You are reviewing the property, plant, and equipment working papers of Mandville Corporation, a company that publishes travel guides. The lead schedule for the account is included in the chapter as Figure 13.1. The following are among the findings relating to changes in the account:

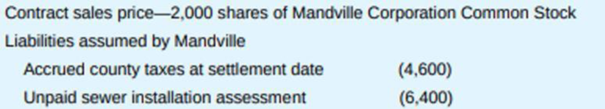

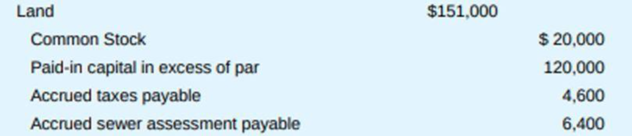

1. Land: The addition represents the purchase of land adjacent to the company’s existing plant and is financed as follows:

On June 17, the date on which the buyer and seller discussed the transaction, shares of Mandville Corporation stock were selling for $77.50. On June 30, the settlement date (day of the sale), Mandville stock was selling for $70.00 per share. The

Examination of publicly available records has indicated that prices of comparable land in the area have been relatively constant, selling in a range from $140,000 to $160,000 during the past 18 months.

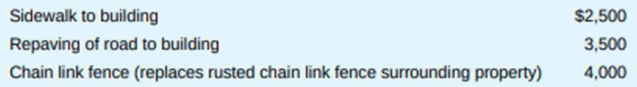

2. Land improvements: This account was increased by three journal entries (each recorded with a debit to land improvements and a credit to cash) during the year. Each of these improvements relates to the new land that was purchased in point (1) above.

3. Building: The building was constructed by an independent contractor; the contract was for $473,000. Progress payments were made during construction through use of proceeds of a bank loan, for which the building serves as collateral. The interest during construction was capitalized ($22,000), while the interest subsequent to construction but prior to year-end ($20,000) was expensed.

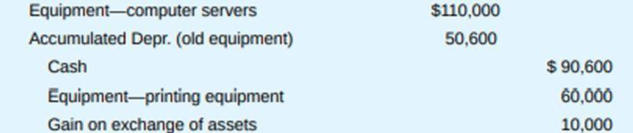

4. Equipment: The change in the equipment was a trade of old book “update printing equipment” for two new computer servers and associated software that will maintain electronic updates. Until recently, updates of outdated portions of guidebooks were printed and “shrinkwrapped” with the guidebook. Now the updates will be available on Mandville’s website. The old equipment had a cost of $60,000 and

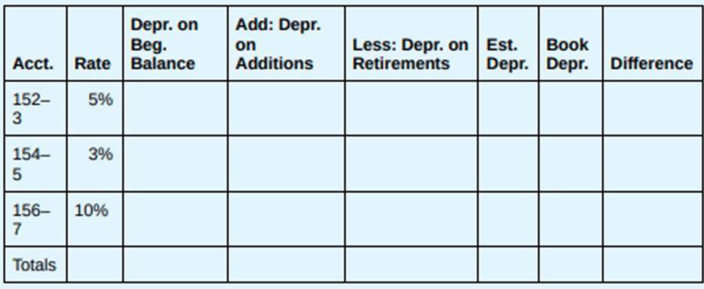

5. Depreciation provisions: Mandville uses software to calculate depreciation to the exact day.

Required:

- a. For additions (1) through (4) above, prepare any necessary

adjusting entries . If in any case your adjusting entry relies upon an assumption, provide that assumption. - b. For item (5), prepare a calculation of the depreciation provisions and determine whether they appear reasonable. For this calculation, assume that acquisitions, on average, occur at mid-year. If the provision does not appear reasonable, discuss follow-up procedures related to the provisions. Use the following table for your calculation:

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

EBK PRINCIPLES OF AUDITING & OTHER ASSU

- What is the amount of the net fixed assets?arrow_forward9 A B C D E 4 Ramsey Miller Style, Inc. manufactures a product which requires 15 pounds of direct materials at a cost of $8 5 per pound and 5.0 direct labor hours at a rate of $17 per hour. Variable overhead is budgeted at a rate of $3 per direct labor hour. Budgeted fixed overhead is $433,000 per month. The company's policy is to end each month with direct materials inventory equal to 45% of the next month's direct materials requirement, and finished 7 goods inventory equal to 60% of next month's sales. August sales were 13,400 units, and marketing expects 8 sales to increase by 500 units in each of the upcoming three months. At the end of August, the company had 9 95,850 pounds of direct materials in inventory, and 8,340 units in finished goods inventory. 10 11 August sales 12 Expected increase in monthly sales 13 Desired ending finished goods (units) 14 Selling price per unit 15 Direct materials per unit 16 Direct materials cost 17 Direct labor hours (DLHS) per unit 18 Direct labor…arrow_forwardSherrod, Incorporated, reported pretax accounting income of $84 million for 2024. The following information relates to differences between pretax accounting income and taxable income: a. Income from installment sales of properties included in pretax accounting income in 2024 exceeded that reported for tax purposes by $3 million. The installment receivable account at year-end 2024 had a balance of $4 million (representing portions of 2023 and 2024 installment sales), expected to be collected equally in 2025 and 2026. b. Sherrod was assessed a penalty of $4 million by the Environmental Protection Agency for violation of a federal law in 2024. The fine is to be paid in equal amounts in 2024 and 2025. c. Sherrod rents its operating facilities but owns one asset acquired in 2023 at a cost of $88 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight- line depreciation the…arrow_forward

- Direct materials price variancearrow_forward$ 36,000 204,000 The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash Noncash assets Liabilities Drysdale, loan $ 50,000 10,000 Total assets $ 240,000 Drysdale, capital (50%) Koufax, capital (30%) Marichal, capital (20%) Total liabilities and capital 70,000 60,000 50,000 $ 240,000 Required: a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $15,000. Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing $74,000 are sold for $60,000. How is the available cash to be divided? Complete this question by entering your answers in the tabs below.arrow_forwardCalculate GP ratio round answers to decimal placearrow_forward

- What is the gross profit percentage for this periodarrow_forwardThe company's gross margin percentage is ?arrow_forwardProblem 19-13 (Algo) Shoney Video Concepts produces a line of video streaming servers that are linked to personal computers for storing movies. These devices have very fast access and large storage capacity. Shoney is trying to determine a production plan for the next 12 months. The main criterion for this plan is that the employment level is to be held constant over the period. Shoney is continuing in its R&D efforts to develop new applications and prefers not to cause any adverse feelings with the local workforce. For the same reason, all employees should put in full workweeks, even if that is not the lowest-cost alternative. The forecast for the next 12 months is MONTH FORECAST DEMAND January February March April 530 730 830 530 May June 330 230 July 130 August 130 September 230 October 630 730 800 November December Manufacturing cost is $210 per server, equally divided between materials and labor. Inventory storage cost is $4 per unit per month and is assigned based on the ending…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College