Horngren's Cost Accounting, Student Value Edition (16th Edition)

16th Edition

ISBN: 9780134476032

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.30P

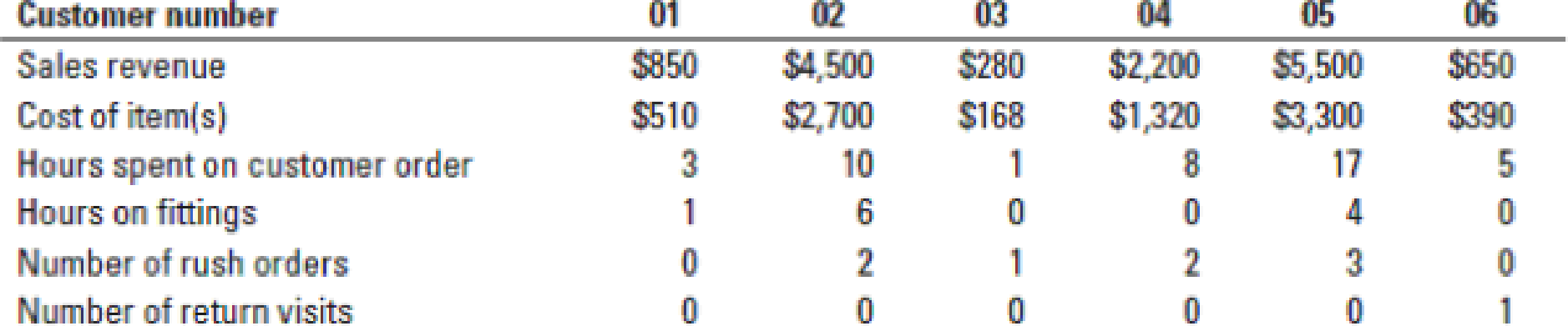

Customer profitability. Bracelet Delights is a new company that manufactures custom jewelry. Bracelet Delights currently has six customers referenced by customer number: 01, 02, 03, 04, 05, and 06. Besides the costs of making the jewelry, the company has the following activities:

- 1. Customer orders. The salespeople, designers, and jewelry makers spend time with the customer. The cost-driver rate is $42 per hour spent with a customer.

- 2. Customer fittings. Before the jewelry piece is completed, the customer may come in to make sure it looks right and fits properly. Cost-driver rate is $30 per hour.

- 3. Rush orders. Some customers want their jewelry quickly. The cost-diver rate is $90 per rush order.

- 4. Number of customer return visits. Customers may return jewelry up to 30 days after the pickup of the jewelry to have something refitted or repaired at no charge. The cost-driver rate is $40 per return visit.

Information about the six customers follows. Some customers purchased multiple items. The cost of the jewelry is 60% of the selling price.

- 1. Calculate the customer-level operating income for each customer. Rank the customers in order of most to least profitable and prepare a customer-profitability analysis, as in Figures 14-3 and 14-4.

Required

- 2. Are any customers unprofitable? What is causing this? What should Bracelet Delights do about these customers?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the correct option? General accounting question

provide correct answer general accounting question

What is the operating income using absorption costing ?

Chapter 14 Solutions

Horngren's Cost Accounting, Student Value Edition (16th Edition)

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please solve this accounting problem not use ai and chatgptarrow_forwardFinancial Accountingarrow_forwardKhayyam Company, which sells tents, has provided the following information: Sales price per unit Variable cost per unit $40 19 $12,800 Fixed costs per month What are the required sales in units for Khayyam to break even? (Round your answer up to the nearest whole unit.) OA. 217 units B. 674 units OC. 610 units D. 320 unitsarrow_forward

- Please need help with this accounting question answer do fastarrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forwardDetermine the total fixed costs of these accounting questionarrow_forward

- Perreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forwardI need answer of this general accounting questionarrow_forwardCalculate the day's sales in receivables for this accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY