Concept explainers

Equipment Replacement and Performance Measures

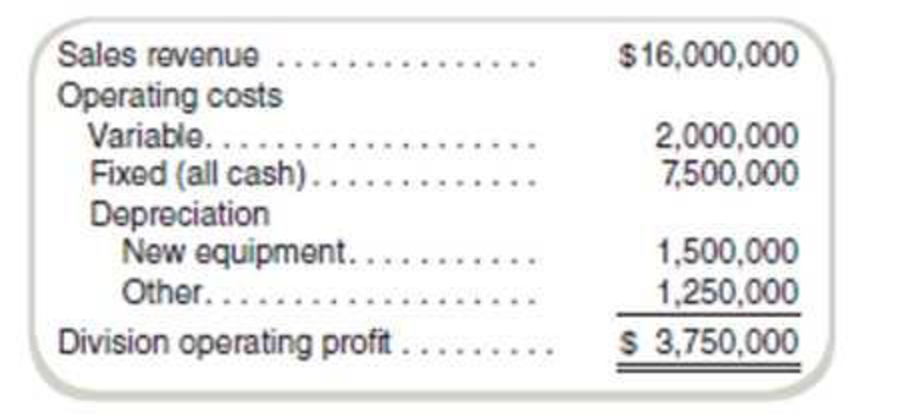

Oscar Clemente is the manager of Forbes Division of Pitt, Inc., a manufacturer of biotech products. Forbes Division, which has $4 million in assets, manufactures a special testing device. At the beginning of the current year, Forbes invested $5 million in automated equipment for test machine assembly. The division’s expected income statement at the beginning of the year was as follows:

A sales representative from LSI Machine Company approached Oscar in October. LSI has for $6.5 million a new assembly machine that offers significant improvements over the equipment Oscar bought at the beginning of the year. The new equipment would expand division output by 10 percent while reducing cash fixed costs by 5 percent. It would be

The old machine, which has no salvage value, must be disposed of to make room for the new machine.

Pitt has a performance evaluation and bonus plan based on

Required

- a. What is Forbes Division’s ROI if Oscar docs not acquire the new machine?

- b. What is Forbes Division's ROI this year if Oscar acquires the new machine?

- c. If Oscar acquires the new machine and it operates according to specifications, what ROI is expected for next year?

a.

Calculate the division F’s ROI if Company O does not acquire the new machine

Answer to Problem 46P

The return on investment is 60% when Company O does not acquire the new machine.

Explanation of Solution

Return on investment:

Return on investment is the amount of total profit earned by a division with its assets. The return on investment is used to check the efficiency of the unit. It shows the efficiency of the unit to utilize its assets to generate the profit.

Calculate the ROI if Company O does not acquire the new machine:

Thus, the return on investment is 60% when Company O does not acquire the new machine.

Working note 1:

Calculate the net asset value:

| Particulars | Amount |

| Opening asset value | $4,000,000 |

| Add: addition in the year | $5,000,000 |

| Total asset value | $9,000,000 |

| Less: depreciation on new equipment | $1,500,000 |

| Less: depreciation on others | $1,250,000 |

| Net asset value | $6,250,000 |

Table: (1)

b.

Calculate the division F’s ROI if Company O acquires the new machine

Answer to Problem 46P

The return on investment is 2.7% when Company O does not acquire the new machine.

Explanation of Solution

Divisional ROI:

Divisional ROI is the return on investment for a division of a business. It is calculated by dividing the operating profit of the division from the divisional assets.

Calculate the ROI if Company O acquires the new machine:

Thus, the return on investment is 2.7% when Company O does not acquire the new machine.

Working note 2:

Calculate the net asset value:

| Particulars | Amount |

| Opening asset value | $4,000,000 |

| Add: improvement in the asset | $6,500,000 |

| Total asset value | $10,500,000 |

| Less: depreciation on others | $1,250,000 |

| Net asset value | $9,250,000 |

Table: (2)

Working note 3:

Calculate the after-tax divisional profit:

| Particulars | Amount |

| Operating profit | $3,750,000 |

| Less: loss on old equipment | $5,000,000 |

| Add: saving in the depreciation of old equipment | $1,500,000 |

| Net operating profit | $250,000 |

Table: (3)

c.

Calculate the ROI if the company acquires a new machine and operates it according to specifications.

Answer to Problem 46P

The return on investment is 83.75% if the company acquires a new machine and operates it according to specifications.

Explanation of Solution

Divisional income:

A business may be operating in various departments or units. Each unit has its own cost and profit structure. The profit of a specific unit is called divisional income. It is calculated by deducting the divisional expense from the divisional profit.

Calculate the ROI if Company O acquires the new machine:

Thus, the return on investment is 83.75% when Company O does not acquire the new machine.

Working note 4:

Calculate the divisional operating income:

| Particulars |

Amount (a) |

% change (b) |

Net amount |

| Sales | $16,000,000 | +10% | $17,600,000 |

| Operating costs: | |||

| Variable | $2,000,000 | +10% | $2,200,000 |

| Fixed | $7,500,000 | -5% | $7,125,000 |

| Deprecation: | |||

| New equipment(6) | $1,500,000 | $2,000,000 | |

| Others | $1,250,000 | $1,250,000 | |

| Divisional operating profit | $5,025,000 |

Table: (4)

Working note 5:

Calculate the net asset value:

| Particulars | Amount |

| Opening asset value | $4,000,000 |

| Add: improvement in the asset | $6,500,000 |

| Total asset value | $10,500,000 |

| Less: depreciation on others | $2,500,000 |

| Less: depreciation on improved assets(6) | $2,000,000 |

| Net asset value | $6,000,000 |

Table: (5)

Working note 6:

Calculate the depreciation on new equipment:

Want to see more full solutions like this?

Chapter 14 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Maplewood Textiles reported $1,100,000 in net sales and $720,000 in cost of goods sold. If operating expenses totaled $250,000, what is the company's gross profit and operating income?arrow_forwardNonearrow_forwardHarbor Freight Equipment issued $800,000 in bonds with a 7% annual interest rate for a term of 6 years. The company makes semiannual interest payments. What will be the total interest expense over the bond's life?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College