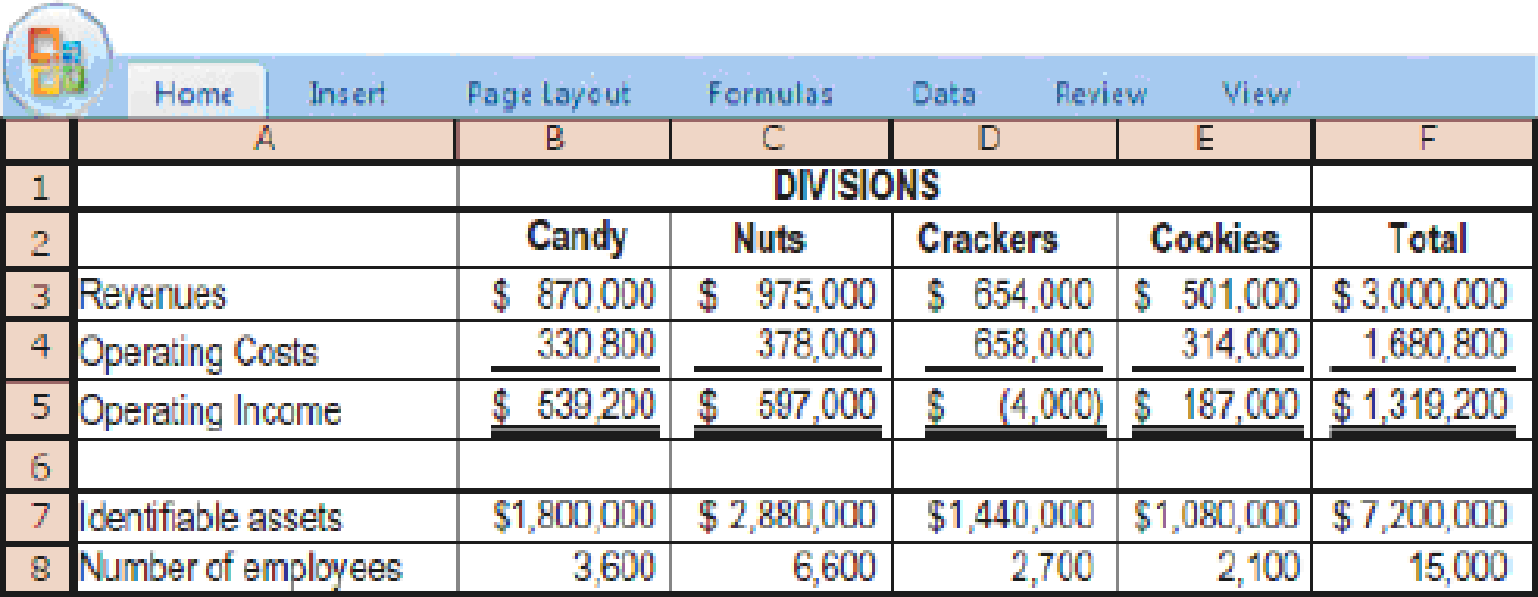

Allocation of corporate costs to divisions. Cathy Carpenter, controller of the Sweet and Salty Snacks is preparing a presentation to senior executives about the performance of its four divisions. Summary data related to the four divisions for the most recent year are as follows:

Under the existing accounting system, costs incurred at corporate headquarters are collected in a single cost pool ($1.2 million in the most recent year) and allocated to each division on the basis of its actual revenues. The top managers in each division share in a division-income bonus pool. Division income is defined as operating income less allocated corporate costs.

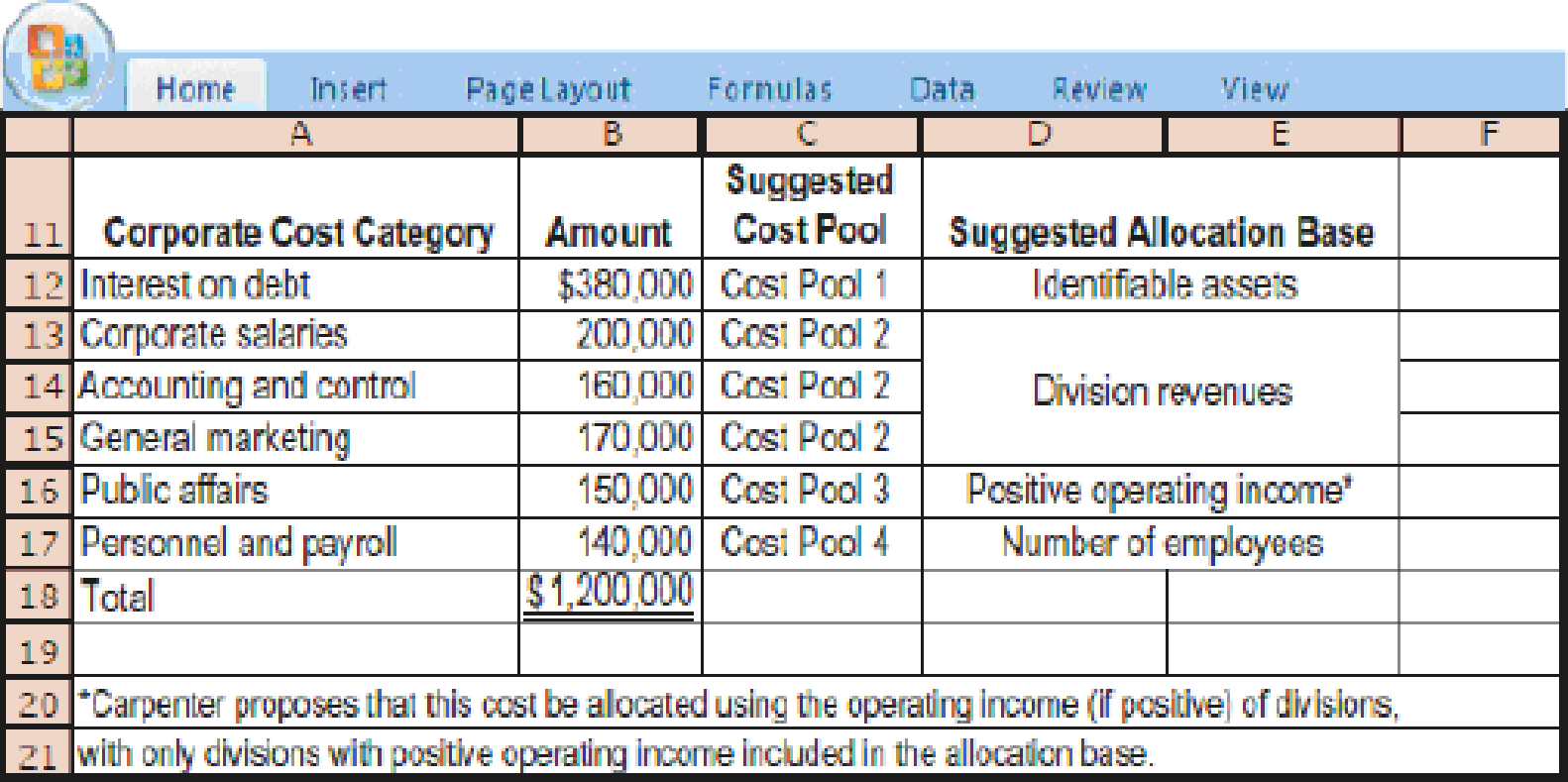

Carpenter has analyzed the components of corporate costs and proposes that corporate costs be collected in four cost pools. The components of corporate costs for the most recent year and Carpenter’s suggested cost pools and allocation bases are as follows:

- 1. Discuss two reasons why Sweet and Salty Snacks should allocate corporate costs to each division.

Required

- 2. Calculate the operating income of each division when all corporate costs are allocated based on revenues of each division.

- 3. Calculate the operating income of each division when all corporate costs are allocated using the four cost pools.

- 4. How do you think the division managers will receive the new proposal? What are the strengths and weaknesses of Carpenter’s proposal relative to the existing single cost-pool method?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning