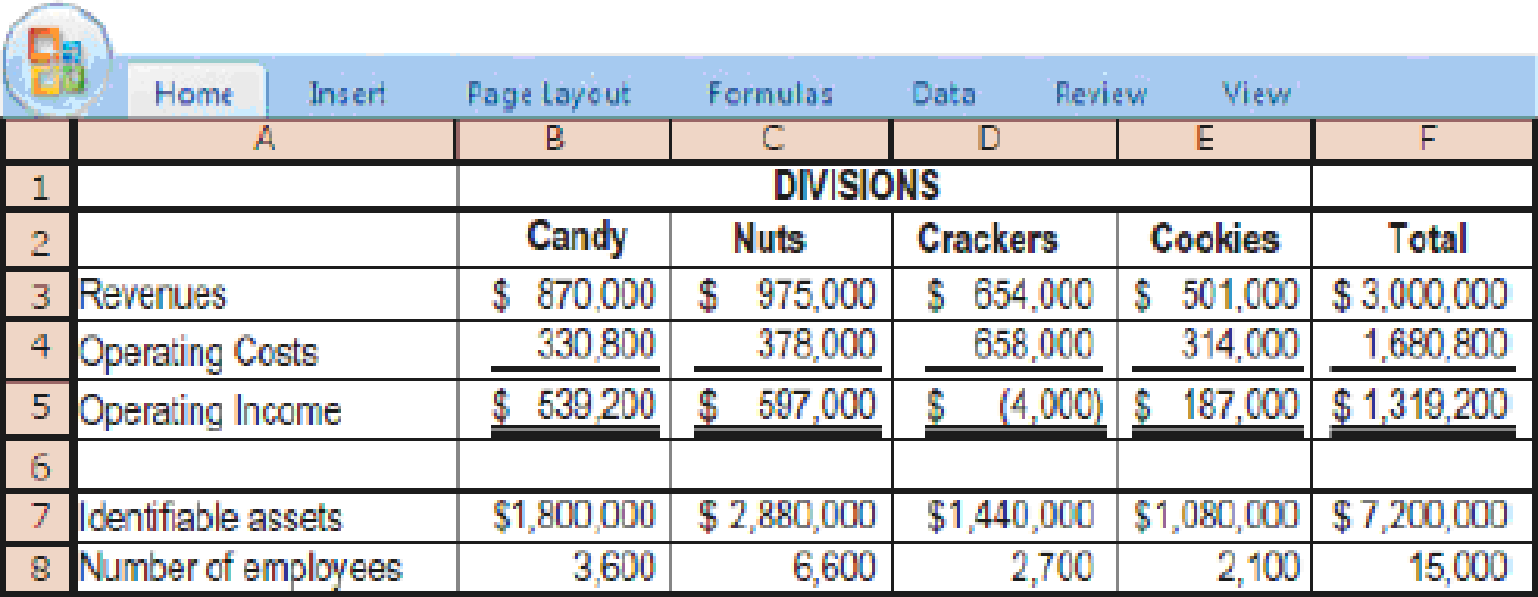

Allocation of corporate costs to divisions. Cathy Carpenter, controller of the Sweet and Salty Snacks is preparing a presentation to senior executives about the performance of its four divisions. Summary data related to the four divisions for the most recent year are as follows:

Under the existing accounting system, costs incurred at corporate headquarters are collected in a single cost pool ($1.2 million in the most recent year) and allocated to each division on the basis of its actual revenues. The top managers in each division share in a division-income bonus pool. Division income is defined as operating income less allocated corporate costs.

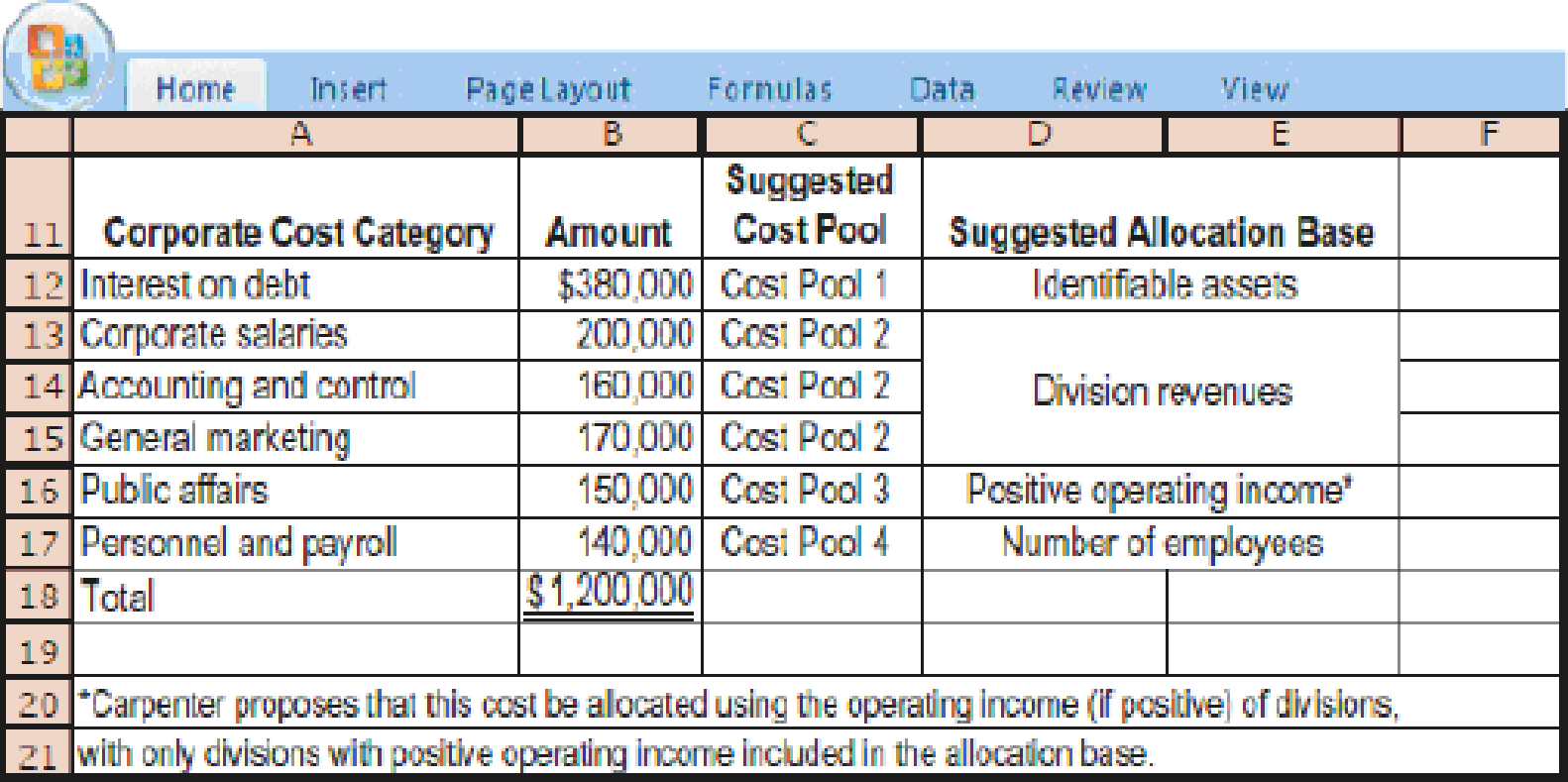

Carpenter has analyzed the components of corporate costs and proposes that corporate costs be collected in four cost pools. The components of corporate costs for the most recent year and Carpenter’s suggested cost pools and allocation bases are as follows:

- 1. Discuss two reasons why Sweet and Salty Snacks should allocate corporate costs to each division.

Required

- 2. Calculate the operating income of each division when all corporate costs are allocated based on revenues of each division.

- 3. Calculate the operating income of each division when all corporate costs are allocated using the four cost pools.

- 4. How do you think the division managers will receive the new proposal? What are the strengths and weaknesses of Carpenter’s proposal relative to the existing single cost-pool method?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

EBK HORNGREN'S COST ACCOUNTING

- John was a civil servant with the Trinidad & Tobago (T&T) Government for over 30 years and retired 5 years ago. He is in receipt of a monthly pension. John also received a lump sum on retirement and invested part of this in a small retail business in downtown San Fernando. He retails designer clothing and perfumes and manages to make a modest profit, after deduction of business expenses. John invested the remainder of his pension lump sum in the Unit Trust Corporation of Trinidad and Tobago and is in receipt of monthly dividends. John receives a monthly pension of $6,000. The retail business has a financial year- end of 31 December and in the fiscal year 2011 he made a taxable profit of $100,000. In the fiscal year 2011 in T&T there is a personal allowance of $60,000 and the rate of Income tax is 25%. John no longer qualifies for any of the other deductions available to individuals and receives his pension after deduction of tax under the P.A.Y.E. system. In 2011, John…arrow_forwardHi expert please give me answer general accounting questionarrow_forwardCalculate the total revenuearrow_forward

- how much is net income?arrow_forwardPLEASE HELP. ALL THE BOXES THAT ARE OUTLINED IN RED ARE INCORRECT/FORMATTED WRONG. PLS DO NOT JUST GIVE ME THE SAME ANSWERS SOMETHING IS WRONG. LOOK AT THE IMAGE AND SEE MY PREVIOUS attempt, AND GO OFF THAT PLS BECAUSE THIS IS MY FINAL ATTEMPTarrow_forwardPlease help. all boxes that are red either are formatted wrong or have the wrong inputs. please do not give me the same answers in the photo as obviously they're red/wrong.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning