)

Property, plant and equipment net…………………………………… 89,474 87,115

Other assets

Goodwill……………………………………………………………...…

Swifty Corporation had 2025 net income of $1,169,000. During 2025, Swifty paid a dividend of $2 per share on 87,850 shares of

preferred stock. During 2025, Swifty had outstanding 301,000 shares of common stock.

Compute Swifty's 2025 earnings per share. (Round answer to 2 decimal places, e.g. 3.56.)

Earnings per share

GA

$

per share

GFH Decorators, a partnership, had the income and expenses shown in the spreadsheet below for the current tax year. Identify whether each item is an "Ordinary Business Income" item (reported on Page 1, Form 1065), a "Separately Stated Item" (reported on Schedule K, Form 1065), or both. Enter the value of ordinary income items in column C and the value of separately stated items in column D. Note that not all the cells in either column C or D will have values. If a response is zero, leave the cell blank.Use a minus sign to enter negative values.

A

B

C

D

1

Ordinary Business Income

Separately Stated Items

2

Fee revenue

$600,000

3

Dividend income

$2,000

4

Capital gain distributions

$10,000

5

Charitable contributions (cash)

($500)

6

Salaries to employees

($150,000)

7

Partner guaranteed payments

($75,000)

8

MACRS depreciation on office furniture

($3,000)

9

Total ordinary business income

$0

Chapter 15 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 15 - Prob. 1GICh. 15 - Prob. 2GICh. 15 - What are the three components and the basic...Ch. 15 - List the various rights of a shareholder. Which do...Ch. 15 - What is the meaning of the following terms: (a)...Ch. 15 - Prob. 6GICh. 15 - Prob. 7GICh. 15 - How does preferred stock differ from common stock?Ch. 15 - What amount of the proceeds from the issuance of...Ch. 15 - Prob. 10GI

Ch. 15 - Prob. 11GICh. 15 - Prob. 12GICh. 15 - Prob. 13GICh. 15 - Prob. 14GICh. 15 - Prob. 15GICh. 15 - Prob. 16GICh. 15 - Prob. 17GICh. 15 - Prob. 18GICh. 15 - Prob. 19GICh. 15 - How is a preferred stock similar to a long-term...Ch. 15 - Prob. 21GICh. 15 - Prob. 22GICh. 15 - Prob. 23GICh. 15 - Prob. 24GICh. 15 - Prob. 25GICh. 15 - What additional disclosures about preferred and...Ch. 15 - Prob. 1MCCh. 15 - Cary Corporation has 50,000 shares of 10 par...Ch. 15 - What is the most likely effect of a stock split on...Ch. 15 - Prob. 4MCCh. 15 - Prob. 5MCCh. 15 - Prob. 6MCCh. 15 - Prob. 7MCCh. 15 - When treasury stock is purchased for cash at more...Ch. 15 - Preferred stock that may be retired by the...Ch. 15 - When treasury stock accounted for by the cost...Ch. 15 - Brown Corporation issues 800 shares of its 5 par...Ch. 15 - Heart Corporation entered into a subscription...Ch. 15 - Blue Corporation issues 200 packages of securities...Ch. 15 - Sun Corporation issues 500 shares of 8 par common...Ch. 15 - Next Level Morgan Corporation issues 500 packages...Ch. 15 - Prob. 6RECh. 15 - On January 1, 2019, Phoenix Corporation adopts a...Ch. 15 - On January 2, 2019, Brust Corporation grants its...Ch. 15 - Prob. 9RECh. 15 - Assume Cole Corporation originally issued 300...Ch. 15 - Violet Corporation issues 1,200 shares of 150 par...Ch. 15 - Assume that Lily Corporation has outstanding 1,500...Ch. 15 - Tulip Corporation uses the cost method to account...Ch. 15 - Par Value and No-Par Stock Issuance Caswell...Ch. 15 - Combined Sale of Stock Maxville Company issues 300...Ch. 15 - Sale of Stock with Bonds Pilsen Company issues 12%...Ch. 15 - Issuance of Stock for Land Putt Company issues 500...Ch. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Restricted Share Units On January 2, 2019, Dekker...Ch. 15 - Prob. 10ECh. 15 - Convertible Preferred Stock On January 2, 2019,...Ch. 15 - Prob. 12ECh. 15 - Stock Rights with Preferred Stock Nelson...Ch. 15 - Various Journal Entries Lodi Company is authorized...Ch. 15 - Treasury Stock, Cost Method On January 1, Lorain...Ch. 15 - Contributed Capital Adams Companys records provide...Ch. 15 - Prob. 17ECh. 15 - Treasury Stock, Cost and Par Value Methods On...Ch. 15 - Treasury Stock, No Par Propst-Steele Production...Ch. 15 - Subscriptions On August 3, 2019, the date of...Ch. 15 - Prob. 2PCh. 15 - Prob. 3PCh. 15 - Prob. 4PCh. 15 - Prob. 5PCh. 15 - Prob. 6PCh. 15 - Issuances of Stock Cada Corporation is authorized...Ch. 15 - Issuances of Stock Epple Corporation is authorized...Ch. 15 - Comprehensive Young Corporation has been operating...Ch. 15 - Comprehensive The shareholders equity section of...Ch. 15 - Treasury Stock Analysis Ray Holt Corporation has...Ch. 15 - Comprehensive Byrd Companys Contributed Capital...Ch. 15 - Prob. 13PCh. 15 - Prob. 14PCh. 15 - Reconstruct Journal Entries At the end of its...Ch. 15 - Treasury Stock, Cost Method Bush-Caine Company...Ch. 15 - Prob. 17PCh. 15 - Prob. 1CCh. 15 - Prob. 2CCh. 15 - Prob. 3CCh. 15 - Capital Stock Capital stock is an important area...Ch. 15 - Treasury Stock A corporation sometimes engages in...Ch. 15 - Prob. 6CCh. 15 - Prob. 7CCh. 15 - Compensatory Share Option Plan Tom Twitlet,...Ch. 15 - Prob. 9CCh. 15 - Treasury Stock For numerous reasons, a corporation...Ch. 15 - Prob. 11CCh. 15 - Prob. 12CCh. 15 - Prob. 13CCh. 15 - Prob. 14C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- explain why preferred stock is referred to as a "hybrid security"?arrow_forwardBriefly recap what is meant by "the preemptive right to purchase common stock"? Explain the concept of Stock-Appreciation Rights (SARs).arrow_forwardWhat's the difference between calculating EPS for a simple capital structure versus a complex capital structure?arrow_forward

- In the first two years of operations, a company reports taxable income of $115,000 and $165,000, respectively. In the first two years, the tax rates were 38% and 32% respectively. It is now the end of the third year, and the company has a loss of $160,000 for tax purposes. The company carries losses to the earliest year possible. The tax rate is currently 25%. Required How much tax was paid in year 1 and year 2? Compute the amount of income tax payable or receivable in the current (third) year.arrow_forwardQuestion 22 (18 points) Problem 2 – Accounting Changes (18 marks) During the audit of Hoppy Ending Brewery for the fiscal year ended June 30, 2027, the auditors identified the following issues: a. The company sells beer for $1 each plus $0.10 deposit on each bottle. The deposit collected is payable to the provincial recycling agency. During 2026, the company had recorded $12,000 of deposits as revenue. The auditors believe this amount should have been recorded as a liability. b. The company had been using the first-in, first-out cost flow assumption for its inventories. In fiscal 2027, management decided to switch to the weighted-average method. This change reduced inventory by $25,000 at June 30, 2026, and $40,000 at June 30, 2027. c. The company has equipment costing $6,000,000 that it has been depreciating over 10 years on a straight-line basis. The depreciation for fiscal 2026 was $600,000 and accumulated depreciation on June 30,…arrow_forwardLes Mills Ltd.'s policy is to report all cash flows arising from interest and dividends in the operating section. Les Mills activities for the year ended December 31, 2026, included the following: • Income tax expense for the year was $30,000. • Sold an investment at FVOCI for $45,000. The original cost of the investment was $52,000. • Depreciation expense for the year was $19,000. • Sales for the year were $1,030,000. • Selling and administration expenses for the year totaled $240,000. • Les Mills cost of goods sold in 2026 was $315,000. • Interest expense for the period was $12,000. The interest payable account increased $5,000. • Accounts payable increased $20,000 in 2026. • Accounts receivable decreased $36,000 in 2026. • Les Mills inventory increased $13,000 during the year. • Dividends were not declared during the year; however, the dividends payable account decreased $5,000. Required Prepare the cash flows from operating activities…arrow_forward

- The following is an excerpt from a company's financial records at year-end. Balance in CAD US dollars chequing account. $10,000 Cash in sinking fund account for a future repurchase of common shares. 50,000 Term deposit maturing 100 days after the year-end. 78,000 Bank loan (60,000) Cash restricted for plant expansion. 45,000 Cash on hand. 7,800 Bank overdraft - part of cash management system (9,000) The "cash and cash equivalents" in the cash flow statement will be: Question 20 options: ($51,200) $8,800 ($1,200) $17,800arrow_forwardWhat are investing activities? Question 19 options: Activities involving the acquisition and disposal of long-term assets and other investments. Activities involving the principal revenue-producing activities of the entity. Activities involving changes in the size and composition of the equity's borrowings. Activities that do not involve cash.arrow_forwardWhat are financing activities? Question 18 options: Activities that result in changes in the size and composition of the contributed equity and borrowings of the entity. Activities involving the principal revenue-producing activities of the entity. Activities involving the acquisition and disposal of long-term assets.arrow_forward

- If a company has gaps between the change in cash and the net income for the year: Question 17 options: the financial statement notes provide explanation for the sources of these changes. the statement of cash flow and balance sheet provide explanation for these changes. the statement of cash flow provides explanation of the sources of these changes. the income statement provides sufficient explanation for the sources of these changes.arrow_forwardIf a company has gaps between the change in cash and the net income for the year: Question 17 options: the financial statement notes provide explanation for the sources of these changes. the statement of cash flow and balance sheet provide explanation for these changes. the statement of cash flow provides explanation of the sources of these changes. the income statement provides sufficient explanation for the sources of these changes.arrow_forwardA company had taxable income of $2 million in fiscal 2026 and paid taxes of 0.7 million; the company incurred a loss of $8 million in fiscal 2027 when the tax rate is 50%. How much refund is the company entitled to? Question 16 options: $3.85 million $4 million Nil $0.7 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License