(a)

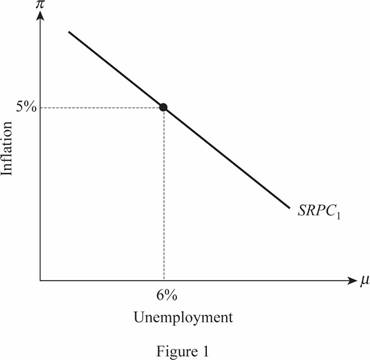

The natural rate of

(a)

Explanation of Solution

The

Here, the people make their expectations about inflation on the basis of the weighted average of the past two year's inflations. When the inflation rate is stable at 5 percent, it means that the actual inflation is same as the expected inflation and so,

Natural Rate of Unemployment: The natural rate of unemployment is the rate of unemployment that is persisting in the economy when the labor market of the economy is in its equilibrium.

(b)

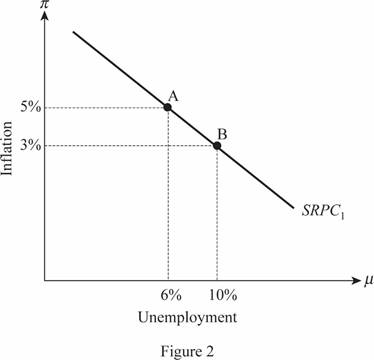

The short run trade-off between the inflation and unemployment.

(b)

Explanation of Solution

The Phillips curve of the economy is given to be

Thus, the short run trade-off between the inflation which is stable at 5 percentage point and the unemployment which is at its natural rate of 6 percentage point is indicated at point A.

(c)

The impact of fall in aggregate demand short run trade-off between the inflation and unemployment.

(c)

Explanation of Solution

The Phillips curve of the economy is given to be

When the unemployment in the economy rises by 4 percentage points and becomes 10 percentage, the impact on the Phillips curve will be different because the expected inflation in the economy does not change. Thus, the Phillips curve determined the inflation rate and this can be calculated as follows:

Thus, the point B that indicates the change in the trade-off between the unemployment and inflation in the economy which will be on the same short run Phillips curve and can be illustrated as follows:

(d)

The economy during higher unemployment and after 2 years at natural rate for 10 years.

(d)

Explanation of Solution

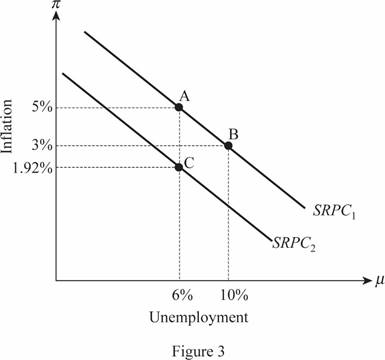

The Phillips curve of the economy is given to be

When the unemployment in the economy rises by 4 percentage points and becomes 10 percentage, the impact on the Phillips curve will be different because the expected inflation in the economy does not change. Thus, the economy's inflation rate will be 3%. The unemployment rate, inflation rate, expected inflation rate, and the rate of output growth for the 10 years can be calculated in the following table:

| Year | Unemployment Rate | Inflation Rate | Expected Inflation Rate | Rate of Output Growth |

| 1 | 6 | 5 | 5 | 3 |

| 2 | 6 | 5 | 5 | 3 |

| 3 | 10 | 3 | 5 | −5 |

| 4 | 10 | 1.6 | 3.6 | 3 |

| 5 | 6 | 2.02 | 2.02 | 11 |

| 6 | 6 | 1.89 | 1.89 | 3 |

| 7 | 6 | 1.93 | 1.93 | 3 |

| 8 | 6 | 1.92 | 1.92 | 3 |

| 9 | 6 | 1.92 | 1.92 | 3 |

| 10 | 6 | 1.92 | 1.92 | 3 |

(e)

The impact of fall in aggregate demand short run trade-off between the inflation and unemployment.

(e)

Explanation of Solution

The Phillips curve of the economy is given to be

When the unemployment in the economy rises by 4 percentage points and becomes 10 percentage, the impact on the Phillips curve will be different because the expected inflation in the economy does not change. Thus, the Phillips curve determined the inflation rate and this can be calculated as follows:

Thus, the point B that indicates the change in the trade-off between the unemployment and inflation in the economy will be on the same short run Phillips curve. When the unemployment rate falls, the expected inflation rate would fall in the economy. This leads to the downward shift in the short run Phillips curve in the economy. From the table above, it is identified that the expected inflation rate in the economy at the end of the 10th year is 1.92 percent but the unemployment rate is 6 percent. This combination is illustrated at the point C as follows:

(f)

Before recession and after recession equilibrium.

(f)

Explanation of Solution

The Phillips curve of the economy is given to be

After recession, equilibrium is indicated at point C where the inflation rate is 1.92 and the unemployment rate is 6 percentage points. This indicates that the inflation in the economy has been decreased by 3.08 percent points in the economy. While looking at the table for the rate of growth of output, it is identified that there were a loss of 8 percent during from year 2 to year 3, whereas there were a gain of 8 percent from year 3 to year 4. From year 5 to 10, the rate of output growth remained the same which means that there is no long run sacrifice in reducing the inflation rate by the economy.

Want to see more full solutions like this?

Chapter 14 Solutions

MACROECONOMICS+ACHIEVE 1-TERM AC (LL)

- Price P 1. Explain the distinction between outputs and outcomes in social service delivery 2. Discuss the Rawlsian theory of justice and briefly comment on its relevance to the political economy of South Africa. [2] [7] 3. Redistributive expenditure can take the form of direct cash transfers (grants) and/or in- kind subsidies. With references to the graphs below, discuss the merits of these two transfer types in the presence and absence of a positive externality. [6] 9 Quantity (a) P, MC, MB MSB MPB+MEB MPB P-MC MEB Quantity (6) MCarrow_forwardDon't use ai to answer I will report you answerarrow_forwardIf 17 Ps are needed and no on-hand inventory exists fot any of thr items, how many Cs will be needed?arrow_forward

- Exercise 5Consider the demand and supply functions for the notebooks market.QD=10,000−100pQS=900pa. Make a table with the corresponding supply and demand schedule.b. Draw the corresponding graph.c. Is it possible to find the price and quantity of equilibrium with the graph method? d. Find the price and quantity of equilibrium by solving the system of equations.arrow_forward1. Consider the market supply curve which passes through the intercept and from which the marketequilibrium data is known, this is, the price and quantity of equilibrium PE=50 and QE=2000.a. Considering those two points, find the equation of the supply. b. Draw a graph for this equation. 2. Considering the previous supply line, determine if the following demand function corresponds to themarket demand equilibrium stated above. QD=.3000-2p.arrow_forwardSupply and demand functions show different relationship between the price and quantities suppliedand demanded. Explain the reason for that relation and provide one reference with your answer.arrow_forward

- 13:53 APP 簸洛瞭對照 Vo 56 5G 48% 48% atheva.cc/index/index/index.html The Most Trusted, Secure, Fast, Reliable Cryptocurrency Exchange Get started with the easiest and most secure platform to buy, sell, trade, and earn Cryptocurrency Balance:0.00 Recharge Withdraw Message About us BTC/USDT ETH/USDT EOS/USDT 83241.12 1841.50 83241.12 +1.00% +0.08% +1.00% Operating norms Symbol Latest price 24hFluctuation B BTC/USDT 83241.12 +1.00% ETH/USDT 1841.50 +0.08% B BTC/USD illı 83241.12 +1.00% Home Markets Trade Record Mine О <arrow_forwardThe production function of a firm is described by the following equation Q=10,000L-3L2 where Lstands for the units of labour.a) Draw a graph for this equation. Use the quantity produced in the y-axis, and the units of labour inthe x-axis. b) What is the maximum production level? c) How many units of labour are needed at that point?arrow_forwardDon't use ai to answer I will report you answerarrow_forward

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning