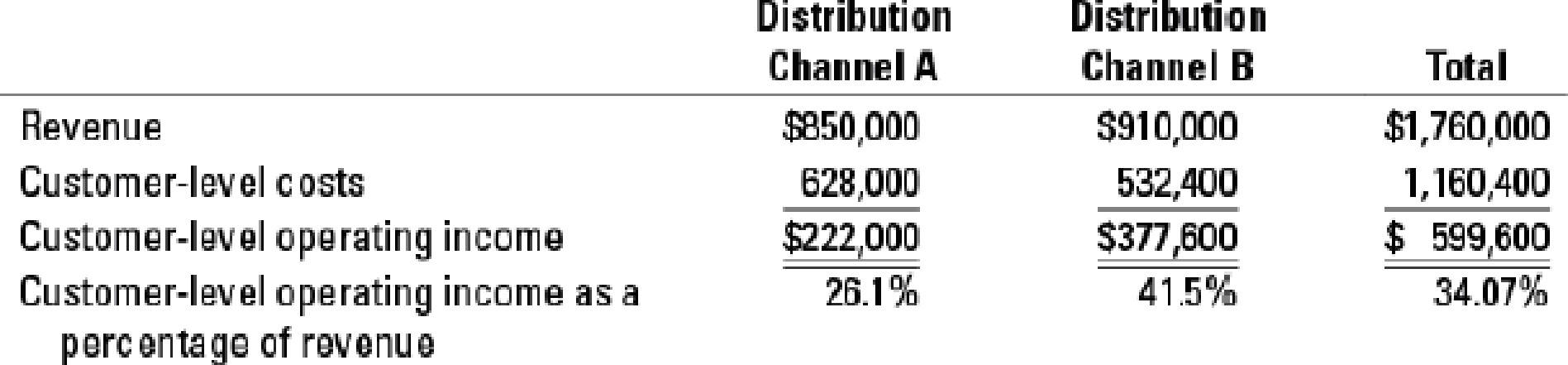

Cost-hierarchy income statement and allocation of corporate, division, and channel costs to customers. Vocal Speakers makes wireless speakers that are sold to different customers in two main distribution channels. Recently, the company’s profitability has decreased. Management would like to analyze the profitability of each channel based on the following information:

The company allocates distribution channel costs of marketing and administration as follows:

| Total | Allocation basis | |

| Distribution-channel costs | ||

| Marketing costs | $260,000 | Channel revenue |

| Administration costs | $200,000 | Customer-level costs |

Based on a special study, the company allocates corporate costs to the two channels based on the corporate resources demanded by the channels as follows: Distribution Channel A, $45,000, and Distribution Channel B, $55,000. If the company were to close a distribution channel, none of the corporate costs would be saved.

- 1. Calculate the operating income for each distribution channel as a percentage of revenue after assigning customer-level costs, distribution-channel costs, and corporate costs.

Required

- 2. Should Vocal Speakers close down any distribution channel? Explain briefly including any assumptions that you made.

- 3. Would you allocate corporate costs to divisions? Why is allocating these costs helpful? What actions would it help you take?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- subject ?? : General accounting questionarrow_forwardGeneral accountingarrow_forwardA company purchased for cash a machine with a list price of $85,000. The machine was shipped FOB shipping point at a cost of $6,500. Installation and test runs of the machine cost $4,500. The recorded acquisition cost of the machine is which amount? a. $96,000 b. $126,000 c. $85,000 d. $92,000arrow_forward

- Baxter Industries reported the following financial data for one of its divisions for the year: • Average invested assets = $600,000 • Sales = $1,200,000 Income = $140,000 What is the investment turnover? a) 2.75 b) 3.40 c) 2.00 d) 4.25 e) 5.00arrow_forwardChapter: Work in process - Vicky Company has beginning work in process inventory of $216,000 and total manufacturing costs of $954,000. If cost of goods manufactured is $980,000, what is the cost of the ending work in process inventory? Don't want wrong answerarrow_forwardA company bought a new cooling system for $150,000 and was given a trade-in of $95,000 on an old cooling system, so the company paid $55,000 cash with the trade-in. The old system had an original cost of $140,000 and accumulated depreciation of $60,000. If the transaction has commercial substance, the company should record the new cooling system at _. Solvearrow_forward

- Financial accountingarrow_forwardCorrect Answerarrow_forwardHarry Company sells 30,000 units at $25 per unit. Variable costs are $20.50 per unit, and fixed costs are $52,000. Determine the following: a. The contribution margin ratio b. The unit contribution margin c. The income from operationsarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College