CASE 12-29 Sell or Process Further Decision LO12-7

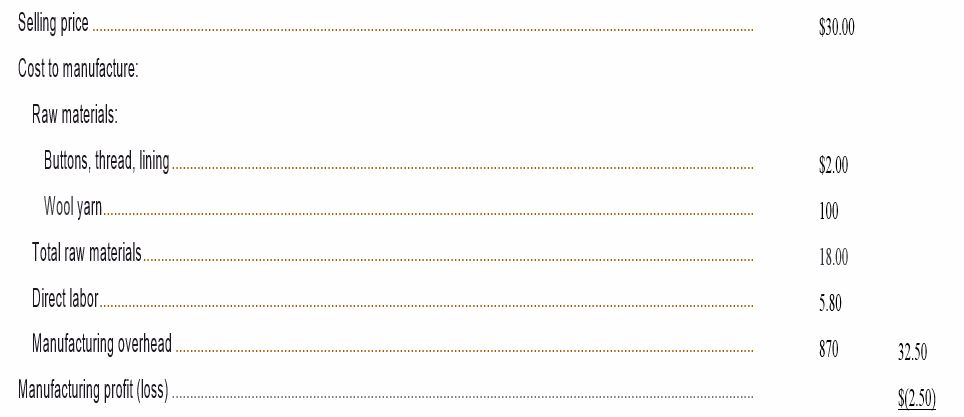

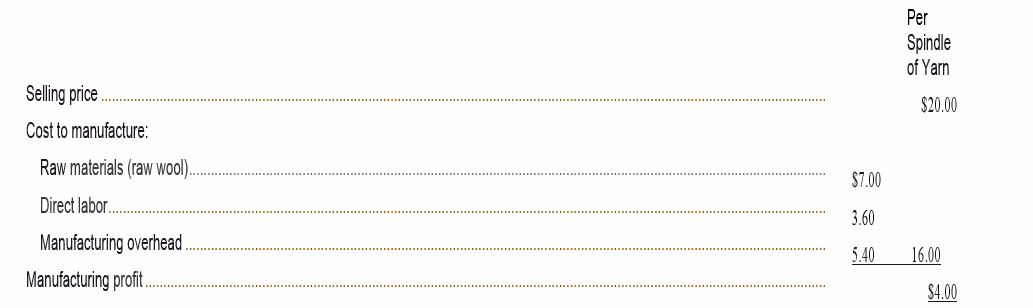

The Scottie Sweater Company produces sweaters under the “Scottie” label. The company buys raw wool and processes it into wool yam from which the sweaters are woven. One spindle of wool yam is required, to produce one sweater. The costs and revenues associated with the sweaters are given below:

Per Sweater

Originally, all of the wool yam was used to produce sweaters, but in recent years a market has developed for the wool yam itself. The yam is purchased by other companies for use in production of wool blankets and other wool products. Since the development of the market for the wool yam, a continuing dispute has existed in the Scottie Sweater Company as to whether the yam should be sold simply as yam or processed into sweaters. Current cost and revenue data on the yam are given below:

The market for sweaters is temporarily depressed, due to unusually warm weather in the western states where the sweaters are sold. This has made it necessary for the company to discount the selling price of the sweaters to $30 from the normal $40 price. Since the market for wool yam has remained strong, the dispute has again surfaced over whether the yam should be sold outright rather than processed into sweaters. The sales manager thinks that the production of sweaters should be discontinued: she is upset about having to sell sweaters at a $2.50 loss when the yam could be sold for a $4.00 profit. However, the production superintendent does not want to close down a large portion of the factory. He argues that the company is in the sweater business, not the yam business, and the company should focus on its core strength.

Required:

All of the

- What is the facial advantage (disadvantage) of further processing one spindle of wool yam into a sweater?

- Would you recommend that the wool yam he sold outright or processed into sweaters? Explain.

- What is the lowest price that the company should accept for a sweater? Support your answer will appropriate computations and explain your reasoning.

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

MANAGERIAL ACCOUNTING CONNECT ACCESS

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub