Customer profitability in a manufacturing firm. Mississippi Manufacturing makes a component called B2040. This component is manufactured only when ordered by a customer, so Mississippi keeps no inventory of B2040. The list price is $112 per unit, but customers who place “large” orders receive a 10% discount on price. The customers are manufacturing firms. Currently, the salespeople decide whether an order is large enough to qualify for the discount. When the product is finished, it is packed in cases of 10. If the component needs to be exchanged or repaired, customers can come back within 14 days for free exchange or repair.

The full cost of manufacturing a unit of B2040 is $95. In addition, Mississippi incurs customer-level costs. Customer-level cost-driver rates are:

| Order taking | $360 per order |

| Product handling | $15 per case |

| Rush-order processing | $560 per rush order |

| Exchange and repair costs | $50 per unit |

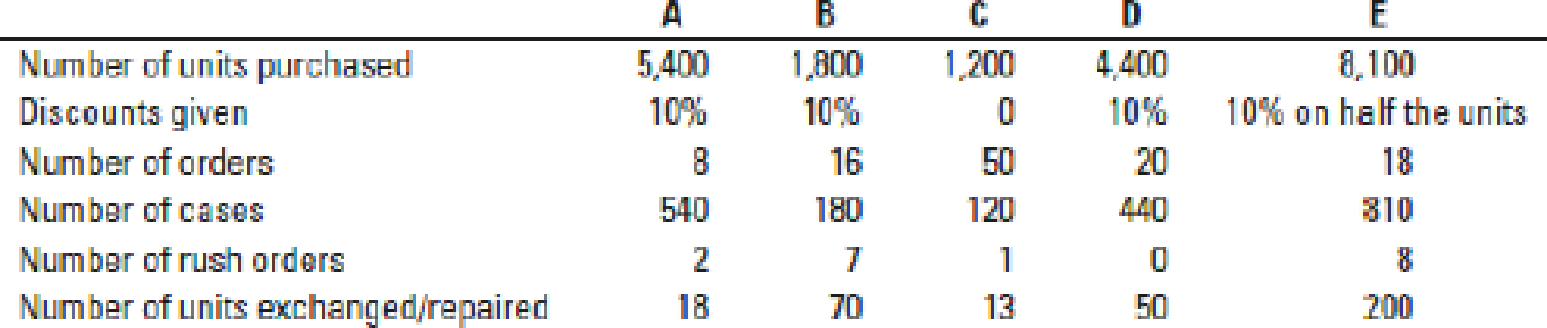

Information about Mississippi’s five biggest customers follows:

All customers except E ordered units in the same order size. Customer E’s order quantity varied, so E got a discount part of the time but not all the time.

- 1. Calculate the customer-level operating income for these five customers. Use the format in Figure 14-3. Prepare a customer-profitability analysis by ranking the customers from most to least profitable, as in Figure 14-4.

Required

Required

- 2. Discuss the results of your customer-profitability analysis. Does Mississippi have unprofitable customers? Is there anything Mississippi should do differently with its five customers?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

EBK HORNGREN'S COST ACCOUNTING

- abc general accountingarrow_forwardStep by step answerarrow_forwardAt the beginning of the year, Anderson Corporation's assets are $275,000 and its equity is $198,000. During the year, assets increase by $95,000 and liabilities increase by $58,000. What is the equity at the end of the year? Helparrow_forward

- Morgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock.arrow_forwardWhat is the new price after the mark up for this financial accounting question?arrow_forwardhi expert please help me financial accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College