Evaluate Performance Evaluation System: Behavioral Issues

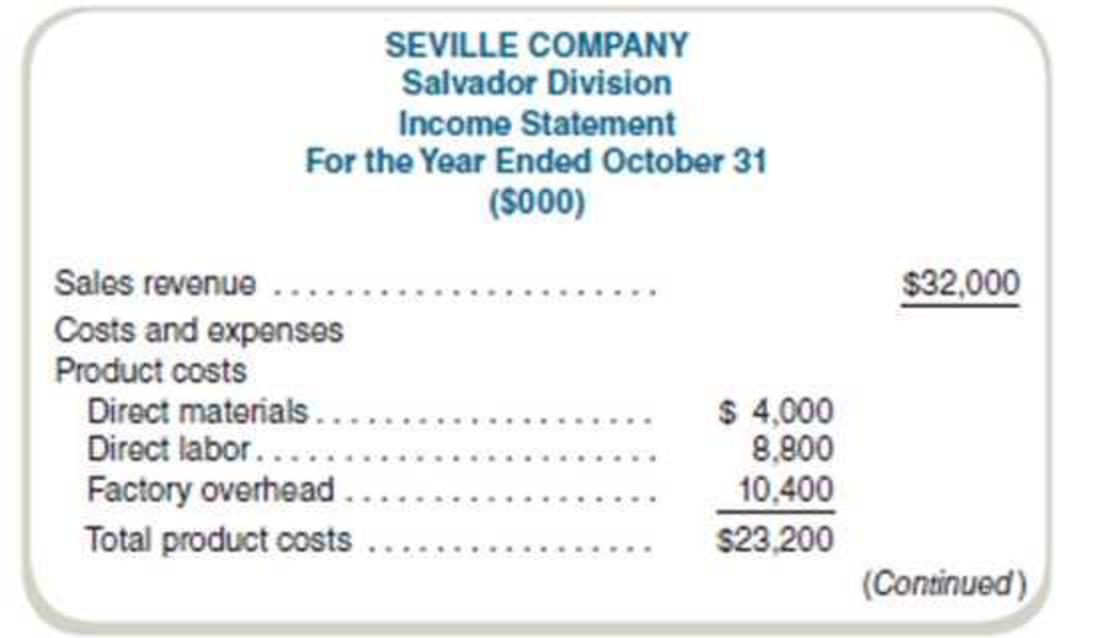

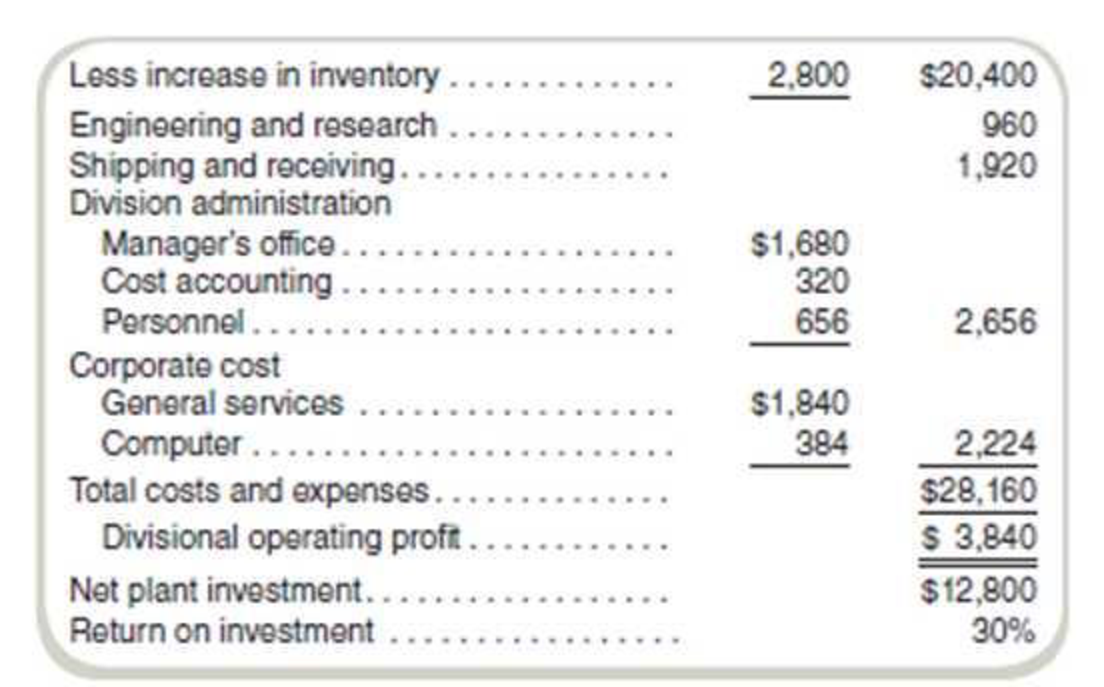

Several years ago, Seville Company acquired Salvador Components. Prior to the acquisition, Salvador manufactured and sold automotive components to third-party customers. Since becoming a division of Seville, Salvador has manufactured components only for products made by Seville’s Luxo Division.

Seville’s corporate management gives the Salvador Division management considerable latitude in running the division’s operations. However, corporate management retains authority for decisions regarding capital investments, product pricing, and production quantities.

Seville has a formal performance evaluation program for all division managements. The evaluation program relies substantially on each division’s

The corporate accounting staff prepares the divisional financial statements. Corporate general services costs are allocated on the basis of sales dollars, and the computer department’s actual costs are apportioned among the divisions on the basis of use. The net divisional investment includes divisional fixed assets at net book value (cost less depreciation), divisional inventory, and corporate

Required

- a. Discuss Seville Company’s financial reporting and performance evaluation program as it relates to the responsibilities of Salvador Division.

- b. Based on your response to requirement (a), recommend appropriate revisions of the financial information and reports used to evaluate the performance of Salvador’s divisional management. If revisions are not necessary, explain why.

(CM A adapted)

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Michael is a 40% partner in the Juno Partnership. At the beginning of the tax year, Michael's basis in the partnership interest was $80,000, including his share of partnership liabilities. During the current year, Juno reported an ordinary income of $50,000. In addition, Juno distributed $7,500 to each of the partners ($22,500 total). At the end of the year, Michael's share of partnership liabilities increased by $15,000. What is Michael's basis in the partnership interest at the end of the year?arrow_forwardFinancial Accounting Question please solve this onearrow_forwardTech Solutions, Inc. is looking to achieve a net income of 18 percent of sales. Here’s the firm’s profile: Unit sales price is $12; variable cost per unit is $7; total fixed costs are $50,000. What is the level of sales in units required to achieve a net income of 18 percent of sales?arrow_forward

- The Suit Factory sells suits. Currently, it sells 20,000 suits annually at an average price of $150 each. It is considering adding a lower-priced line of suits that sell for $120 each. The firm estimates it can sell 8,000 of the lower-priced suits but will sell 3,000 fewer of the higher-priced suits by doing so. What is the amount of the sales that should be used when evaluating the addition of the lower-priced suits? A. $510,000 B. $420,000 C. $605,000 D. $530,000arrow_forwardWhat is level of accounts receivable?arrow_forwardOveraplied or underapplid overhead?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning