Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

5th Edition

ISBN: 9780134642093

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.32BE

Calculate ratios (Learning Objective 4)

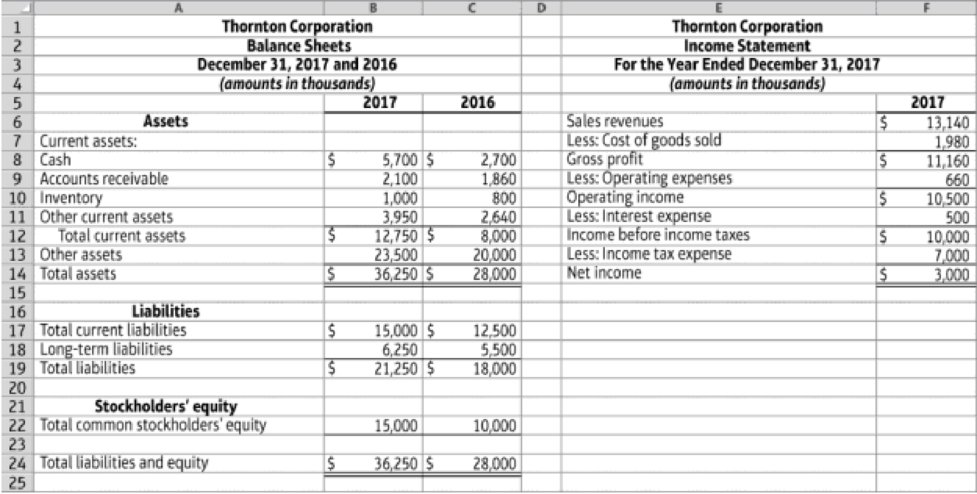

Thornton Corporation reported these figures:

14.3-88 Full Alternative Text

Thornton Corporation has 3,125,000 shares of common stock outstanding. Its stock has traded recently at $31,20 per share, You would like to gain a better understanding of Thornton Corporation’s financial position. Assume all sales are on credit. Calculate the following ratios for 2017 and interpret the results:

- a. Inventory turnover

- b. Days’ sales in receivables

- c. Acid-test ratio

- d. Times-interest-earned

- e. Gross profit percentage

- f. Operating income percentage

- g. Return on stockholders’ equity

- h. Earnings per share

- i. Price/earnings ratio

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Quick answer of this accounting questions

What is the ending work in process inventory balance?

Get correct answer general accounting question

Chapter 14 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

Ch. 14 - (Learning Objective 1) Which of the following...Ch. 14 - Prob. 2QCCh. 14 - Prob. 3QCCh. 14 - Prob. 4QCCh. 14 - (Learning Objective 3) Which of the following is...Ch. 14 - (Learning Objective 4) Working capital is defined...Ch. 14 - Prob. 7QCCh. 14 - Prob. 8QCCh. 14 - Prob. 9QCCh. 14 - Prob. 10QC

Ch. 14 - Prob. 14.1SECh. 14 - Find trend percentages (Learning Objective 1)...Ch. 14 - Prob. 14.3SECh. 14 - Prepare common-size income statements (Learning...Ch. 14 - Analyze common-size income statements (Learning...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Prob. 14.9SECh. 14 - Prob. 14.10SECh. 14 - Prob. 14.11SECh. 14 - Prob. 14.12AECh. 14 - Prob. 14.13AECh. 14 - Prob. 14.14AECh. 14 - Prob. 14.15AECh. 14 - Prob. 14.16AECh. 14 - Calculate ratios (Learning Objective 4) Kelleher...Ch. 14 - Prob. 14.18AECh. 14 - Prob. 14.19AECh. 14 - Prob. 14.20AECh. 14 - Prob. 14.21AECh. 14 - Classify company sustainability measurements into...Ch. 14 - Prob. 14.23BECh. 14 - Prob. 14.24BECh. 14 - Prob. 14.25BECh. 14 - Prob. 14.26BECh. 14 - Prob. 14.27BECh. 14 - Calculate ratios (Learning Objective 4) Ponderosa...Ch. 14 - Prob. 14.29BECh. 14 - Prob. 14.30BECh. 14 - Prob. 14.31BECh. 14 - Calculate ratios (Learning Objective 4) Thornton...Ch. 14 - Prob. 14.33BECh. 14 - Prob. 14.34APCh. 14 - Comprehensive analysis (Learning Objectives 2, 3, ...Ch. 14 - Prob. 14.36APCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Prob. 14.38APCh. 14 - Prob. 14.39BPCh. 14 - Prob. 14.40BPCh. 14 - Prob. 14.41BPCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Make an investment decision (Learning Objective 4)...Ch. 14 - Prob. 14.44SCCh. 14 - Discussion Questions 1. Describe horizontal...Ch. 14 - Prob. 14.47ACTCh. 14 - Using financial statement ratios to analyze...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need help this questionsarrow_forwardAt the beginning of the year, Many Precision Tools estimates annual overhead costs to be $1,500,000 and that 350,000 machine hours will be operated. Using machine hours as a base, what is the amount of overhead applied during the year if actual machine hours for the year was 365,000 hours?arrow_forwardI want answerarrow_forward

- The sugar shack reports net incomearrow_forwardNani Pelekai works at Halalu Building Society in Jamaica. For 2014, she received a basic pay of $65 000 per month, her commissions were $10,000 monthly and she also received a bonus of 5% of her monthly pay. Nani contributed 10% of her basic pay to a pension scheme operated by the company. Halalu pays $30,000 per month to Nani’s landlord. She drives a car owned by Halalu, which is 2 years old and was purchased at a cost of $1,200,000. It is estimated that she has up to 50% private usage of the vehicle. Each month, Nani receives lunch vouchers worth $6,000, which may be used in Halalu’s canteen or other nearby restaurants. Halalu provides Nani with a cellular phone and agrees to pay a maximum bill of $45,000 per year. For the year, Nani’s cellular phone bill was $50,000. Halalu has an approved ESOP plan. For the year 2014, the employees agreed to purchase 6% of the share capital of 10 million shares of $1 each. There are 50 employees in the plan and each employee agreed to…arrow_forwardBergson Manufacturing had a beginning work in process inventory balance of $38,500. During the year, $82,400 of direct materials were placed into production. Direct labor was $65,200, and indirect labor was $21,300. Manufacturing overhead is allocated at 125% of direct labor costs. Actual manufacturing overhead was $92,000, and jobs costing $245,700 were completed during the year. What is the ending work in process inventory balance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License