Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 6PA

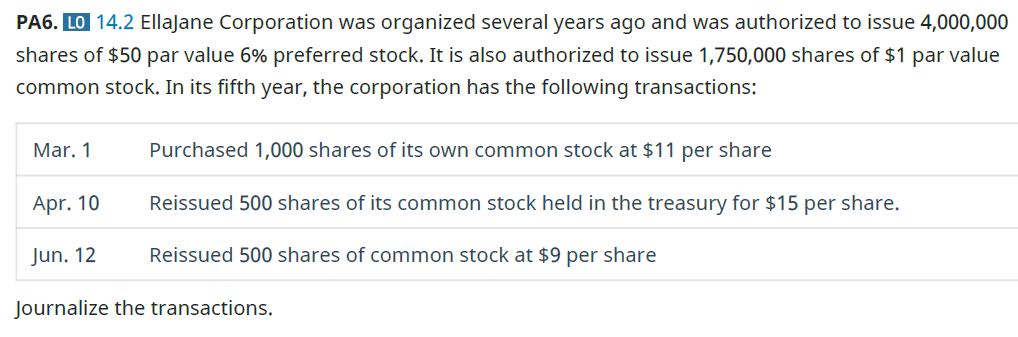

EllaJane Corporation was organized several years ago and was authorized to issue 4,000,000 shares of $50 par value 6%

Journalize the transactions.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The corporate charter of Metlock, Corporation allows the issuance of a maximum of 100,000 shares of common stock. During its first two years of operations, Metlock, sold 57,600 shares to shareholders and reacquired 3,100 of these shares. After these transactions, how many shares are authorized, issued, and outstanding?

During its first year of operations, Anchor Holdings Corporation entered into the following transactions relating to shareholders’ equity. The articles of incorporation authorized the issue of 12,000,000 common shares, $1.50 par per share, and 1,500,000 preferred shares, $30.00 par per share.

January 12

Sold 3,000,000 common shares for $9.00 per share.

February 1

Issued 60,000 common shares in exchange for legal services.

February 1

Sold 120,000 of its common shares and 24,000 preferred shares for a total of $1,884,000.

September 4

Issued 480,000 of its common shares in exchange for land for which the cash price was known to be $5,424,000.

Required:

Prepare the shareholders' equity section of the December 31 balance sheet.

Lagoon Company was organized at the beginning of the current year.The entity provided the following transactions affecting shareholders' equity:1. The corporation was authorized to issue 100,000 ordinary shares with par value ofP100.2. Twenty-five percent of the authorized ordinary capital was subscribed for at par value.3. Collected twenty-five percent of the subscription.4. Full collection was received on 10,000 shares originally subscribed.5. Issued the share certificates on the fully paid 10,000 shares.6. Land with fair value of P800,000 and a building thereon fairly valued at P2,500,000were acquired for 30,000 shares.7. Issued 10,000 shares for an outstanding bank loan of P1,300,000, including accruedinterest of P200,000. On this date, shares are quoted at P120 per share.8. Net income for the year amounted to P3,000,000.Required:a. Prepare journal entries using journal entry method.

b. Present the shareholders' equity

Chapter 14 Solutions

Principles of Accounting Volume 1

Ch. 14 - Which of the following is not a characteristic...Ch. 14 - Issued stock is defined as stock that ________. A....Ch. 14 - Your friend is considering incorporating and asks...Ch. 14 - Par value of a stock refers to the ________. A....Ch. 14 - Which of the following is not one of the five...Ch. 14 - When a C corporation has only one class of stock...Ch. 14 - The number of shares that a corporations...Ch. 14 - The total amount of cash and other assets received...Ch. 14 - Stock can be issued for all except which of the...Ch. 14 - A company issued 40 shares of $1 par value common...

Ch. 14 - A company issued 30 shares of $.50 par value...Ch. 14 - A corporation issued 100 shares of $100 par value...Ch. 14 - The date the board of directors votes to declare...Ch. 14 - Which of the following is true of a stock...Ch. 14 - Stockholders equity consists of which of the...Ch. 14 - Retained earnings is accurately described by all...Ch. 14 - If a companys board of directors designates a...Ch. 14 - Corrections of errors that occurred on a previous...Ch. 14 - Owners equity represents which of the following?...Ch. 14 - Which of the following is a measurement of...Ch. 14 - Which of the following measures the portion of a...Ch. 14 - The measurement of earnings concept that consists...Ch. 14 - The correct formula for the calculation of...Ch. 14 - Most analysts believe which of the following is...Ch. 14 - Your corporation needs additional capital to fund...Ch. 14 - How many shares of stock should your new...Ch. 14 - What factors should a new company consider in...Ch. 14 - What are some of the reasons a business owner...Ch. 14 - Why would a company repurchase its own stock?Ch. 14 - The following data was reported by Saturday...Ch. 14 - A corporation issues 6,000 shares of $1 par value...Ch. 14 - When corporations issue stock in exchange for...Ch. 14 - A corporation issues 5,000 shares of $1 par value...Ch. 14 - On April 2, West Company declared a cash dividend...Ch. 14 - When does a corporation incur a liability for a...Ch. 14 - How does a stock split affect the balance sheet of...Ch. 14 - Your friend has questions about retained earnings...Ch. 14 - What does owners equity mean for the owner?Ch. 14 - What types of transactions reduce owners equity?...Ch. 14 - Sometimes financial statements contain errors....Ch. 14 - Retained earnings may be restricted or...Ch. 14 - Which financial statements do you need to...Ch. 14 - Where is EPS disclosed for publicly traded...Ch. 14 - Should investors rely on EPS as an investing tool?...Ch. 14 - What information do you need to calculate the...Ch. 14 - Which is the only ratio required to be reported on...Ch. 14 - You are an accountant working for a company that...Ch. 14 - What is the impact on stockholders equity when a...Ch. 14 - What is the most obvious difference between debt...Ch. 14 - How do creditors assess risk when lending funds to...Ch. 14 - Fortuna Company is authorized to issue 1,000,000...Ch. 14 - James Incorporated is authorized to issue...Ch. 14 - McVie Corporations stock has a par value of $2....Ch. 14 - Anslo Fabricating, Inc. is authorized to issue...Ch. 14 - St. Marie Company is authorized to issue 1,000,000...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Blanket Company has paid quarterly dividends every...Ch. 14 - Farmington Corporation began the year with a...Ch. 14 - Montana Incorporated began the year with a...Ch. 14 - Jesse and Mason Fabricating, Inc. general ledger...Ch. 14 - Roxannes Delightful Candies, Inc. began the year...Ch. 14 - Jupiter Corporation earned net income of $90,000...Ch. 14 - Longmont Corporation earned net income of $90,000...Ch. 14 - James Corporation earned net income of $90,000...Ch. 14 - Your high school friend started a business that...Ch. 14 - You are an accountant working for a manufacturing...Ch. 14 - What is the impact on stockholders equity when a...Ch. 14 - What is the biggest disadvantage to be considered...Ch. 14 - Your high school friend started a business that...Ch. 14 - Spring Company is authorized to issue 500,000...Ch. 14 - Silva Company is authorized to issue 5,000,000...Ch. 14 - Juniper Company is authorized to issue 5,000,000...Ch. 14 - Vishnu Company is authorized to issue 500,000...Ch. 14 - Ammon Company is authorized to issue 500,000...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Nutritious Pet Food Companys board of directors...Ch. 14 - Birmingham Company has been in business for five...Ch. 14 - Chelsea Company is a sole proprietorship. Ashley,...Ch. 14 - Tart Restaurant Holdings, Incorporated began the...Ch. 14 - Josue Fabricating, Inc.s accountant has the...Ch. 14 - Trumpet and Trombone Manufacturing, Inc. began the...Ch. 14 - Brunleigh Corporation earned net income of...Ch. 14 - Errol Corporation earned net income of $200,000...Ch. 14 - Bastion Corporation earned net income of $200,000...Ch. 14 - You are a CPA who has been hired by DEF Company to...Ch. 14 - You are a CPA who has been hired by DEF Company to...Ch. 14 - You are a CPA who has been hired by DEF Company to...Ch. 14 - Wingra Corporation was organized in March. It is...Ch. 14 - Copper Corporation was organized in May. It is...Ch. 14 - EllaJane Corporation was organized several years...Ch. 14 - Aggregate Mining Corporation was incorporated five...Ch. 14 - Aggregate Mining Corporation was incorporated five...Ch. 14 - Aggregate Mining Corporation was incorporated five...Ch. 14 - The board of directors is interested in investing...Ch. 14 - You are a consultant for several emerging,...Ch. 14 - You are the accountant for Kamal Fabricating, Inc....Ch. 14 - You are a consultant working with various...Ch. 14 - You are the president of Duke Company and are...Ch. 14 - You are the president of Duke Company and are...Ch. 14 - Autumn Corporation was organized in August. It is...Ch. 14 - MacKenzie Mining Corporation is authorized to...Ch. 14 - Paydirt Limestone, Incorporated was organized...Ch. 14 - Tent Tarp Corporation is a manufacturer of...Ch. 14 - Tent Tarp Corporation is a manufacturer of...Ch. 14 - Tent Tarp Corporation is a manufacturer of...Ch. 14 - You are a CPA working with sole proprietors....Ch. 14 - You are a consultant for several emerging, high...Ch. 14 - You are the accountant for Trumpet and Trombone...Ch. 14 - You have some funds that you would like to invest...Ch. 14 - You are a consultant working with various...Ch. 14 - Your bakery is incorporated and is looking for...Ch. 14 - Do some research: why did Facebook choose to...Ch. 14 - Do some research: why is Comcast incorporated in...Ch. 14 - On November 7, 2013, Twitter released its initial...Ch. 14 - Research online to find a company that bought back...Ch. 14 - As a bakery business continues to grow, cash flow...Ch. 14 - Use the internet to find a company that declared a...Ch. 14 - Use the internet to find a publicly-held companys...Ch. 14 - Use the internet to find a publicly-held companys...

Additional Business Textbook Solutions

Find more solutions based on key concepts

How can Facebook balance the concerns of its users with the necessity of generating revenue through advertising...

Principles of Management

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (12th Edition)

Fixed manufacturing overhead variance analysis (continuation of 8-23). The Sourdough Bread Company also allocat...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Prepare a production cost report and journal entries (Learning Objectives 4 5) Vintage Accessories manufacture...

Managerial Accounting (5th Edition)

What are some of the problems with using the CPI?

Construction Accounting And Financial Management (4th Edition)

What is the relationship between management by exception and variance analysis?

Cost Accounting (15th Edition)

Knowledge Booster

Similar questions

- Paydirt Limestone, Incorporated was organized several years ago and was authorized to issue 3,000,000 shares of $40 par value 9% preferred stock. It is also authorized to issue 3,750,000 shares of $2 par value common stock. In its fifth year, the corporation has the following transactions: Journalize the transactions.arrow_forwardJames Incorporated is authorized to issue 5,000,000 shares of $1 par value common stock. In its second year of business, the company has the following transactions: Journalize the transactions.arrow_forwardAnslo Fabricating, Inc. is authorized to issue 10,000,000 shares of $5 stated value common stock. During the year, the company has the following transactions: Journalize the transactions.arrow_forward

- Wingra Corporation was organized in March. It is authorized to issue 500,000 shares of $100 par value 8% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forwardSt. Marie Company is authorized to issue 1,000,000 shares of $5 par value preferred stock, and 5,000,000 shares of $1 stated value common stock. During the year, the company has the following transactions: Journalize the transactions.arrow_forwardAutumn Corporation was organized in August. It is authorized to issue 100,000 shares of $100 par value 7% preferred stock. It is also authorized to issue 500,000 shares of $5 par value common stock. During the year, the corporation had the following transactions: Journalize the transactions.arrow_forward

- Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000 shares of $100 par value 8% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. It has issued only 50,000 of the common shares and none of the preferred shares. In its sixth year, the corporation has the following transactions: Journalize these transactions.arrow_forwardCopper Corporation was organized in May. It is authorized to issue 50,000,000 shares of $200 par value 7% preferred stock. It is also authorized to issue 75,000,000 shares of $5 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forwardMacKenzie Mining Corporation is authorized to issue 50,000 shares of $500 par value 7% preferred stock. It is also authorized to issue 5,000,000 shares of $3 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forward

- Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000 shares of $100 par value 8% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. It has issued only 50,000 of the common shares and none of the preferred shares. In its seventh year, the corporation has the following transactions: Journalize these transactions.arrow_forwardFortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Journalize the transactions and calculate how many shares of stock are outstanding at August 3.arrow_forwardThe following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning