Concept explainers

Budget: It is forward looking exercise which the company takes by preparing estimated revenues, costs and resources needed by company for a period. It can be prepared for single period or for multiple periods

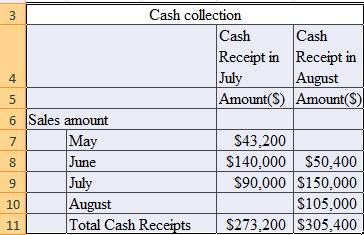

The cash collection of sales for the month of July and August

The cash collections of sales for month of July and August is given below

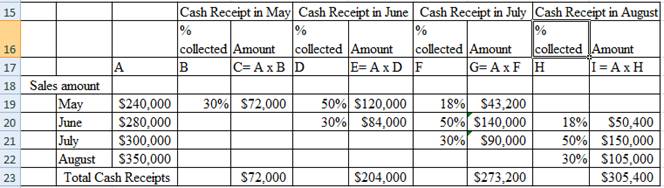

The following information is required to calculate cash collection of sales for the month of July and August

- The sales amount for the month of May, June, July and august is $240,000, $280,000, $300,000 and $350,000

- The cash collection of sales are 30% of sales amount on the month of sales, the following month 50% will be collected and 18% the following month means the sales amount of May of $240,000 will be collected as follows

- 30% of $240,000 will be collected in May

- 50% of $240,000 will be collected in June

- 18% of $240,000 will be collected in July

The cash receipt of sales amount from May, June, July and August is calculated as under

The total cash receipts for the month of July and August is $273,200 and $305,400 respectively

The total cash receipts for the month of July and August is $273,200 and $305,400 respectively

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Accounting: What the Numbers Mean

- Absorption costing unit product cost?arrow_forwardIn its income statement for the year ended December 31, 2025, Oriole Company reported the following condensed data. Salaries and wages expenses $511,500 Loss on disposal of plant assets $71,500 Cost of goods sold 1,059,850 Sales revenue 2,431,000 Interest expense 78,100 Income tax expense 33,000 Interest revenue 71,500 Sales discounts 176,000 Depreciation expense 341,000 Utilities expense 121,000 Prepare a multiple-step income statement. (List other revenues before other expenses.) Sales Sales Revenue Less Sales Discounts Net Sales Cost of Goods Sold Gross Profit Operating Expenses ORIOLE COMPANY Income Statement For the Year Ended December 31, 2025 2,431,000 176,000 2,255,000 1,059,850 1,195,150arrow_forwardFinancial accounting [5 points]arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education