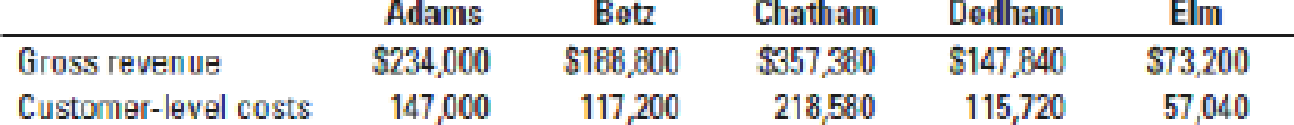

Customer-cost hierarchy, customer profitability. Louise Newman operates Interiors by Louise, an interior design consulting and window treatment fabrication business. Her business is made up of two different distribution channels, a consulting business in which Louise serves two architecture firms (Adams and Betz) and a commercial window treatment business in which Louise designs and constructs window treatments for three commercial clients (Chatham, Dedham, and Elm). Louise would like to evaluate the profitability of her two architecture firm clients and three commercial window treatment clients, as well as evaluate the profitability of each of the two channels and the business as a whole. Information about her most recent quarter follow:

On the revenues indicated above, Louise gave a 10% discount to Adams in order to lure it away from a competitor and gave a 5% discount to Elm for advance payment in cash.

- 1. Prepare a customer-cost hierarchy report for Interiors by Louise, using the format in Figure 14-6.

Required

- 2. Prepare a customer-profitability analysis for the five customers, using the format in Figure 14-4.

- 3. Comment on the results of the preceding reports. What recommendations would you give Louise?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education