HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.28E

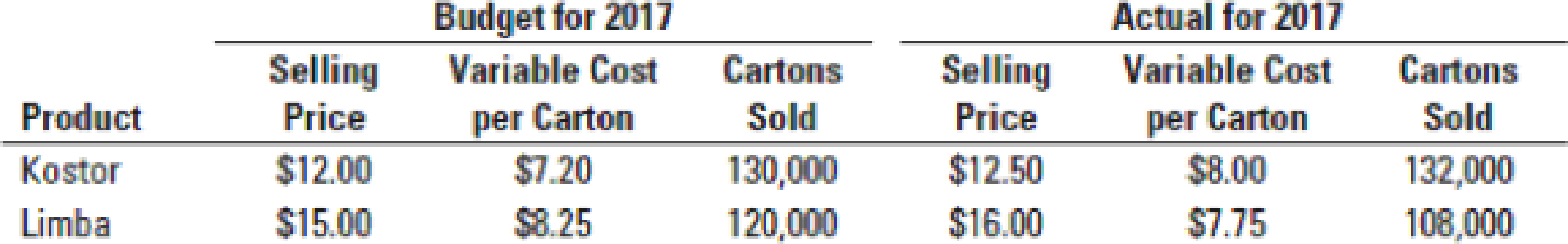

Market-share and market-size variances (continuation of 14-27). Emcee Inc. prepared the budget for 2017 assuming a 20% market share based on total sales in the Midwest region of the United States. The total fruit drinks market was estimated to reach sales of 1.25 million cartons in the region. However actual total sales volume in the western region was 1.5 million cartons.

Calculate the market-share and market-size variances for Emcee Inc. in 2017. (Calculate all variances in terms of contribution margin.) Comment on the results.

14-27

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Correct Answer

Harry Company sells 30,000 units at $25 per unit. Variable costs are $20.50

per unit, and fixed costs are $52,000.

Determine the following:

a. The contribution margin ratio

b. The unit contribution margin

c. The income from operations

Correct answer

Chapter 14 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Choose the correct optionarrow_forwardThe following is information concerning a product manufactured by Harper Industries: • Sales price per unit = $80 • Variable cost per unit = $50 Total fixed manufacturing and operating costs (per month) = $500,000 a. The unit contribution margin b. The number of units that must be sold each month to break even c. The number of units that must be sold to earn an operating income of $300,000 per montharrow_forwardQuestionarrow_forward

- A company bought a new cooling system for $150,000 and was given a trade-in of $95,000 on an old cooling system, so the company paid $55,000 cash with the trade-in. The old system had an original cost of $140,000 and accumulated depreciation of $60,000. If the transaction has commercial substance, the company should record the new cooling system at _.arrow_forwardcalculate Bethlehem's asset turnover ratio.arrow_forwardQuestion: Variance (accounting) - Wisley Corporation makes a product whose direct labor standards are 0.8 hours per unit and $28 per hour. In April the company produced 7,350 units using 5,380 direct labor hours. The actual direct labor cost was $112,980. The labor efficiency variance for April is ___.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY