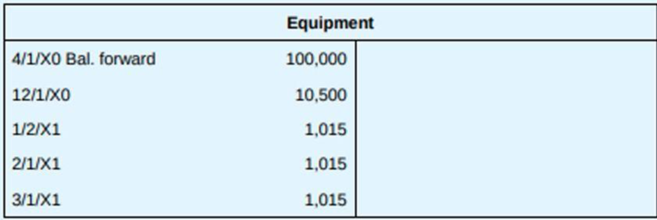

Chem-Lite, Inc., maintains its accounts on the basis of a fiscal year ending March 31. At March 31, 20X1, the Equipment account in the general ledger appeared as shown below. The company uses straight-line

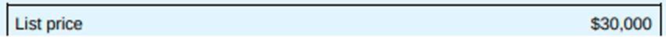

Upon further investigation, you find the following contract dated December 1, 20X0, covering the acquisition of equipment:

Required:

Prepare in good form, including full explanations, the

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

EBK PRINCIPLES OF AUDITING & OTHER ASSU

- On August 3, Cinco Construction purchased special-purpose equipment at a cost of $1,000,000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $50,000. a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention).arrow_forwardAdkins Bakery uses the modified half-month convention to calculate depreciation expense in the year an asset is purchased or sold. Adkins has a calendar year accounting period and uses the straight-line method to compute depreciation expense. On March 17, 2018, Adkins acquired equipment at a cost of $220,000. The equipment has a residual value of $43,000 and an estimated useful life of 4 years. What amount of depreciation expense will be recorded for the year ending December 31, 2018? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) $44,250 $33,188 $36,875 $22,125arrow_forwardSwindall Industries uses straight-line depreciation on all of its depreciable assets. The company records annual depreciation expense at the end of each calendar year. On January 11, 2017, the company purchased a machine costing $117,000. The machine's useful life was estimated to be 12 years with an estimated residual value of $17,200. Depreciation for partial years is recorded to the nearest full month. In 2021, after almost five years of experience with the machine, management decided to revise its estimated life from 12 years to 20 years. No change was made in the estimated residual value. The revised estimate of the useful life was decided prior to recording annual depreciation expense for the year ended December 31, 2021. a. Prepare journal entries in chronological order for the given events, beginning with the purchase of the machinery on January 11, 2017. Show separately the recording of depreciation expense in 2017 through 2021. (Do not round intermediate calculations. Round…arrow_forward

- Swanson & Hiller, Inc., purchased a new machine on September 1 of the current year at a cost of $149,000. The machine’s estimated useful life at the time of the purchase was five years, and its residual value was $9,000. The company reports on a calendar year basis. 1) Prepare a complete depreciation schedule, beginning with the current year, using the 200 percent declining-balance method. (Assume that the half-year convention is used). 2) Prepare a complete depreciation schedule, beginning with the current year, using the 150 percent declining-balance, switching to straight-line when that maximizes the expense. (Assume that the half-year convention is used).arrow_forwardChahal Company’s fiscal year-end is December 31. The company purchased a machine costing $129,000 on April 1, 2022. The machine is expected to be obsolete after five years (60 months), and thereafter no longer useful to the company. The estimated salvage value is $6,000. The company’s depreciation policy is to record depreciation for the portion of the year that the asset is in service. Compute depreciation expense for 2022 under the straight‑line depreciation method. (Round your answer to the nearest whole number. Do not include a $ sign in your answer.)arrow_forwardRifhan products use straight-line depreciation on all its depreciable assets. The accounts are adjusted and closed at the end of each calendar year. On January 4, 1999, the corporation purchased machinery for cash at a cost of $90,000. Its useful life was estimated to be 10 years with a residual value of $22,000. Depreciation for partial years is recorded to the nearest full month. In 2001, after almost 2 years of experience with the equipment, management decided that the estimated life of the equipment should be revised from 10 years to 7 years. No change was made in the estimate of residual value. The revised estimate of useful life was decided on prior to recording to depreciation for the period ended December 31, 2001. Instructions: Prepare journal entries in chronological order for the above events, beginning with the purchase of the machinery on January 4, 1999. Show separately the depreciation for 1999, 2000, and 2001 and 2002.arrow_forward

- Travis Inc. has just completed its financial statements for the reporting year ended December 31 of Year 5. Pretax income is $160,000. The accounts have not been closed for December 31 of Year 5. Further consideration and review of the records revealed the following items related to the Year 5 statements.1. On January 1 of Year 1, a machine was acquired that cost $10,000. The estimated useful life was 10 years, and the residual value was $2,000 . At the time of acquisition, the full cost of the machine was incorrectly debited to the land account. The company uses straight-line depreciation.2. On January 1 of Year 3, a long-term investment of $18,000 was made by purchasing a $20,000, 8% bond of FDC Corporation. The investment account was debited for $18,000. Each year, starting on December 31 of Year 3, the company has recognized and reported investment revenue on these bonds of $1,600. The bonds mature in 10 years from the date of purchase. Assume that any amortization would follow the…arrow_forwardRahman Company, a manufacturer of steel products, began operations on January 1, 2020. Rahman has a December 31 fiscal year-end and adjusts its accounts annually. Selected transactions related to its Brampton plant are as follows: Jan. 1, 2020 Paid cash for six (6) stamping machines for a total price of $15,300 plus delivery costs of $200 per unit Dec. 31, 2020 Recorded depreciation at year end. Assume that the stamping machines have a 5 year useful life and a residual (salvage) value of 10% of the original cost. Dec. 31, 2021 Recorded depreciation at year end. Jan. 1, 2022 One (1) stamping machine was sold for $1,250. . Dec. 31, 2022 Exchanged one (1) stamping machine for a welding machine. The list price of the welding machine was $8,000 and Rahman received a trade-in allowance for the stamping machine of $2,000 (remainder paid in cash). A new welding machine could be bought (without a trade-in) for $7,500. The fair market value of the stamping machine was $1,000.…arrow_forwardIn addition to the question in the pciture: Calculate and record depreciation for the year. None of the machines currently included in the balance of the account was acquired before January 1, 2012.arrow_forward

- Aloha Company is starting its new fiscal year on July 1. The company has owned a specialized piece of equipment for three years that it depreciates using the straight-line method. The equipment was estimated to have a useful life of seven years, and the company feels that this estimate is still reasonable. Which reversing entry should the company make on July 1 to reverse the adjusting entry recorded on June 30, the end of the fiscal year, for depreciation on the equipment? a.Debit Accumulated Depreciation—Equipment and credit Equipment b.Debit Accumulated Depreciation—Equipment and credit Depreciation Expense—Equipment c.No reversing entry should be recorded. d.Debit Depreciation Expense—Equipment and credit Accumulated Depreciation—Equipmentarrow_forwardCompany E purchased a piece of equipment for $28,000 on April 1, Year 1. The company has a fiscal year-end of 12/31. The asset will be depreciated using the straight-line method over its four-year useful life. Assuming the asset's residual value is $2,000, the company should recognize depreciation expense in Year 1 and Year 2 in the amount of:arrow_forwardSheridan's Repair Service uses the straight-line method of depreciation. The company's fiscal year-end is December 31. The following transactions and events occurred during the first three years. Purchased equipment from the Equipment Center for $7,900 cash plus sales tax of $580, and shipping costs of $490. 2021 July 1 Nov. 3 Incurred ordinary repairs on computer of $280. Dec. 31 Recorded 2021 depreciation on the basis of a four-year life and estimated salvage value of $450. 2022 Dec. 31 Recorded 2022 depreciation. Paid $2,900 fora major upgrade of the equipment. This expenditure is expected to increase the operating efficiency and capacity of the equipment. 2023 Jan. 1 Prepare the necessary entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Prepare the necessary…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education