COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.38P

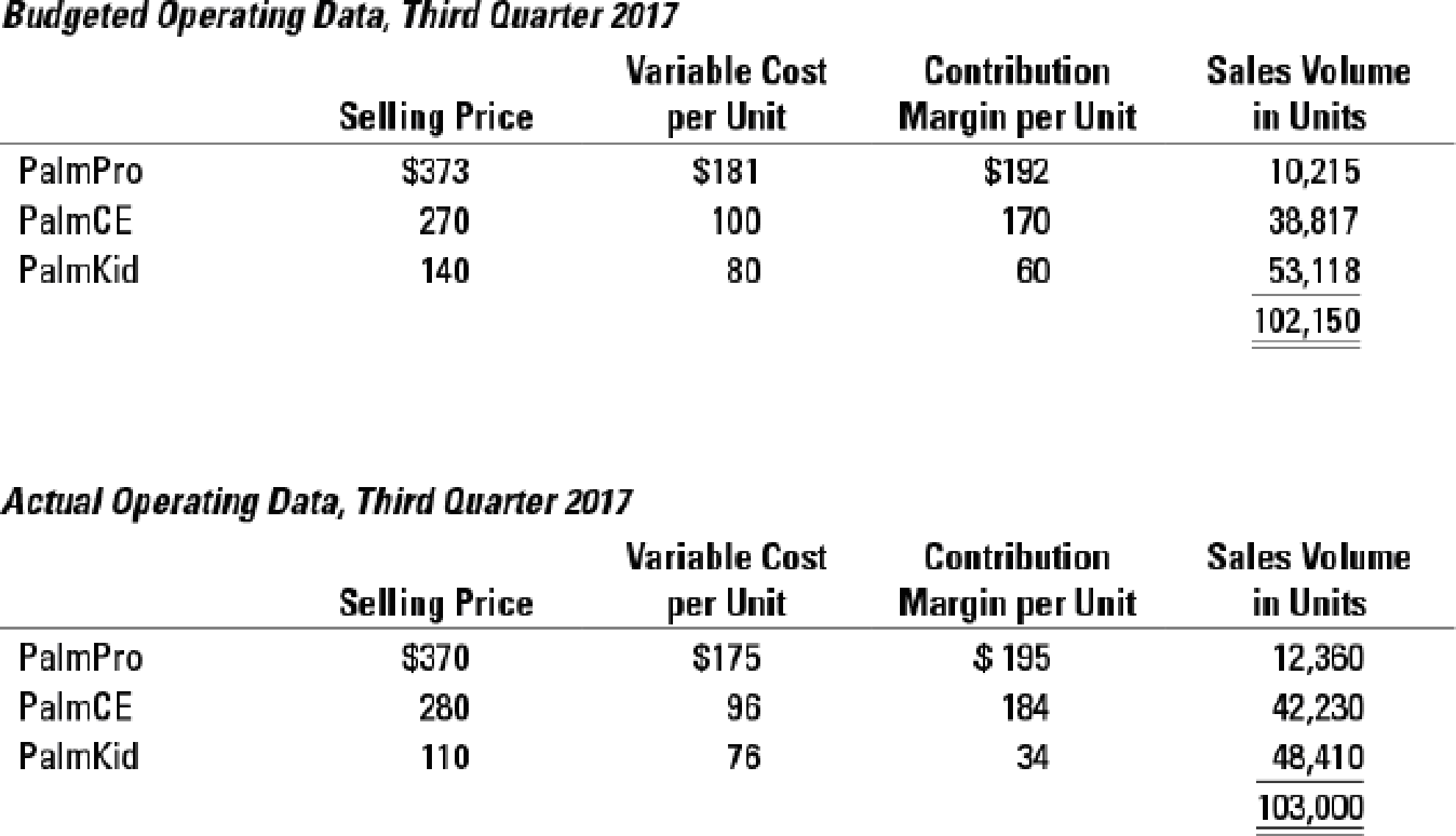

- 1. Compute the actual and budgeted contribution margins in dollars for each product and in total for the third quarter of 2017.

Required

- 2. Calculate the actual and budgeted sales mixes for the three products for the third quarter of 2017.

- 3. Calculate total sales-volume, sales-mix, and sales-quantity variances for the third quarter of 2017. (Calculate all variances in terms of contribution margins.)

- 4. Given that your CEO gets very angry if actual results differ from budget, you want to be well prepared for this meeting. In order to prepare, write a paragraph or two comparing actual results to budgeted amounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Q.no. 45-FINANCIAL ACCOUNTING: On March 1, 2016, E Corp. issued $2,700,000 of 15% nonconvertible bonds at 105, due on February 28, 2026. Each $2,500 bond was issued with 47 detachable stock warrants, each of which entitled the holder to purchase, for $65, one share of Evan's $40 par common stock. On March 1, 2016, the market price of each warrant was $8. By what amount should the bond issue proceeds increase shareholders' equity? Help

Hello teacher please help me this question solution

Answer need for this general account question

Chapter 14 Solutions

COST ACCOUNTING

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- choose best answer general accountingarrow_forwardWhat is the capital gain yield?arrow_forwardGlobex Corp. has forecasted sales of $30.0 million for next year and expects its cost of goods sold (COGS) to remain at 80% of sales. Currently, the firm holds $2.8 million in inventories, $2.3 million in accounts receivable, and $2.4 million in accounts payable. (Use 365 days are the length of a year in all calculations.) a. Approximately how long does it currently take Globex Corp. to convert raw materials to its finished products and then to sell them? b. On average, how long does it take from the time a sale is made until the time cash is collected from customers? c. Globex Corp. relies on customer credit when it buys raw materials from its suppliers. How long does it take after the firm purchases materials before it sends cash to its suppliers? d. What is the length of Globex Corp.'s cash conversion cycle (CCC)?arrow_forward

- Sam sold land to Brenda. The sales price was $200,000. Sam paid a commission to a real estate broker of $12,000 and paid other selling expenses of $2,425. Sam's basis in the land was $116,750. What was Sam's gain realized on the sale of the land?arrow_forwardHii tutor give me Answerarrow_forwardFinancial Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY