Analyze common-size income statements (Learning Objectives 1, 2, & 3)

Pandora Internet Radio by Pandora Media is a streaming music service. Its free advertising-supported radio service was first launched in 2005. Pandora users streamed 20.03 billion hours of Internet radio during 2014. In December 2014, there were 81.5 million active users of Pandora, making it the largest streaming music service currently, Pandora has a database of over 1,000,000 songs from over 125,000 artists.

Pandora offers its streaming music through two services:

- 1. Free Service: This option allows the listener access to the music by including advertisements.

- 2. Pandora One: This option is a paid subscription model without any advertisements; it also allows users to have more daily skips and longer listening times.

While Pandora currently has plenty of cash from its investors, it has yet to generate a profit since its inception. Pandora is facing increasing competition from sources such as Apple Music (approximately 6.5 million subscribers in 2015), Spotify (approximately 20 million paid subscribers in 2015), and other streaming services. In addition, Pandora’s costs in some areas are increasing.

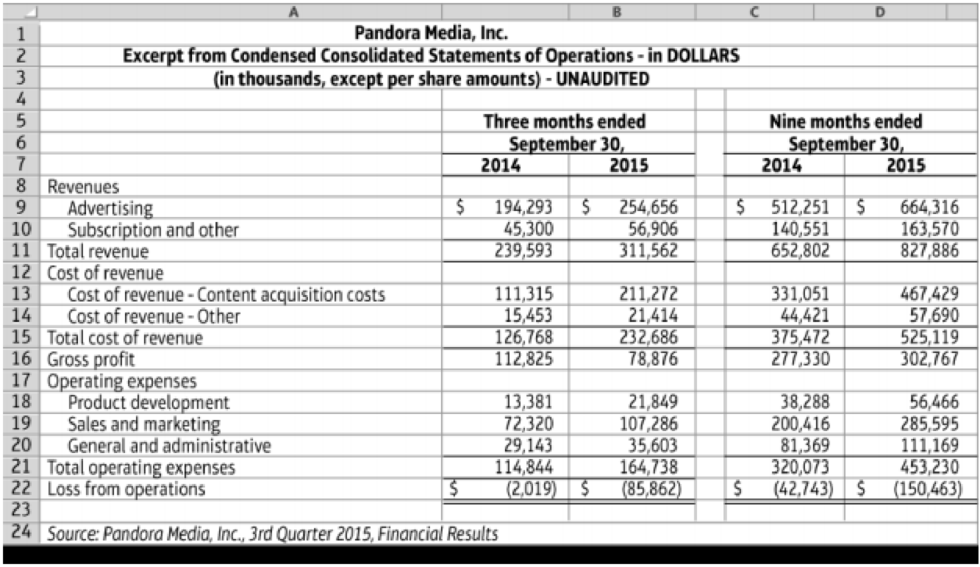

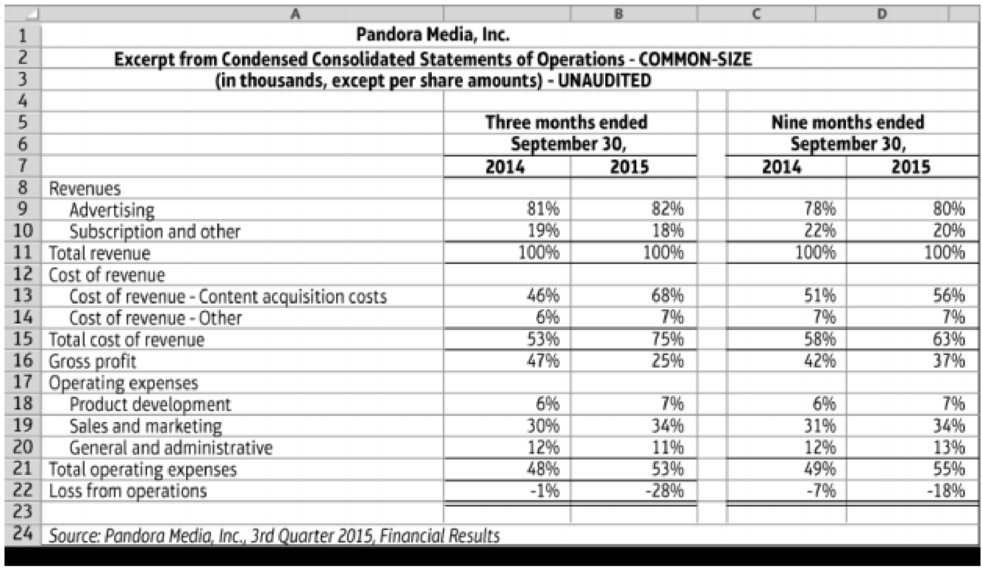

When Pandora released its earnings for the third quarter of 2015, earnings were less than expected by investors and Pandora’s stock price fell sharply. Following are excerpts from Pandora’s statement of operations, both in dollars and in common-size formats. (These excerpts are condensed for educational use only.)

14.1-71 Full Alternative Text

14.1-72 Full Alternative Text

Requirements

- 1. Using the statement of operations excerpt in dollars, what can you say about how Pandora is doing in the third quarter of 2015 compared to the third quarter of 2014? What can you say about how Pandora is doing for the nine months ended September 30, 2015 compared to September 30, 2014? Can you tell if the rate of increase is greater for revenues or expenses from 2014 to 2015? Why or why not?

- 2. Using the statement of operations excerpt in dollars again, why is the loss from operations larger in 2015 than in 2014?

- 3. Using the common-size statement of operations excerpt, what can you say about how Pandora is doing in the third quarter of 2015 compared to the third quarter of 2014? What can you say about how Pandora is doing for the nine months ended September 30, 2015 compared to September 30, 2014? Is the rate of increase greater for revenues or expenses from 2014 to 2015?

- 4. Using the common-size statement of operations excerpt again, why is the loss from operations larger in 2015 than in 2014? Also, what can you say about the mix of advertising revenue versus subscription revenue?

- 5. Which statement (dollars versus common-size) is more useful for analyzing the financial performance of Pandora in this case? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

Additional Business Textbook Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting (2nd Edition)

Microeconomics

Management (14th Edition)

Engineering Economy (17th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,