Concept explainers

Budget: It is forward looking exercise which the company takes by preparing estimated revenues, costs and resources needed by company for a period. It can be prepared for single period or for multiple periods

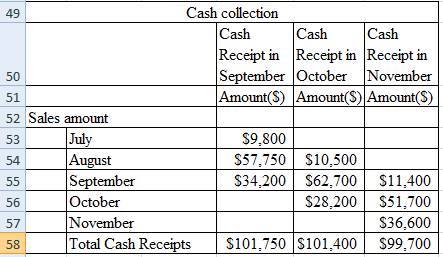

The estimated cash receipts of sales for the month of September, October and November

The estimated cash receipts of sales for the month of September, October and Novemberis given below

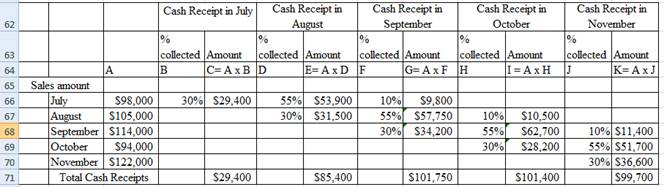

The following information is required to calculate cash receipts of sales for the month of September, October and November

- The sales amount for the month of July, august, September, October, November and December is $98,000, $105,000, $114,000, $94,000, $122,000 and $107,000

- The cash collection of sales are 30% of sales amount on the month of sales, the following month 55% will be collected and 10% the following month means the sales amount of July of $98,000 will be collected as follows

- 30% of $98,000 will be collected in July

- 55% of $98,000 will be collected in August

- 10% of $98,000 will be collected in September

The cash receipt of sales amount from July, August, September, October and November is calculated as under

The total cash receipts for the month of September, October and November is $101,750, $101,400 and $99,700 respectively

The total cash receipts for the month of September, October and November is $101,750, $101,400 and $99,700 respectively

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Accounting: What the Numbers Mean

- Please explain the correct approach for solving this general accounting question.arrow_forwardSuppose Webster Resort has annual fixed costs applicable to its rooms of $3.2 million for its 400-room resort. Average daily room rents are $85 per room, and average variable costs are $22 for each room rented. It operates 365 days per year. If the resort is completely full throughout the year, what is the net income for one year?arrow_forwardNonearrow_forward

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardBased on this information the cost that would be collected to the land isarrow_forwardEddie Woodworks manufactures custom shelving. During the most productive month of the year, 4,200 units were manufactured at a total cost of $73,500. In the month of lowest production, the company made 1,600units at a cost of $49,800. Using the high-low method of cost estimation, total fixed costs are__.arrow_forward

- Please explain the solution to this financial accounting problem with accurate principles.arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education