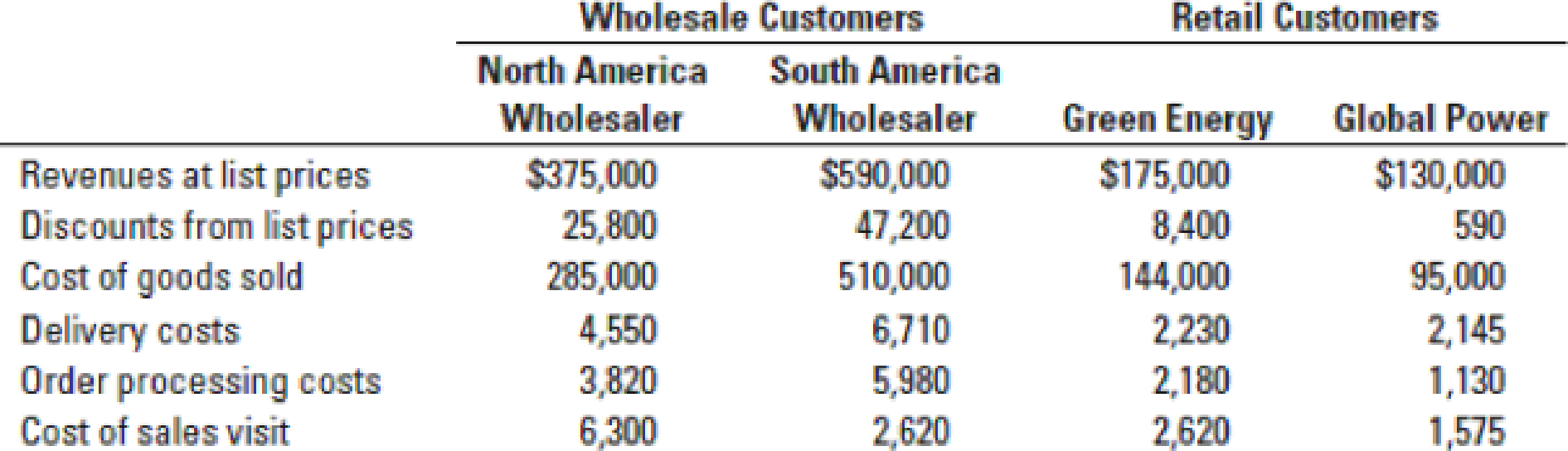

Customer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands):

Enviro-Tech’s annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company’s annual corporate-sustaining costs, such as salary for top management and general-administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Enviro-Tech could save corporate-sustaining costs only if the company completely shuts down.

- 1. Calculate customer-level operating income using the format in Figure 14-3.

Required

- 2. Prepare a customer-cost hierarchy report, using the format in Figure 14-6.

- 3. Enviro-Tech’s management decides to allocate all corporate-sustaining costs to distribution channels: $38 million to the wholesale channel and $10 million to the retail channel. As a result, distribution channel costs are now $71 million ($33 million + $38 million) for the wholesale channel and $22 million ($12 million + $10 million) for the retail channel. Calculate the distribution-channel-level operating income. On the basis of these calculations, what actions, if any, should Enviro-Tech’s managers take? Explain.

- 4. How might Enviro-Tech use the new cost information from its activity-based costing system to better manage its business?

Learn your wayIncludes step-by-step video

Chapter 14 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Operations Management

Horngren's Accounting (12th Edition)

- N. General Accountarrow_forwardCost accounting systems are used A. by manufacturing companies, not service companies B. to accumulate and assign period costs to products C. to accumulate product cost information D. by stockholders for decision-making purposesarrow_forwardprovide correct general account answer goivearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education