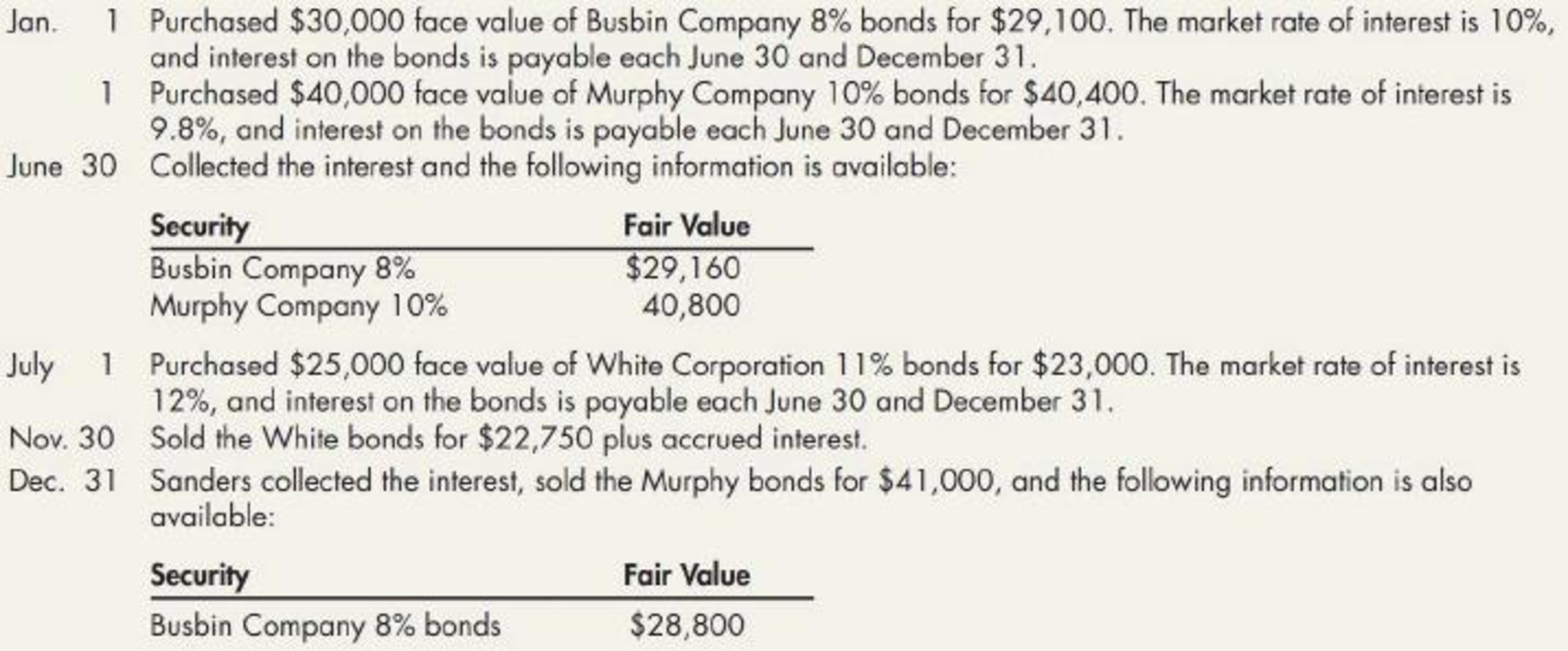

Investment in Trading Securities The following information relates to Sanders Company’s investment in trading securities for 2019:

Required:

- 1. Prepare

journal entries to record the previous information for 2019. Use the effective interest method and round all amounts to the nearest dollar. Assume that Sanders prepares semiannual financial statement. - 2. Show the items of income or loss from investment transactions that Sanders reports for each 2019 semiannual income statement.

- 3. Show how the investment items are reported on each of the 2019 semiannual

balance sheets , assuming that management expects to dispose of all investments within one year of purchase.

1.

Record the journal entries in the books of Company S related to the investments made in the trading securities.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Trading securities: these are the securities which are purchased to earn the profits due to changes in their market prices.

Record the journal entries in the books of Company S related to the investments made in the trading securities.

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| 2019 | Investment in trading securities | 29,100 | |

| January 1 | Cash | 29,100 | |

| (To record the purchase of Available-for-sale securities at discount) | |||

| January 1 | Investment in trading securities | 40,400 | |

| Cash | 40,400 | ||

| (To record the purchase of Available-for-sale securities at premium) | |||

| June 30 | Cash (1) | 1,200 | |

| Investment in trading securities | 255 | ||

| Interest income (2) | 1,455 | ||

| (To record the earned interest and amortization of discount) | |||

| June 30 | Cash (3) | 2,000 | |

| Investment in trading securities | 20 | ||

| Interest income (4) | 1,980 | ||

| (To record the earned interest and amortization of premium) | |||

| June 30 | Investment in trading securities (5) | 225 | |

| Unrealized holding gain/loss: Trading securities | 225 | ||

| (To adjust the allowance and the unrealized gain on holding the Securities) | |||

| July 1 | Investment in trading securities | 23,000 | |

| Cash | 23,000 | ||

| (To record the purchase of Available-for-sale securities at discount) | |||

| November 30 | Interest receivable (6) | 1,146 | |

| Investment in trading securities | 4 | ||

| Interest income (7) | 1,150 | ||

| (To record the interest earned for 5 months) | |||

| November 30 | Cash | 23,896 | |

| Loss on sale of Available-for-sale Securities | 254 | ||

| Investment in trading securities | 23,004 | ||

| Interest receivable | 1,146 | ||

| (To record the sale of Corporation W's bond on loss) | |||

| December 31 | Cash (8) | 1,200 | |

| Investment in trading securities | 268 | ||

| Interest income (9) | 1,468 | ||

| (To record the earned interest and amortization of discount) | |||

| December 31 | Cash (10) | 2,000 | |

| Investment in trading securities | 21 | ||

| Interest income (11) | 1,979 | ||

| (To record the earned interest and amortization of premium) | |||

| December 31 | Cash | 41,000 | |

| Gain on sale of trading securities | 40,779 | ||

| Investment in trading securities | 221 | ||

| (To record the sale of Company M's bond at gain) | |||

| December 31 | Unrealized holding gain/loss: Available-for-sale securities | 628 | |

| Investment in trading securities (12) | 628 | ||

| (To adjust the allowance and the unrealized loss on holding the Securities) |

Table (1)

Working note (1):

Calculate the amount of cash received as interest.

Working note (2):

Calculate the amount of interest income:

Working note (3):

Calculate the amount of cash received as interest.

Working note (4):

Calculate the amount of interest income:

Working note (5):

Calculate the amount of investment in trading securities:

| Investment | Book value at 06/30/2019 | Fair value at 06/30/2019 (b) |

Change in value (c) |

| $30,000 face value of Company B' bonds | $29,355 (a) | $29,160 | ($195) |

| $40,000 face value of Company M' bonds | $40,380 (a) | $40,800 | $420 |

| Total | $69,735 | $69,960 | $225 |

Table (2)

Working note (a):

Determine the fair value of the investment as at June 30, 2019.

Working note (6):

Calculate the Actual interest receivable from Corporation W.

Working note (7):

Calculate the interest income earned.

Working note (8):

Calculate the amount of cash received as interest.

Working note (9):

Calculate the amount of interest income earned.

Working note (10):

Calculate the amount of cash received as interest.

Working note (11):

Calculate the amount of interest income earned.

Working note (12):

Calculate the amount of investment in trading securities:

| Investment | Book value at 12/31/2019 | Fair value at 12/31/2019 (b) |

Change in value (c) |

| $30,000 face value of Company B' bonds | $29,428 (b) | $28,800 | ($668) |

| Total | $29,428 | $28,800 | $668 |

Table (3)

Working note (b):

Calculate the book value of Company B’s bonds at 12/31/2019:

2.

Show the items that would be reported as income or loss from the investment in the income statement.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

| Particulars | For semiannual period ended | |

| 06/30/2019 | 12/31/2019 | |

| Interest income | $3,435 (c) | $4,597 (d) |

| Unrealized holding gain/ (Loss) | 225 | ($628) |

| Loss on sale of available-for-sale securities | $0 | ($254) |

| Gain on sale of available-for-sale securities | $0 | $221 |

Table (4)

Working note (c):

Calculate the amount of interest income as on 06/30/2019:

Working note (d):

Calculate the amount of interest income as on 12/31/2019:

3.

Show the way in which the investments items are reported in the 2019 balance sheet.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Show the way in which the investments items are reported in the 2019 balance sheet:

| Company S | ||

| Balance sheet Statement (Partial) | ||

| Assets | 06/30/2019 | 12/31/2019 |

| Current assets: | ||

| Investment in trading securities (Fair value) | $69,735 | $29,623 |

Table (5)

Want to see more full solutions like this?

Chapter 13 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning